Last week New York Attorney General Eric Schneidermann launched an investigation into ExxonMobil for misleading the public and investors on climate risks, with indications that the case may expand into other companies.[i]

Last week New York Attorney General Eric Schneidermann launched an investigation into ExxonMobil for misleading the public and investors on climate risks, with indications that the case may expand into other companies.[ii]

Climate change is not the only area where Exxon and other big oil companies have a history of misleading the public. Global Witness and others have repeatedly shown how oil companies enter into risky deals which they fail to disclose to their investors and the public.

“Exxon’s troubles are just the tip of the iceberg – one of the few that isn’t shrinking,” said Zorka Milin of Global Witness. “We and others have repeatedly shown how oil companies deal in secrecy to hide risks from investors and the wider public, whether that’s to do with corruption, global oil reserves or Arctic drilling. The AG is right to investigate Exxon – but they are not the only bad apple. The investigations should be widened and strong laws brought in to make sure oil companies do their business in the open like everyone else.”

Other areas in urgent need of investigation include:

- Shell is now at risk of losing a major

investment it made in Nigeria, due to corruption risks. In 2011, Shell and Eni secretly

paid US$1.1bn for OPL 245, one of West Africa’s largest and most lucrative oil

fields, situated off the coast of Nigeria. It turns out that the funds

ultimately ended up in the pockets of a former oil minister who had awarded the

block to a company that he secretly owned. The deal

deprived state coffers of a sum equivalent to 80% of the country’s 2015 health

budget.[iii]

The Nigerian House of Representatives called for the licence to be revoked in

2014 and the deal is being investigated in the UK, Italy and Nigeria. The oil

block holds an estimated 9.23 billion barrels of crude oil according to the

findings of the Nigerian House of Representatives. If the estimates turn out to

be correct, when booked, Shell’s share could conceivably boost its reserves by up

to a third.[iv]

The threat to this block represents a major risk to investors – if the

companies lose the rights to the block, it would hurt their bottom line.

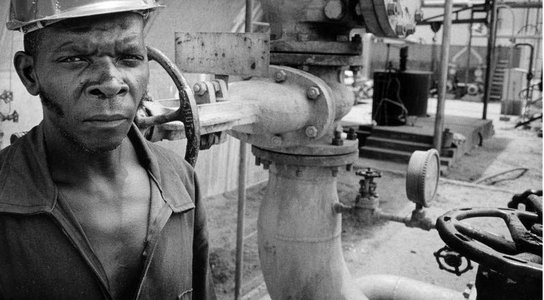

- Such ongoing exploitation is especially tragic

in the context of the environmental destruction and human rights abuses that

have plagued Shell’s activities in Nigeria. Last week marked the 20th

anniversary of the murder of Nigerian activist Ken Saro-Wiwa and eight other

Ogoni activists, who were executed for their peaceful opposition to Shell’s

pollution of his ancestral lands. In the 20 years since Saro-Wiwa’s death, the

environmental devastation of the Nigerian Delta has continued, while the

promise of oil revenues has remained elusive.[v]

- Closer to home, Shell has also come under fire

for misleading investors on the risks of Arctic drilling, with environmental

groups and members of Congress calling for an investigation by the US

Securities and Exchange Commission (SEC).[vi]

These issues all fall under the scope of the same law that the NY AG is using to investigate Exxon, called the Martin Act, aimed at protecting investors.[vii] At Shell’s 2015 Annual General Meeting, Global Witness asked the company why it hadn’t disclosed its risks around the OPL 245 deal to investors; the company’s CEO told investors “there is no risk or nothing extraordinary about this transaction that should concern our shareholders.” Global Witness disagrees with this statement, and considers it critical that Shell’s investors, and regulators, get to the bottom of whether or not Shell has been open enough about its role in this corrupt deal, and the risks the company now faces.

That oil companies routinely mislead the public is nothing new, but it can be fixed. It is a systemic problem, which must be addressed at the root. Just like with banks, the US needs tools to police and sanction these companies so as to rebuild public and market confidence in their behavior. One of the most promising tools in this respect is a groundbreaking transparency law that requires companies to disclose the payments they make to governments around the world to access natural resources. This would make it much harder to keep citizens in the dark over critical information.

Unfortunately the implementation of this law, Section 1504 of the Dodd-Frank Act, has been delayed for over five years, due to vehement political and legal opposition from the oil industry lobby, including key players like Shell and Exxon. The SEC is now on track to finally implement the law next year. It is time for Shell and other oil companies to end their misguided assault on transparency by publicly supporting a strong US oil transparency law.

[i] http://www.nytimes.com/2015/11/07/science/more-oil-companies-could-join-exxon-mobil-as-focus-of-climate-investigations.html

[ii] http://www.nytimes.com/2015/11/07/science/more-oil-companies-could-join-exxon-mobil-as-focus-of-climate-investigations.html

[iii] Premium

Times, 18/2/2015, “Download: Nigeria 2015 Budget Proposal the Jonathan govt

does not want Nigerians to see”, http://www.premiumtimesng.com/news/headlines/177004-download-nigeria-2015-budget-proposal-the-jonathan-govt-does-not-want-nigerians-to-see.html;

Proposed Federal Budget for the Federal Ministry of Health 2015 is 257,543,773,757

Naira equal to approximately US$1.3bn

[iv]

Nigerian House of Representatives, Report by the Ad-Hoc Committee on the

transaction involving the Federal Government and Shell/AGIP companies and

Malabu Oil and Gas Limited in respect of the sale of oil bloc OPL 245, 9 July

2013, p64; Probable reserves are those which have a 50% chance of being

present; Shell, “Annual Report 2014 - Proved reserves“, http://reports.shell.com/annual-report/2014/strategic-report/upstream/reserves.php

/ ENDS

Contacts

Notes to editor:

For more details of the deal for OPL 245 please see “Shell and Eni’s Misadventures in Nigeria: Shell And Eni At Risk Of Losing Enormous Oil Block Acquired In Corrupt Deal” at https://www.globalwitness.org/reports/shell-and-enis-misadventures-nigeria

You might also like

-

Briefing Shell and Eni's Misadventures in Nigeria

In 2011, Shell and Eni paid US$1.1bn for one of West Africa’s largest oil fields, situated off the coast of Nigeria, but the money did not benefit the country’s citizens.

-

Report How to lose $4 billion

Credibility test for global transparency standard as £4bn lost to anonymous oil and mining companies.

-

Campaign Oil, gas and mining transparency

Corruption and fraud in the oil, gas and mining industries props up brutal regimes and lines the pockets of kleptocrats. Companies and governments must end the secrecy and bring deals and profits into the open