Claims from far-right UK political party Reform about fracking’s potential benefits to the UK are “simply farcical”, new analysis from Global Witness shows

New research from the investigative campaigning organisation reveals that not only are the vast majority of companies with UK onshore drilling licenses unable to supply energy as cheaply as renewables, but they have very poor records as fossil fuel companies, with most producing little oil or gas globally and making significant financial losses.

The Reform Party – a recipient of significant fossil fuel donations – has announced a renewed commitment to ditching net zero policies and reversing the fracking ban, despite widespread public support for climate policies and significant opposition to fracking.

Reform has consistently called for more UK fossil fuel extraction, particularly in the North Sea. On 30 July, the party’s Greater Lincolnshire Mayor Andrea Jenkyns claimed without evidence that net zero was a “con” and said oil and gas was the answer to Britain’s energy needs.

UK onshore drilling licenses can allow for either traditional fossil fuel drilling or fracking.

A moratorium on fracking was announced in 2019 after regulators found it was impossible to rule out earthquakes being linked to this type of drilling. Liz Truss lifted the moratorium briefly in 2022, but it was reinstated shortly after she left office due to persistent safety concerns.

A Survation poll from 2022 also showed it was the most unpopular form of energy generation in the UK. Other studies show that fracking has particularly destructive climate impacts, with the fossil fuel drilling method releasing large amounts of methane, which is more potent at trapping heat than carbon dioxide.

Despite its adverse climate impact, significant community opposition and links to local tremors, Jenkyns recently announced she would meet with an American-owned oil and gas company Heyco, which wants to drill in Gainsborough.

Campaigners say new analysis into fracking firms highlights the “farcical” nature of Reform’s commitment to this outdated technology which has poisoned water supplies and devastated communities in the US and Australia.

Earlier studies have also pointed to the high cost of energy produced through fracking in the UK, the likely small volumes of commercially-extractable gas, and the fact that wind and solar have been the cheapest sources of energy in the UK for years.

Global Witness senior investigator Jon Noronha-Gant said:

“We all want cleaner, cheaper, homegrown energy, but Reform’s fracking fantasy won’t deliver on any of these fronts.

“We already know fracking is deeply unpopular, with people the world over protesting the dirty drilling method because of its connection to local earthquakes, water pollution and the climate emergency.

“This research exposes another truth: these firms are not credible suppliers, delivering almost no real energy or profits anywhere in the world. Fracking isn’t just environmentally destructive and outdated, it’s a dead end economically.

“It’s time politicians of all stripes moved on from talking up dirty oil and gas. The UK public don’t want ludicrous fossil fuel pipe dreams – we want clean, affordable renewable energy that’s in our hands.”

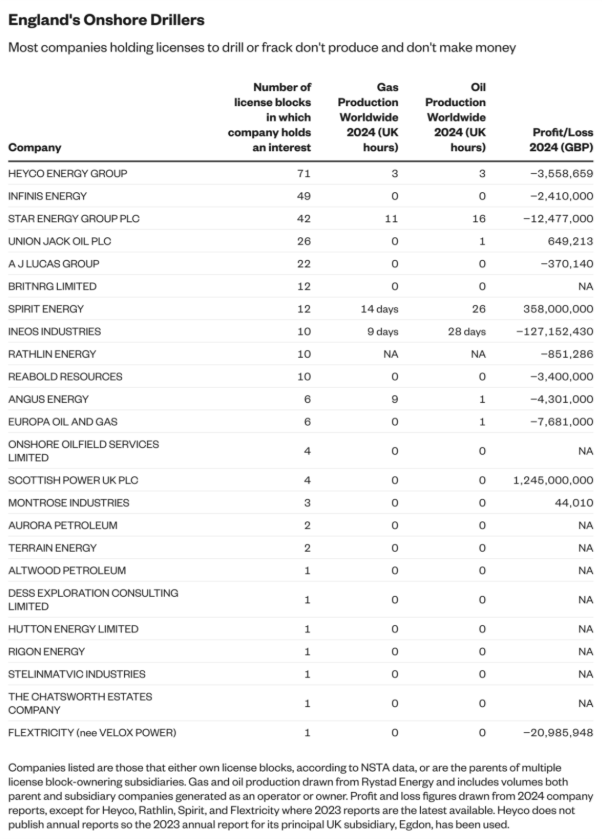

The new Global Witness investigation showed that 22 out of the 24 companies with interests in UK onshore license blocks produced almost no oil or gas anywhere in the world in 2024. Together these 22 companies only produced enough gas worldwide to power the UK for 13 hours.

Heyco, which has an interest in more license blocks than any other company, produced only enough gas and oil to power the UK for three hours. This despite having licenses around the world.

Global Witness also highlights that four out of the top five companies, ranked by numbers of license blocks held, lost money during the last financial year. Together these four lost £18 million, while Heyco alone lost £3.6 million. Only one of the top five made a profit – a relatively small sum of £650,000.

Out of the 14 companies for which financial data was available, Global Witness’ research revealed that only four turned a profit.

Only one of these companies, Spirit, produced any real volume of oil or gas. The other license holder that produced real volumes in 2024 – Ineos – lost £127 million last year.

Eight of the firms with licenses to drill in the UK are so small that they do not need to report their finances – reporting instead how many staff they have, between zero and three. Two companies have gone out of business.

Global Witness contacted all of the companies holding onshore drilling licenses. Four responded.

Montrose Industries, which holds three license blocks, and Flextricity, which holds one, both stated they had no intention to frack.

Europa (six licenses), also said its licenses were not for fracking but for “conventional” oil and gas extraction. The company also said its licenses contain 200 billion cubic feet of gas; it was developing its projects; that UK households still use gas and imports some from overseas; and, that domestically produced gas is more environmentally responsible.

Asked about its most recent published annual finances, covering August 2023 to July 2024, which showed a loss of £6.8 million, Europa did not respond directly. The company instead pointed to interim results for the five months before December 2024, which showed a pre-tax loss of £300,000.

In its response, ScottishPower (four license blocks) said it had no intention of exploring for gas and that its licenses “were automatically inherited after the acquisition of the Hatfield storage site in 2006 are for non-intrusive purposes only and are required for ongoing operation of the facility.”

The company also said it produces “100% of its electricity from renewables and continues to be one of the largest renewable developers in the UK.”

Global Witness also sought comment from a representative from Reform. As of the time of publication, no immediate response was received.

Fracking – an intensive form of onshore fossil fuel extraction which involves injecting water, chemicals and sand into cracks in the earth at high pressure to help extract oil or shale gas – was banned in the UK in 2019 after several tremors, and finally a magnitude 2.9 earthquake, were recorded near the country’s only active fracking site in Lancashire.

The Reform party was criticised in the run-up to the 2024 UK general election for accepting £2.3 million from fossil fuel interests.

Notes and methodology

- Data on companies with interest in fracking license blocks drawn from North Sea Transition Authority (NSTA). Fracking permits in England are awarded as licenses, which then can be subdivided into license blocks - specific sites where drilling occurs. Global Witness’ analysis identifies companies holding license blocks rather than licenses to better show the intent of companies to actually operate.

- Companies listed are those that either own license blocks or are the parents of multiple license block-owning subsidiaries. Corporate structure data draws upon Global Witness research and NSTA data

- Gas and oil production drawn from Rystad Energy and includes volumes both parent and subsidiary companies generated as an operator or owner.

- Profit and loss figures drawn from 2024 company reports, except for Heyco, Rathlin, Spirit, and Flextricity where 2023 reports are the latest available.

- Heyco does not publish annual reports so the 2023 annual report for its principal UK subsidiary, Egdon, has been used.