Capture on the Nile

South Sudan's state-owned oil company, Nilepet, has been captured by the country's predatory elite and security services.

Summary

South Sudan’s state-owned oil company, the Nile Petroleum Corporation (Nilepet), has been captured by predatory elites at the heart of the country’s brutal civil war. The company is almost entirely unregulated and has fallen under the direct control of the President and his inner circle, including the head of South Sudan’s oppressive Internal Security Bureau, who sits on Nilepet’s Board. This combination of capture and secrecy has allowed it to funnel millions in oil revenues to the country’s brutal security services and ethnic militias with limited oversight and accountability. Yet Nilepet is also deeply integrated into global oil supply chains. Little has been done to use the leverage of the international partners it depends on to challenge a company that sits at the heart of South Sudan’s conflict economy. This further undermines an already desperate situation, and risks linking international companies, traders, and lenders to atrocities and serious human rights abuses.

On 19 January 2016 the Managing Director of the Nile Petroleum Corporation, South Sudan’s state-owned oil company, received a letter.

The letter is signed by Stephen Dhieu Dau, then Minister of Petroleum and Mining, and the subject line, bolded for emphasis, requests payment of over US$1.5 million. If this was not enough to command the reader’s attention, the first paragraph recalls a separate letter, sent a few days earlier, also demanding payment, but signed by Lt. Gen. Akol Koor Kuc, the Director General of South Sudan’s Internal Security Bureau (ISB), a division of the feared and powerful National Security Services (NSS).

The bill is not for costs incurred by the company’s staff. The Nile Petroleum Corporation—known locally simply as Nilepet—is being asked to pay US$1,516,720 for expenses incurred by South Sudan’s security services.1

The itemised list that follows includes hundreds of thousands of dollars for transportation, accommodation, and food for ISB personnel and South Sudanese army (SPLA) troops deployed “in and around the oilfields,” including the conflict areas of Wau, Paloch, and Malakal. The latter are both in the oil-rich area then known as Upper Nile State. The bill also includes over US$900,000 for vehicles taken by the SPLA in the same areas, though supposedly during earlier operations in 2013/14.

Fighting in oil-producing areas, coupled with a disastrous decision to suspend oil production in 2012, had significantly decreased oil output. This left Upper Nile home to the few remaining active wells and a fragile life-line to a cash-strapped government struggling with the costs of war and corruption. The area has therefore often been a strategic target for opposition fighters hoping to disrupt the government’s precarious finances, leading to some of the conflict’s most intense fighting.

“the worst violence of the conflict,”

identifying serious abuses perpetrated by forces on both sides. Their report counts incidents of “rape, extrajudicial killings, targeting of civilian populations along ethnic lines, destruction of homes to drive possible opposition supporters into the wilderness, and denial of humanitarian access.”5

As has become common throughout South Sudan’s conflict, the militarisation of civilian communities was also widespread in Upper Nile, with both the government and opposition forging alliances with local militias. The United Nations Human Rights Division reported that the government’s SPLA (South Sudan People's Liberation Army/Movement) forces, the opposition SPLM/A-IO (SPLA/M-In Opposition), and both their affiliated militias, had committed “killings, abductions, rape and forced displacement that have become routine.”6

Now Nilepet was being asked to foot the bill for military expenditure linked to these operations.

This request is not likely to have come as a surprise. As the letter reminds the Managing Director, Nilepet had previously agreed to settle other “security related bills” in 2015, suggesting this was not an unusual or one-off request. In the same year, Africa Intelligence reported that much of Nilepet’s revenues had been earmarked for the payment of as many as 210,000 soldiers stationed in and around the oil fields.7

A separate United Nations Panel of Experts report found that Nilepet provided “financial authorization for the purchase and transfer” of small arms and ammunition to the Pandang Dinka, one of the local militias recruited to fight with the government in Upper Nile state in 2015. These weapons were, according to the UN report, transferred to the militia through Akol Koor’s ISB.8

Similarly, in their extensive account of the conflict in Upper Nile during this period, The Small Arms Survey found that Pandang Dinka militia groups “rapidly became the central actors in an offensive struggle waged against the Shilluk for control of the east bank of the White Nile.” They report that these militias often operated “in concert” with the government’s SPLA troops, though outside of the official military command structure. Their weapons and ammunition were supplied by the ISB under the command of Akol Koor.9

Nilepet, South Sudan’s state-owned oil company, thus finds itself at the heart of the economics that sustain South Sudan’s civil war and violence.

This is not the function Nilepet was meant to serve. But like many of South Sudan’s institutions—like South Sudan itself—it has been captured by powerful elites that have enlisted it in service of their own aims, rather than those of the South Sudanese people.

In South Sudan’s capital, where Juba’s Unity Avenue meets Lainya Street, a roundabout recalls the peace agreements that have come to define South Sudan’s modern history.

While South Sudan still produces millions of barrels of oil, it cannot refine this oil into the various petroleum products its population needs. South Sudan’s oil is, therefore, all exported via a single pipeline that runs through Sudan, the country’s northern neighbour. Petrol and other refined products are in turn imported, usually by trucks that make the long—and sometimes dangerous—journey through Uganda from the Kenyan port city of Mombasa.

Nilepet’s mandate covers every aspect of this process, from extracting, selling, and exporting the country’s oil—its ‘upstream’ function; to re-importing and distributing refined products, such as diesel and petrol, to the car and generator dependent country—its ‘downstream’ operations.

But Nilepet is failing to meet demand.

Rumour has it this particular station is expecting a delivery from one of the tankers that have made the long journey by road from Kenya. A queue of white vans and cars snake their way down Lainya Street as the queue grows to cover several city blocks. Near the front, twenty to thirty young men lean over the handlebars of their bodas—Juba’s ubiquitous motorcycle taxis—in a huddled scrum competing for both shade and a prime spot in line.

Some have waited for days. Others have paid people to sleep in their cars, anxious not to lose their spot in the line.

“You have to spend many hours at the petrol station waiting for fuel. Sometimes fuel isn’t available so you have to resort to buying from the black market which is very expensive,” says one boda driver. “To make a profit, it becomes very difficult.”13

This is the other side of Nilepet’s capture. Juba’s fuel queues have become a way of life. A country built on oil, but where the pumps run dry for those without power or connections.

Nilepet is vulnerable to capture

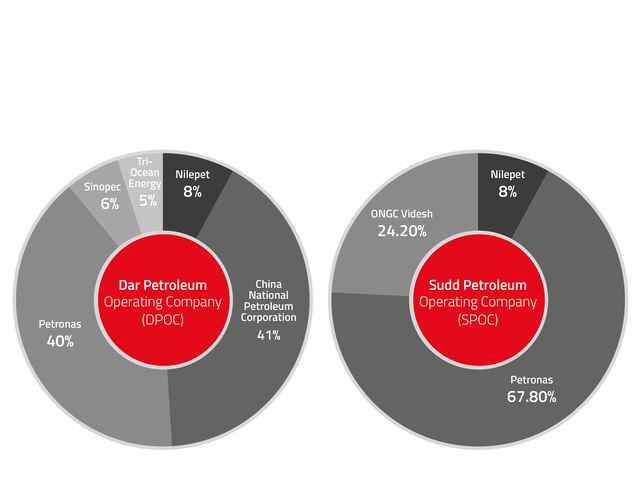

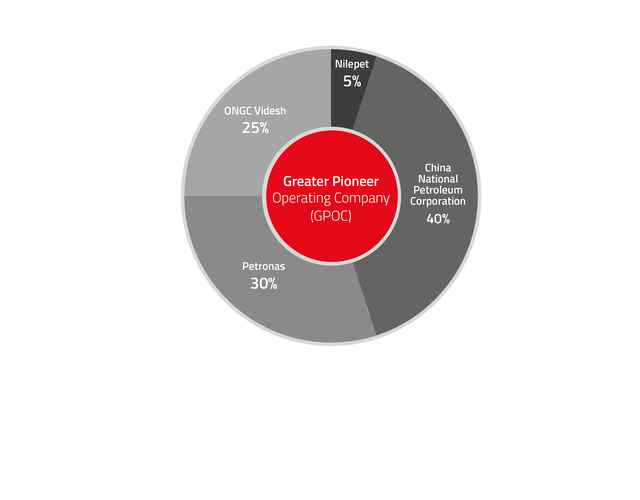

Nilepet was established in 2009 as the commercial arm of the then Southern government, which became the government of South Sudan upon independence in 2011.14 As a private company, owned entirely by the state, it is the vehicle through which the state enters into commercial relationships in the oil sector. Formally under the control of the Ministry of Petroleum and Mining, the company holds shares in all three of South Sudan’s active joint venture oil projects.15

In 2017, Nilepet was also given 10 per cent of an exploration deal with Nigerian company Oranto Petroleum International, which will cover block B3.16 B3 is part of the vast B-block, long held by the French company Total, but split following the government’s growing frustration with Total’s limited activity and determination to diversify its business partners by bringing in new international operators.

Nilepet is a private company. It is therefore not subject to the same oversight and scrutiny as a government ministry. National oil companies are common in oil producing countries and are not necessarily problematic. A transparent and accountable company would struggle to move significantly beyond its mandate. But, as one former public official told us,17

"the involvement of the Office of the President [in Nilepet] is where there is a real problem."

Nilepet is controlled directly by President Salva Kiir and has successfully resisted the implementation of the meagre set of laws in place to regulate its operations. This combination of capture and secrecy has made it the vehicle of choice for many of the transactions South Sudan’s ruling clique and security forces wish to shield from preying eyes and the relatively strong laws that regulate other aspects of South Sudan’s oil sector, though these have never been meaningfully enforced.18

Nilepet’s management and accountability structures appear designed to facilitate this autocratic control.

Day to day, the company is run by a Managing Director who is accountable to a Board of Directors. This Board is, in accordance with South Sudan’s Petroleum Act, appointed by the President.

Similarly, the Managing Director appears largely subject to the preference of President Kiir. Three managing directors rotated through the company’s top office in 2015, and two more have followed since, with each change made by simple presidential decree. This has firmly entrenched the President’s personal influence over the company and those who manage it.

The clearest example of how these powers have been used to staff Nilepet with government loyalists is the surprising presence of Lt. Gen. Akol Koor, Director General of the ISB, on Nilepet’s board.

The National Security Service is powerful and loyal to the President

Near Juba’s Jebel Market a large incongruous structure dominates its surroundings. Known simply as “the Blue House,” it is home to South Sudan’s powerful National Security Services (NSS), of which the Internal Security Bureau (ISB) is part. The building takes its name from the large blue reflective windows sure to frustrate anyone who wants to steal a closer look.

The NSS is an unaccountable and violent organisation loyal to the presidency rather than the government as a whole. Amnesty International has reported on the NSS’s use of arbitrary arrests, prolonged and incommunicado detentions, and linked it to enforced disappearances of perceived government opponents. It has also alleged some detainees were subjected to torture and other ill-treatment.19 Human Rights Watch has reported on the torture hundreds of detainees have suffered at the hands of the NSS.20 In 2016, the UN Panel of Experts on South Sudan also linked the NSS to the arrest of journalists and closure of newspapers.21

The NSS has grown increasingly significant to the government and South Sudan’s conflict in recent years.

The National Security Service Act of October 2014 granted the NSS sweeping powers to arrest, detain, and seize property, with very limited judicial oversight and few measures limiting the use of force by what is in principle an intelligence gathering body.22

Growth in the NSS's largely unchecked power may have been intended to offset the rising influence and suspected ambition of Lt. Gen. Paul Malong, the SPLA Chief of Staff, as well as concerns that future power-sharing arrangements that might emerge from the then ongoing peace talks could further restrict the President's security options.

Informal reports suggest the better-equipped and more professional NSS have increasingly been favoured for significant security operations by President Kiir.

The gradual ascendancy of the NSS advanced still further in May 2017, when President Kiir removed the powerful Lt. Gen. Paul Malong from his position as SPLA Chief of Staff. Malong, a long-standing ally of President Kiir, commanded significant power through his influence over SPLA troops and irregular militia forces—known as the Mathian Anyoor—created largely to protect the President and Malong. This split between the President and the second major pillar in the government's security establishment, further empowered Akol Koor and the extensive national NSS network, leaving it among the most potent security forces in the country.

Akol Koor held a Nilepet board seataccording to a 2016 report by the UN Panel of Experts on South Sudan, with sources interviewed by Global Witness confirming he has done so since at least 2014.23 The 2016 letter to the Managing Director of Nilepet requesting payment to the security services also cites an accompanying letter signed by Akol Koor a few days earlier, suggesting he exercises significant control over Nilepet expenditure, especially with respect to the security sector.

While his presence on the Board is rarely, if ever, publicly acknowledged, several sources interviewed by Global Witness claim Koor is highly influential in deciding how the company and its resources are deployed. According to a source with close knowledge of the company;24

"You can’t turn down a request from Akol Koor, these are security matters."

Nilepet’s Board was changed in January 2017. Public statements made no reference to Koor’s previous presence on the Board, nor to whether he would retain his seat. Several sources close to South Sudan’s oil industry have privately confirmed that he has retained his seat and influence over the company.25

This level of secrecy is not unusual for Nilepet, and along with the President’s personal influence over the company’s structure, supplies the other critical component of its capture. A senior international official described the company, starkly, as “a black box.” “There is no transparent operation.”26 This has, to some extent, concealed Nilepet’s capture and the true scope of its activities.

In a leaked 2017 report from the South Sudanese Parliament’s sub-committee on Revenues, Committee members appear to voice similar concerns about both its capture and opacity, noting that it seemed as though “some powerful institutions within the government are taking” Nilepet’s resources, accusing them of “killing the goose that lays golden eggs.”27

Nilepet has never made public its audited accounts in line with its obligation under the law, claiming on one occasion that there was no physical space for the staff of the Auditor General in their offices.28 The company’s expenditure is not clearly delineated within the ministerial budget, making it impossible to form an accurate picture of its activities.29 And the passage of a bill to regulate Nilepet and its activities ground to a halt with the outbreak of conflict in 2013. This bill has since disappeared from parliamentary records. Without this law, the regulation of South Sudan’s increasingly powerful state owned company hangs on a few provisions in the barely implemented Petroleum Act of 2012 and Petroleum Revenue Management Act of 2013.

Nilepet’s capture undermines oversight and accountability

Nilepet's role in bankrolling South Sudan’s security services and conflict not only takes it well beyond its intended role as a commercial oil company; it has significant consequences for democratic and civilian oversight of South Sudan’s security

One of the most effective ways of controlling powerful security institutions is by making their budgets and other financial resources subject to democratic and civilian control. Security forces still have access to the resources they need, but independent oversight limits their ability to step beyond their proper role in pursuit of their own agenda.

But when powerful institutions—like the NSS and military—are given direct access to the funds generated by companies like Nilepet, these safeguards are undermined. This is particularly significant in the wake of the National Security Act, which substantially limits judicial and institutional oversight over the NSS.

The National Legislative Assembly appears, for example, to have been entirely bypassed during the purchase of arms, financed by Nilepet, as reported by the UN Panel of Experts in 2016. No tenders were issued for the logistics services and no information was submitted to the Assembly. The Panel of Experts, therefore, concluded that the arms purchases30

“circumvented SPLA weapon supply and accounting mechanisms.”

South Sudan’s security forces stand accused of atrocities and unthinkable abuses, all in service of a senseless civil war perpetrated mainly against civilians. Ensuring South Sudan’s civilian institutions, as well as donors and business partners, have information to exercise greater oversight and accountability for abusive security forces is an important step towards breaking South Sudan’s cycle of war and violence.

Additional resources channelled into Nilepet

The benefits of channelling security sector expenditure through Nilepet appear to have been clear to South Sudan’s President Salva Kiir and those closest to him. Evidence suggests assets were deliberately diverted away from Ministries and into this relatively opaque company at key moments in the conflict.

Most notable is the increase in Nilepet’s financial means since 2014. Financial assets have been moved out of the view and direct control of South Sudan’s institutions—notably the Ministry of Petroleum and Mining and the Ministry of Finance—and into Nilepet. The expenditure of Nilepet is subject to considerably less oversight and scrutiny than that of government ministries, and the President and his allies exercise far greater direct control over its operations. These transfers may, therefore, have been critical to enabling the company to meet the financial demands placed on it by the security services.

In the financial year that followed, however, running from June 2014 to May 2015, Nilepet’s sales jumped to 1.9 million barrels.33 Some single months saw sales exceeding the total sales of the year before. In addition, and for reasons that remain unclear, the Ministry of Petroleum and Mining “reallocated” a further two 600,000 barrel cargoes to Nilepet during this period, bringing total Nilepet sales up to 3.1 million barrels.34

From a mere US$25 million in the 2013-14 financial year, Nilepet’s sales in 2014-15 grew almost tenfold to a total of US$227 million.35 With these oil revenues now equivalent to 2.5 per cent of South Sudan’s GDP, Nilepet was likely one of the single most significant economic actors in the country.

This growth was not the result of increased production. South Sudan’s oil production stayed relatively constant during this period. Nilepet’s relative share of government sales therefore also grew tenfold during this period.36

The Ministry of Petroleum has not produced an equivalent marketing report detailing oil sales since May 2015. But, one source, with good knowledge of the country’s oil industry, has confirmed that Nilepet’s allocation has been sustained at around 150,000 to 200,000 barrels per month, totalling around 1.9 million barrels per year.37

This tallies with the Ministry of Finance’s report for the financial year 2015/2016, in which it states that “Nile Pet took an average of 170,000 barrels of oil per month over the fiscal year.”38

Further reporting from the Ministry of Finance also speaks to Nilepet’s continued economic clout. Nilepet appears, repeatedly, to have secured preferential access to substantial oil revenues, often significantly exceeding its budgeted share, and to the evident frustration of the Ministry of Finance.

In its final report for the financial year 2016/17, the Ministry reports that Nilepet and Addax, the latter now a subsidiary of Chinese state-owned Sinopec, had received over 7.5 billion SSP in oil revenues. This was a staggering 1,275 per cent of the 1.5 billion SSP that had been budgeted, with fourth-quarter payments alone amounting to five times its budget for the entire year.39

This may be partially linked to the depreciation of the SSP, although the Ministry’s Third Quarter Report clarifies that, by that point in the year, “Nile Pet and Addax took US$139 million in oil shipments, which is over the SSP budget by almost SSP 10.6 billion and exceeds the annual dollar budget for Nilepet almost six times. Addax took $53 million. Combined, the total of $123 million is 70% of the net oil revenues GRSS received, and is enough to fund the projected 2016/17 salary arrears gap around twice over.”40

The same report noted that “net income from oil after financing collapsed in the third quarter [2016/17] to $22m. Without new advances, just $11 million was received by GRSS in the third quarter from oil revenues.” By comparison, “Nilepet and Addax took $66 million.”41

These increases may also be linked to growing pressures on Nilepet’s role in supplying heavily subsidised fuel into South Sudan. Again, however, the lack of clear Nilepet budgets and accounting make it impossible, even for the Ministry of Finance, to inspect Nilepet’s expenditure during this period, which again coincided with an escalation of hostilities and violence in South Sudan.

Nilepet’s continued significance was also on clear display at the appropriately named “Oil and Power” conference, held in Juba in October 2017. Before an assembled crowd of investors and executives, the Minister of Petroleum, Ezekiel Lol Gatkuoth, reportedly warned companies present that the government was planning a more assertive stance towards companies sitting on dormant assets, telling delegates that “I’m not threatening anybody, but if you don’t meet our terms, we will say ‘bye bye’,” and insisting that42

“You will team up with Nilepet.”

The growing financial strength of Nilepet may also have been significant for another reason.

South Sudan’s 2015 peace agreement introduced a power sharing arrangement between the two warring parties—the SPLM/A and the SPLM/A-IO. The former led by President Salva Kiir, the latter by his long-term rival and former Vice-President, Riek Machar. The Agreement aimed to address not just the conflict, but the governance crisis that had precipitated it.

South Sudan’s Ministry of Petroleum and Ministry of Finance are the two most economically significant Ministries in government. Under the government of national unity established in April 2016, these would be shared, with the Ministry of Petroleum held by the SPLM-IO, and the Ministry of Finance by the SPLM. Each would check the power of the other.

By shifting resources away from the SPLM-IO controlled Ministry of Petroleum, and towards Nilepet, over which he retained significant control, President Kiir may have been undermining the premise of this arrangement.

Shared institutions only translate into shared power if each institution retains its significance and its power. With the Ministry of Petroleum’s financial resources eroding, genuine power sharing risked becoming relatively hollow ‘institution sharing.’

This may mirror the simultaneous empowerment of the NSS. While the formal powers of the NSS were expanded, Nilepet—with Akol Koor on its Board—claimed the resources necessary to reliably finance its ambitions and make full use of its new powers.

Nilepet’s role in the ‘Letters of Credit’ scandal

Oil was not the only significant financial resource Nilepet controlled during this period. Nilepet, rather than the Ministry of Petroleum and Mining, was also central to a controversial loan programme at the heart of one of South Sudan’s largest recent corruption scandals—the so-called ‘Letters of Credit’ scandal. Here too, the direct control the President and his inner circle exercise over the company, and the secrecy with which it operates, may have been used to divert critical state assets.

Under South Sudan’s soil sits an estimated 3.5 billion barrels of oil. Although conflict has significantly reduced production, South Sudan has repeatedly found partners willing to lend against this immense potential—for a price.

As of October 2016, for example, the government reported that it “continued to use oil advances for short term liquidity management.”43

Oil advances enable producing governments to raise cash quickly by taking payment for oil that has not yet been extracted from the ground. The producer usually commits to delivering the oil within a relatively short time-frame and, in exchange for the advance payment, on terms more favourable to the buyer than regular sales.

As of 31 March 2016, government documents suggest oil advances had been taken from the China National Petroleum Corporation totalling US$1 billion; Norinco, a Chinese state-owned arms manufacturer, totalling US$1.9 billion;44 and a further US$125 million from commodity trading giant Trafigura. A further advance was taken from Addax Energy, though, remarkably, the Ministry of Finance was unable to specify the amount that had been borrowed.45

This practice continued the following year, with the Ministry of Finance reporting repayments to Trafigura totalling US$184 million in the financial year ending April 2017.46

This form of oil backed lending has been widely criticised, not least because it significantly limits future revenues available to the government. With most of the oil coming out of the ground already sold, or going to service debts to Sudan, South Sudan’s economy is trapped in a worsening cycle of debt. This is especially troubling when much of the money raised is diverted away from development expenditure that may bring returns in the future, and is instead used to service corruption and a senseless war.

Recent statements from the Ministry of Finance make it clear that the impacts of this debt cycle are significantly impacting the South Sudanese economy, with only a small percentage of oil revenues now reaching the South Sudanese Treasury.

In December 2017 they lamented that after “Trafigura repayments and other deductions including Sudan and Nilepet refined oil deductions and USD grants to Nilepet, South Sudan took just 24% of the gross revenue, but could not refinance from oil advances. After net oil advances, GRSS received just 14% of Gross Oil revenues.”47

By 2014, South Sudan’s economy was in dire straits.

The country relies almost entirely on imports. Everything

from food to fuel is brought in from neighbouring countries. All these imports

have to be paid for. As few, if any, countries accept South Sudanese Pounds

(SSP), imports have to be paid for in dollars. If dollars dry up, so do

supplies in the market.

When South Sudan was flush with oil revenues, this was as simple as going to a bank and changing some SSP for dollars. But by 2014, oil revenues had dwindled as conflict reduced production and the global oil price continued to fall, leaving dollars in ever shorter supply. As the official supply of dollars fell, their price on the black market rose, as did the prices of the goods they were used to import.

By early 2016, the country’s inflation rate hit 300 per cent. By mid-2016, it had reportedly surged beyond 600 per cent, before falling back to rates in excess of 300 per cent in the first four months of 2017.48

South Sudan’s dependence on imports passes this cost on to ordinary citizens almost immediately through inflated prices for imported goods.

The price of transport in Juba shot up fivefold as the resulting fuel shortages started to bite.

A local civil society activist, interviewed in Juba in 2015, stopped using public transport. It had become too expensive.51

“Even though I am a director, I go footing [walk] most of the time. We no longer dress smartly when we are going to the office for we have to put on something that will allow us to walk a long distance.”

Families paying for school fees in neighbouring Uganda, where many have sent family members to take refuge from the fighting, struggled to keep up, as the value of their SSP continued to plummet.

The government sought to address the foreign currency shortage with loans.

These dollars were earmarked for companies importing essential goods into South Sudan, including petrol and diesel.

After undergoing several checks, select importing companies were permitted to access a dollar denominated ‘letter of credit.’ This gave the company special access to the government’s newly borrowed dollars. Critically, the selected companies were permitted to buy these dollars at the official government exchange rate of 3.16 SSP to the dollar. With access to cheaper dollars, it was hoped importers would be able to maintain a steady supply of essential imports at affordable prices, keeping at least some of the rampant inflation at bay.

Although the SSP officially traded at 3.16 SSP to the dollar, this official rate was effectively a fiction to most ordinary South Sudanese. The government had long lacked enough dollars to satisfy demand at this price, and so all but a privileged few were forced to exchange their SSP for dollars on the black market, where the rates were climbing rapidly.

Five ministries were permitted to hand out the letters of credit: The Ministry of Health; the Ministry of Trade, Industry and Investment; the Ministry of Petroleum and Mining; the Ministry of Housing and Physical Planning; and the Ministry of Agriculture. A number of States were also given allocations.

Letters worth US$235 million were allocated to the Ministry of Petroleum and Mining between 2012 and 2015.54

Again, the majority of these were shifted to Nilepet. According to a document seen by Global Witness, letters of credit totalling just over US$190 million—just over 80 per cent of the Ministry’s allocation—were eventually distributed by Nilepet, rather than the Ministry.

In many cases, this may well have been appropriate. The letters of credit given to the Ministry were mainly for the import of fuel, the import and distribution of which falls within Nilepet’s mandate.

It did, however, place Nilepet at the centre of one of the largest corruption scandals in South Sudan’s recent history.

Many of the dollars that were borrowed and allocated through this vast credit scheme never made their way to Kenya or Uganda, where most of the goods would have been purchased for import. Instead, they fuelled the booming black-market dollar trade in Juba.

As dollars grew scarce and more expensive, companies with access to cheap government dollars eyed a quicker route to profit. As the black-market dollar rate climbed from 8, to 15, to 19, a US$100,000 letter of credit—purchased for 316,000 SSP at the official rate of 3.16 SSP to the dollar —was in effect worth closer to 1,900,000 SSP on the black market.

Instead of using the cheap dollars to pay for imports, greater profits could be made by selling them on to the foreign exchange black-market, then going back to the Ministry to buy more cheap dollars with the profits.

This should not have been possible if the prescribed checks were carried out. These should have included initial checks on the companies seeking letters of credit, as well as subsequent checks to ensure the promised goods were in fact delivered. These two layers of checks are both critical, and closely linked. Companies can only be held to account for their deliveries—or lack thereof—if their owners and operators are known to the government in advance.

But few checks appear to have been carried out in reality. This allowed many companies that may have been little more than fronts for the well-connected to secure letters of credit and the profits they brought. Subsequent efforts to determine which companies actually delivered, and which simply racked up vast profits selling government-subsidised dollars onto the black market, have been hampered by this lack of transparency.

A document seen by Global Witness reports that Nilepet was unable to confirm the actual delivery of fuel linked to any of the letters of credit it issued, totalling just over US$190 million.

This sum was disbursed through around 275 individual letters of credit, with 166 from QNB and a further 109 from Stanbic. These were awarded to around 160 separate companies.

Almost a quarter of these companies appear to have had no public identifying information at all: no corporate records, no social media or website, and no mention in any media, though Global Witness was not able to effectively access the corporate registry in Juba. Just under 40 forty per cent had only their corporate registration, with no social media on online presence. This has made it very difficult to determine whether the allocated letters of credit were used for their intended purpose, and to identify who profited if they were not. It also raises the possibility that many may have been little more than hastily assembled from companies used to conceal the profiteering of their connected owners.55

Neither Nilepet nor the Ministry of Petroleum responded to Global Witness' request for comment.

Also here, the relatively opaque Nilepet appears to have been the vehicle of choice for connected elites wishing to evade scrutiny of financial transactions worth millions.

In a private shaded garden that offers some respite from the sun and Juba’s near-constant chorus of horns and motorcycles, the fate of Nilepet is clear to a former public official with close knowledge of South Sudan’s oil industry. “Nilepet,” he says,56

“is a cash cow for [President] Salva [Kiir] and his cronies.”

Supply chain due diligence could bring additional resources to disrupting financial flows

South Sudan’s economy is among the most oil-dependent in the world. Oil accounts for 60 per cent of South Sudan’s GDP and, more importantly, almost the entirety of its exports.57 It is therefore also critical to securing foreign currency and the loans and lines of credit that have supplemented oil sales.

South Sudan’s conflict may, therefore, also be among the most oil-dependent in the world.

Disrupting the financial flows that finance South Sudan’s violence and predatory corruption is widely recognised as an important step towards motivating, building, and sustaining some form of peace. Oil remains a relatively centralised revenue stream, arguably fuelling a determination among the warring parties to seize central power, and the revenue it brings, at all costs. The country’s oil wealth is therefore critical to any peace effort, as reflected by the presence of an entire chapter on resource management in the 2015 Peace Agreement.

Oil remains a relatively centralised revenue stream, arguably fuelling a determination among the country's warring parties to seize central power—and the revenue it brings—at all costs. The country’s oil wealth is therefore critical to any peace effort, as reflected by the presence of an entire chapter on resource management in the 2015 Peace Agreement.

But, in a familiar dilemma, it is challenging to disrupt the financial flows that sustain the conflict without further compounding the misery of an already impoverished population dependent on an economy built on the same underlying resource. South Sudan’s leadership may be vulnerable to their dependence on oil, but so too are those braving ever longer fuel queues and ever higher prices.

Targeted sanctions are gaining momentum as a means of isolating the kleptocratic elites at the centre of South Sudan’s conflict. These may offer a means of challenging the economic dynamics standing in the way of peace, while limiting the impact on the civilian population. This is particularly appealing where targeted assets, such as the personal wealth amassed by elites, have been secreted abroad—such as in neighbouring Kenya or Uganda—limiting any productive role they may be playing in South Sudan’s economy.

The bar for sanctions, however, is high, and their enforcement is a challenge. Secret or anonymised transactions, facilitated by institutions such as Nilepet, make it difficult to identify stolen wealth, particularly when sanctions do not come as a surprise to those they target.

Some entities, including Nilepet—which is a joint venture partner in each of South Sudan’s operational oil fields—may also be difficult to sanction without hurting South Sudan’s economy and civilian population.58

As meaningful leverage over the principal actors in South Sudan’s conflict grows ever more elusive, additional measures are needed to alter the economic dynamics of the conflict, and to support the meaningful enforcement of any sanctions that are put in place. Some measures may not contribute to resolving the conflict directly, but may generate information of value to developing new and innovative policies and initiatives. They may also engage a new sector of actors, such as oil companies and commodity traders, in a more comprehensive peace process. These new actors may not bring decisive leverage, but the information and influence they bring may still usefully alter the political and economic dynamics that shape the peace process.

Nilepet’s integration into the global oil supply chain offers additional leverage that has not yet been meaningfully explored.

The company has been linked to South Sudan’s army, the National Security Services (NSS), and the arming of ethnic militias. Its capture and lack of transparency have also likely facilitated significant corruption. This corruption has, in turn, been vital to sustaining the patronage networks that make up South Sudan’s “political market-place,”59 in which violence and rebellion are too often traded as the chief commodity. While looting may be viewed as a distinct transgression less relevant to the conflict, it is in fact key to servicing South Sudan's patronage networks and the violence and rebellion in which they trade.

Yet, as a commercial entity—at least on paper—it is also a business partner to a range of international oil companies and traders. While Nilepet’s mandate is broad, it is largely confined to the two ends of the oil supply chain.

As a partner in each of the active joint-venture extraction projects, Nilepet is present at the very beginning—the ‘upstream’—of the global oil supply chain. And, as those waiting for fuel beneath its signs know all too well, it is also the last link in the ‘downstream’ chain that brings refined fuel products to South Sudan’s population.

In the middle of this supply chain, however, Nilepet has no significant role. Its upstream arm depends on joint venture partners, international traders and refiners; and its downstream operations need traders willing to sell it refined fuel. While Nilepet may have been captured in South Sudan, it is deeply integrated and dependent on global oil supply chains.

The companies that make up this supply chain share in the responsibility for the risks and harms it may lead to. These companies can look the other way, further entrenching Nilepet’s capture and its consequences, or they can use their commercial leverage and influence to challenge it.

Greater due diligence is practical and feasible in oil supply chains

All oil starts in the ground somewhere. It is typically extracted by state owned companies or, as in South Sudan, by joint ventures between government companies and private partners. These are typically brought in when the State lacks the capital and expertise needed to get a complex oil project up and running. In 2014, 58 per cent of the world’s oil production came from national oil companies, which controlled 75 per cent of global reserves between them.60

The extracted crude oil is then typically taken to a storage facility—a terminal. Here it may be mixed, or “blended,” with other crude oil, usually of a similar type and specification. Crude oil varies in its composition, and so the ease with which it can be refined into commercial products. All of South Sudan’s existing production is a blend called ‘Dar blend,’ which is relatively difficult to refine, and trades at a considerable discount internationally as a consequence.

Some of South Sudan’s oil is sent north, directly to Sudan’s Kosti power-plant or Khartoum Refinery, as payment for the use of its pipeline or transfers agreed under the Transitional Financial Arrangement that was negotiated when the two countries split. The majority, however, makes its way by pipeline to Port Sudan. Like about two–thirds of the world’s crude, it is then sent onwards in vast tankers, destined for a refiner.

Refineries are an important choke-point in the oil supply chain. By some estimates there are only about 650-670 large industrial refiners in the world, with a small number of large refiners responsible for a significant percentage of global refining capacity.61

Most are set up to refine fairly specific grades of crude oil. While they draw on a variety of sources, their inputs are usually carefully controlled to make sure they can meet the relevant market demand while operating at optimal efficiency. Refineries consequently have fairly detailed knowledge and understanding of where their oil has originated.

Much of this crude oil changes hands based on long-term supply contracts between producer companies and refiners, end-users, or vertically integrated international oil companies. Such arrangements bring both price stability and certainty.

But a significant number of global oil cargoes—about a third—also enter the global spot market. Here they are traded in smaller quantities and on shorter time-frames.62

Many of South Sudan’s cargoes are sold, individually, through an auction process led by the country’s oil Marketing Committee. In 2015, this committee had approved 39 companies, including refiners, end-users, and oil traders, all of whom were permitted to bid on South Sudanese cargoes through this process. Of these, only six companies were awarded cargoes.63

In July 2015 Nilepet also awarded one cargo, worth just over US$9 million, “through its own marketing process” to a company named Petro Diamond, which was not on the Committee’s list of approved customers. This is a further example of Nilepet circumventing existing oversight and accountability mechanisms, doing business on its own opaque terms rather than in accordance with established rules and regulations.

Large international commodity traders are an important part of the global market for crude. By some estimates, the major Swiss commodity traders alone account for some 35 per cent of global oil trading.64 But smaller companies, international oil companies, and even state-owned companies, all buy crude cargoes.

In 2014/15, South Sudan’s sales mirrored this global pattern fairly closely. While Chinese UNIPEC received just below 70 per cent of the oil sold through this process, commodity traders accounted for about a quarter of sales between them. The commodity trading giants Trafigura, based in Switzerland and Singapore, and Anglo-Swiss Glencore accounted for 11 per cent and 8 per cent respectively, with Dutch/UK based commodity trader Vitol awarded two cargoes (4 per cent). Any advance sales, loans, or other payments agreed would likely have come in addition to these quantities.

In November 2016, Africa Intelligence reported that it had obtained a letter in which Trafigura’s Chief Financial Officer for Asia and the Pacific offered the Ministries of Finance and Petroleum US$10 million in order to “facilitate the award of the [November 2016 oil] cargo and support furthermore the Ministry in its activities.”65 Trafigura declined to comment on this letter in correspondence with Global Witness.

A great deal of international oil trading is made possible by short-term financing. Banks, and European banks in particular, are thus a critical part of the oil supply chain, facilitating the trade of crude and blend stocks. Their short-term financing enables a greater number of companies to participate in trading, and enables trading at volumes that far exceed the assets of the companies involved. These lenders may therefore have considerable power to influence the traders and companies to which they lend.

Once the cargoes arrive, refineries produce blend-stocks. This fuel is not yet ready for sale, as these stocks must be mixed again to create a wide variety of products—from gasoline and kerosene, to jet-fuel—and often customised to meet local requirements. This blending happens at a variety of points along the onward supply chain, including in the refineries themselves, at storage terminals, or on transport vessels.

Again, a range of companies participate in the market for blend-stocks. Also here, global commodity traders are becoming increasingly important. They source blend-stocks that they can mix before onward sales, in addition to their more traditional focus on crude.

These products then follow an onward supply chain, destined for airlines, manufacturers, petro-chemical companies, and others; often via wholesalers and other intermediaries that complete the downstream portion of the supply chain.

Global Witness contacted several commodity traders that have been active in South Sudan for comment.

Trafigura stated that

“Our policy on the disclosure of payments to governments commits Trafigura to publish details of payments in EITI implementing countries. The Republic of South Sudan is not, as yet, a member of the EITI and as such we are not at liberty to disclose information as requested.”

As such, Trafigura confirmed only that “Trafigura has delivered refined products to Nilepet and been paid in return,” adding that “this is the extent of our business relationship with the company.”

The fact that South Sudan is not an EITI member means Trafigura is not required to disclose payments, as it would in an EITI member country. It does not, however, preclude companies from doing so on a voluntary basis in non-member countries, acting with the same transparency as they do elsewhere. Trafigura discloses equivalent information in EITI member countries, and the Government of South Sudan has published information about its commercial dealings with Trafigura.

By contrast, Glencore confirmed that they purchased “eleven Dar Blend crude oil cargoes from South Sudan’s Ministry of Petroleum and Mining, which were shipped between December 2013 and February 2016.”

Glencore stated in paid for these cargoes “in accordance with the invoices issued by the Ministry of Petroleum and Mining. Nine payments were made to an account at the Bank of South Sudan. According to the respective invoices, the beneficiaries of this account were either The Ministry of Finance, Bank of South Sudan or Nile Petroleum Corporation. Nile Petroleum was named as beneficiary for one of these payments.” In addition, payment for one cargo was made to an account at Stanbic Bank in South Sudan, where Nile Petroleum was the beneficiary of the account, and payment for one cargo was made to “an account of the China National Petroleum Company pursuant to a payment assignment authorised by the Ministry of Petroleum and Mining.”

“Since Glencore does not have operational assets in South Sudan, the payments for these crude oil cargoes are not captured by the Glencore Payments to Governments Report.”

Glencore has, however, claimed it aims to include “additional disclosure around payments to State Owned Enterprises (SOEs)” in its forthcoming 2017 report.

Glencore added further that “it has never made loans to the Government of South Sudan, or entered into pre-finance arrangements, for the acquisition of South Sudanese oil.” (Glencore's full response.)

Vitol, who do not appear to have purchased any cargoes from South Sudan since 2014, and UNIPEC did not respond to Global Witness’ request for comment. Global Witness was not able to reach Addax for comment.

Nilepet depends on the global oil supply chain

Without this supply chain, Nilepet would be unable to raise revenues. Just as South Sudan’s elites are dependent on banks in Kenya, Uganda, and beyond to move and store their wealth, so too Nilepet depends on an international supply chain to turn oil into foreign currency.

This is not uncommon. The market for many natural resources is not found in the countries where they are extracted. Diamonds dug from the ground in the Central African Republic and Zimbabwe are destined for cutters in India and jewellery in the EU, China, and the US. Cobalt from the Congo is a critical component of Chinese-made batteries that power electric vehicles in California.

The companies that make up these supply chains have increasingly recognised that this affords them both a responsibility and an opportunity to influence how these resources are extracted and traded.

The UN Guiding Principles on Business and Human Rights make it clear that companies are responsible for the impact their business activities can have on human rights and conflict.66 Companies cannot simply pass this responsibility on to states, reasoning that in the absence of sanctions they are free to pursue profit without question or responsibility. The companies that continue to supply Nilepet with foreign currency—whether directly or indirectly—share responsibility for its actions.

In the mineral sector, including oil, the Organisation for Economic Cooperation and Development (OECD) has developed practical guidance dedicated to helping companies meet their human rights responsibilities.67 This guidance has been endorsed by a growing number of states, as well as the UN Security Council. It clearly includes oil within its scope. Trafigura have recently joined the Multi-Stakeholder Group tasked with advancing and developing this Guidance.

At the heart of these initiatives is the concept of “due diligence.” This requires companies to acknowledge responsibility for risks and negative impacts linked to their business activities, and to proactively map their supply chains in search of warning signs. These might include secrecy and opacity; opaque management structures limiting oversight and accountability; or direct or indirect links to known perpetrators of human rights abuses. Where these, or other, risks are found, the company is required to do what it can to deal with them, using either their own commercial leverage, or by working in concert with other companies in the supply chain.

This is not a sanction. Companies are not discouraged from engaging, except where links to serious human rights abuses are clear and where little or nothing can be done. Companies are instead encouraged to engage, where possible and appropriate, but using the influence this brings to promote more transparent and responsible behaviour from those they are in business with. These practices will, it is hoped, in turn, help deliver more sustainable and equitable development.

The failure to do so in South Sudan was most dramatically illustrated when famine was declared in parts of South Sudan in 2017, near the oil fields of Unity State. Food levels in much of the Upper Nile region, where oil is still being produced, were designated as in “crisis.”68

These responsibilities are not restricted to sectors where there is substantial informal or artisanal extraction, as is common in many mineral supply chains. Significant human rights and conflict finance risks can also arise in industrial mining operations, such as where a state uses mineral resources to finance oppressive security forces. In 2017 Global Witness reported on extensive links between Zimbabwe’s diamond sector and the country’s oppressive and highly partisan security forces.69

The UN Office of the High Commissioner for Human Rights has recently clarified that the responsibilities captured by the UNGPs extend also to banks and others who provide finance, and so can be linked to relevant human rights impacts through their lending.70 This is particularly key to the oil sector, where short term lending is both critical and common. The lenders that make the purchase of many crude cargoes possible have a responsibility to ensure the proceeds are going where they should—not funding conflict or human rights abuses—and an opportunity to use their significant leverage to make sure the companies they lend to are doing their bit.

While still far from perfect, greater due diligence in international mineral supply chains has started to disrupt the finances sustaining predatory armed groups, and has brought greater transparency and attention to the role this trade has played in driving conflict and instability. It has seen some companies take greater ownership of the risks in their supply chains and, in some cases, has led to concrete efforts to do something about them.

Regrettably, it has also seen companies simply choosing to divest at the first sign of added scrutiny, rather than remaining engaged on more responsible terms. This has seen companies abandon locations and miners they have previously profited from, or efforts to pass the costs of a more responsible trade on to the most vulnerable link in the supply chain, which too often means the artisanal miners at the very bottom.

Recognising the limitations of voluntary encouragement, several governments have also recently made supply chain due diligence mandatory for some of companies they regulate. Section 1502 of the US Dodd-Frank Act requires many listed US companies to conduct supply chain due diligence on supply chains for tin, tantalum, tungsten, and gold that may originate in the Congo or its neighbours, including South Sudan. Rwanda and Congo both passed similar laws soon after, and China has developed its own Guidelines, closely modelled on this international standard. In June 2017, the European Union adopted a regulation requiring importers of metals and ores of the same minerals to exercise due diligence on their supply chains, regardless of where they originate.

International companies are not doing enough

While notable progress has been made in a number of mineral sectors—notably the trade in tin, tantalum, and tungsten—supply chain due diligence remains relatively rare in the oil sector, despite falling within the scope of both the UNGPs and OECD’s Due Diligence Guidance.

The oil sector shares many similarities with mineral supply chains where due diligence is already established.

The oil supply chain divides relatively neatly into an upstream and downstream component, with refiners potentially serving as a convenient choke point. As refiners command fairly good knowledge of their suppliers and the origin of the crude they source, they are in a strong position to establish the degree of traceability needed to facilitate risk identification. Refiners, traders, international oil companies, and lenders, have significant leverage between them to do something about the risks that are found.

As in other mineral supply chains, companies further downstream may have less visibility over the origin of the oil-based products they source, given that it may be heavily blended by the time it reaches them. But the OECD standard does not require them to trace their oil to the point of extraction. Downstream companies are instead asked to map their supply chain to the relevant choke-point—such as refiner—and to make sure they are using their commercial leverage to influence the behaviour of these companies.

But the oil industry has largely ignored this trend towards greater due diligence in high risk supply chains and, as such, is far from meeting its responsible business obligations.

Nilepet’s role in financing South Sudan’s conflict illustrates the costs of this blind spot, as well as the risks to international companies and lenders which may find themselves linked to South Sudan’s widespread human rights abuses and atrocities.

This not only has implications for the conflict in South Sudan. Oil trading has financed organised criminal groups, terrorists, and oppressive state institutions in west Africa, the Middle East, and beyond.

International complicity in South Sudan’s corruption and conflict-finance

There is a striking line in South Sudan’s 2015 Peace Agreement.

In chapter four, dedicated to reforming South Sudan’s natural resource sector, article 4.1.9 requires that “[a]ll oil revenue including surface rentals, training fees, bonuses, etc., shall be remitted to the oil account in BoSS [Bank of South Sudan] and withdrawals shall be in accordance with the law and procedures of the Ministry of Finance and Economic Planning.”

The practice of directing oil payments to accounts other than the officially designated government account—a practice that would contravene South Sudanese law—appears to have been sufficiently widespread to require the inclusion of this reminder in the internationally negotiated peace agreement.

These payments will likely, in most cases, have been made by international buyers

They are a good example of the ways in which companies can influence the landscape of conflict and corruption. By questioning payment instructions that deviate from national law, international trading partners can promote transparency and make corruption and secret conflict financing harder. When they do not, they facilitate corruption and frustrate accountability.

National laws exist, in part, to constrain the otherwise unbridled power of governments and institutions that may be prone to capture. These constraints are, however, only effective where the government cannot reliably order such laws to be overridden.

The companies that share a supply chain with Nilepet can also challenge its capture and secrecy in other ways.

Nilepet has successfully resisted legally mandated audits, as well as the publication of its accounts and expenditure. This has frustrated oversight from South Sudan’s civilian institutions and civil society, enabling murky payment to the security forces and ethnic militia. It may also have linked its international trading partners to serious human rights abuses; a risk they can only properly address if they pressure Nilepet to submit to required audits and transparency, and for an explanation when assets are shifted to Nilepet, or when Nilepet operates outside existing regulatory or legal frameworks.

Payment disclosures can also help challenge corruption and misappropriation. Under the Extractive Industries Transparency Initiative (EITI), companies are required to report on their payments to governments, and governments are required to report on their receipts on a disaggregated project-by-project basis. This ‘double disclosure’ of both sides of the same transaction makes corruption harder to hide. If a portion of the government’s receipts fail to appear in national budgets, their disclosures will not match those of the company that made the payment.

South Sudan is not an EITI member, but could still benefit from this added transparency. But international buyers, including large international traders, have failed to report their payments to the South Sudanese government, information they do provide in other countries where they operate. One trader, Trafigura, even cited South Sudan’s non-EITI Membership as a reason not to disclose payments to the South Sudanese government in correspondence with Global Witness, despite the significance of their commercial activity in the country. Another, Glencore, provided information upon request, suggesting companies purchasing South Sudanese oil may productively be engaged in the process.

Similarly, oil-backed lending, including through advance sales, has been closely linked to both conflict financing and corruption in South Sudan. The banks and traders funnelling foreign currency to South Sudan’s leaders and opaque companies, while adding to the country’s already crippling debt-burden, share in the responsibility for the consequences.

International companies may also be in a position to press for structural reforms that could help guard against capture. They could, for example, press for the passage of laws to regulate Nilepet; efforts to limit and delineating its mandate; and steps to reform its oversight mechanisms to limit the personal influence of any one person—such as the President—and securing a professional Board of Directors free from political or security sector interference.

Greater attention to the supply chains that sustain Nilepet will not end the conflict in South Sudan. The economic forces driving South Sudan’s conflict are far more complex, and the indifference of South Sudan’s leaders to the suffering of their people limits the prospect of meaningful engagement. Capture extends well beyond both Nilepet and South Sudan, and includes a sector and economic system that has allowed a company linked to conflict-financing and human rights abuses to entrench itself so thoroughly in international supply chains. But the pressure the supply chain can leverage could play a role in starting to dismantle some of the capture and secrecy that characterises Nilepet, or at least promoting some of the transparency that can aid the development of more ambitious and comprehensive solutions. It may also play a part in limiting the looting that rewards anyone that can capture Juba and central power, perhaps driving a determination in others to ensure their time too will come.

He has clearly lost much of the optimism that flowed from the country’s vast oil reserved upon independence. But unlike the oil, any curse is of our own making.

Nilepet’s capture and secrecy is the sum of numerous smaller transgressions. In the absence of meaningful regulation, control has been vested in the President, with few checks and balances. The Director General of the ISB has been given a secret seat on the Board, through which significant sums have been diverted to security sector spending linked to horrific violence and abuses. These payments have been difficult to identify, as the company has resisted both clear accounting, legally mandated audits, and basic oversight responsibilities when disbursing millions in letters of credit.

Far from challenging this capture, those who trade in South Sudan’s oil have been among its facilitators.