Spain’s largest bank Banco Santander has helped finance a company responsible for the destruction of an area of climate-critical forests three times the size of Madrid, a new Global Witness investigation reveals

Santander backed major South American deforester Cresud despite net zero pledge

Download ResourceThe findings show that Santander has played a key role in underwriting $1.3 billion to Cresud, an Argentina-based "agricultural real estate" company. Satellite imagery analysis shows Cresud has been responsible for deforesting over 170,000 hectares of forests in South America since 2001.

Cresud’s deforestation in these globally important, carbon-dense forests is estimated to have generated emissions equivalent to a single passenger flying across the Atlantic more than 30 million times.

Santander’s deals appear to contradict the bank’s own internal policies and its high-profile commitment becoming net zero by 2050, and highlight the need for international action to restrict the financing of deforestation ahead of COP30 in Brazil.

Giulia Bondi, senior campaigner at Global Witness said:

“Cresud would not be able to turn a profit without being able to deforest because their entire business model relies on being able to raze large areas of climate-critical forests to the ground. And yet, when Banco Santander introduced a policy to limit financing of deforesting companies, their investments in Cresud actually increased.

Ahead of COP30 in the Brazilian Amazon, this shows the urgent need for coordinated international action, including in the EU, to stop banks from investing in and profiting from companies that are destroying vital forests – it could not be clearer, left to their own devices they will keep bankrolling major deforesters like Cresud.”

Bankrolling the bulldozers

Santander played a pivotal role in raising the $1.3 billion for Cresud since 2011, jointly underwriting the total in consortium with multiple Argentinian and international banks, and frequently acting as lead underwriter.

In 2018, the bank introduced a sustainability policy to limit funding to projects linked to deforestation in high-risk areas. However, rather than limiting its financing to Cresud, from 2018 onwards Santander has given Cresud even more money, working in consortia to arrange $850 million in financing to the company.

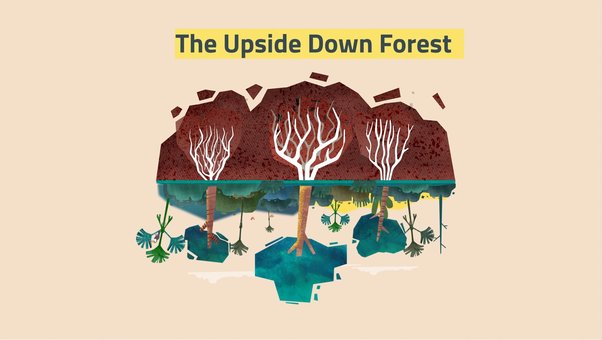

This financing has enabled Cresud to deforest major swaths of the Argentinean and Paraguayan Gran Chaco forest, as well as in Brazil’s biodiverse Cerrado, as part of its business model to expand the agricultural frontier into South America’s climate-critical forests.

Cresud operates by buying up large areas of forest land, deforesting and converting the area into farmland. The company then grows soy, wheat, sunflowers or raise cattle on the land. When the land appreciates in value, the company often sells it to the highest bidder.

The company’s expansion has also led to conflicts with Indigenous Peoples and local communities in Brazil, Paraguay and Bolivia.

The high levels of deforestation in the Argentinean Chaco in the north of the country are affecting access to water and resources for Indigenous Peoples.

“With all the deforestation, the estuaries and gullies, the fresh water, have dried up, and that is now a big problem,” says Sergio Rojas, an Indigenous activist from the Qom community.

“We are in a very difficult situation, because there is nothing to eat, nothing to drink, and the temperatures at the moment are also extreme.”

When the findings of this investigation were put to Santander, a spokesperson described them as "containing imprecisions and potential information regarding our policies that is not accurate,” but declined to provide specific evidence to support these claims and did not deny they would continue to finance Cresud. Cresud did not respond to multiple requests for comment.

Bondi added: “This shows the urgent need for the EU to bring in rules to prevent the financial sector from funding the destruction of climate-critical forests. The EUDR review of the financial sector’s role in global deforestation is a critical opportunity to extend the regulation to hold banks such as Santander to account.”