Indonesian coal company that won awards for paying tax used subsidiaries in tax havens to move hundreds of millions of dollars offshore.

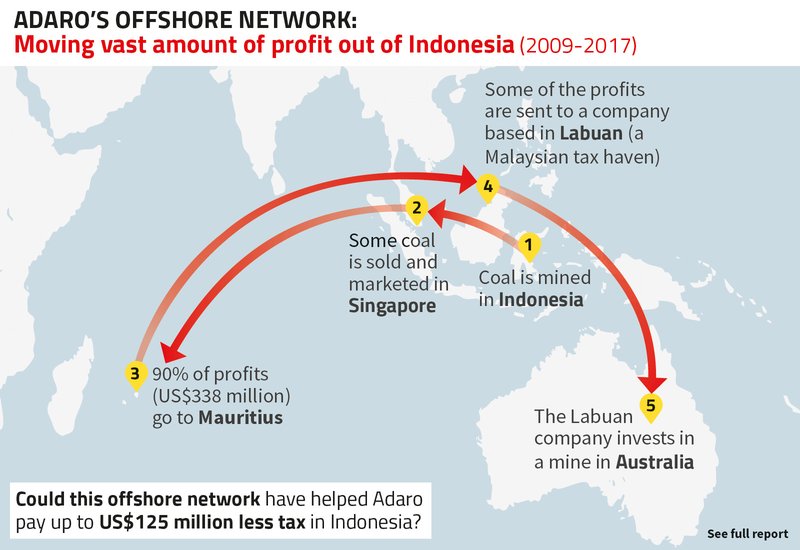

Adaro Energy, one of the world’s largest coal companies, has been moving vast amounts of profit to a growing offshore network - that may have helped it avoid or minimise the tax it pays in Indonesia.

The Indonesian company cultivates a proud image of contributing to the nation, but might have reduced the amount of tax it would otherwise pay in Indonesia by US$125 million between 2009 and 2017 using its tax haven network. If Adaro had structured its activities differently, it may have registered more profit in Indonesia, increasing the government funds available for essential services by an average of US$15million each year.

This is the third in our series of investigations into Indonesia’s shifting coal money, revealing the use of opaque companies to shift millions of dollars from the country’s coal industry offshore.

Previous instalments in our series showed the financial risks to investors in Indonesian coal on top of already well-known environmental risks.

These new findings offer another reason why the Indonesian government and its citizens should be concerned with plans to rapidly expand this murky industry: they could already be losing out on potential tax revenue from one the country’s biggest companies, Adaro Energy, as a result of its offshore practices.

This is a company which currently stands to benefit from state guarantees for building a huge new plant – yet whose actions stand in stark contrast to a carefully constructed public image of proudly contributing to Indonesia and its development.

Key findings

Our investigation reveals how Adaro:

- Earned significant profit from trading coal it mined in Indonesia through its subsidiary in the low-tax jurisdiction of Singapore (where it paid an average tax rate of 10%) rather than in its home country of Indonesia (where it paid an average tax rate of 50%).

- Moved the vast majority of this profit to related companies in Mauritius where it appears not to have been subject to tax until at least 2017.

- Established and maintained subsidiaries in other low tax jurisdictions, growing its offshore network, with the recent addition of a company based in the low tax jurisdiction of Labuan in Malaysia, through which it now holds a major investment in Australia.

At the same time, Adaro stands to benefit from Indonesian government financial guarantees for the US$4 billion Batang coal-fired power plant, which will be the biggest in Indonesia. Adaro is a joint venture partner, owning 34% in the power plant which is forecast to create up to $80 million a month in revenues once up and running.

Background: Indonesian coal, Adaro – and tax

Indonesia is one of the world’s top coal producers and exporters. With global demand for coal dropping, a raft of planned new coal-fired power stations in Indonesia could help to maintain a market for its coal.

However, within Indonesia, coal is also seen as increasingly controversial. Recent corruption scandals, a swathe of improperly issued licenses, contaminated land and water, and the reliance on an increasing level of government subsidies - among other problem - are creating a growing body of opposition to the industry.

In public statements Adaro is keen to “emphasize” its “commitment to the nation” through its tax payments and other contributions” to stress that “as a national company [it] is, committed to contributing to the development and progress of Indonesia’s economy through taxes” and that it aspires to provide “its full support for the advancement of the nation”. One of its Indonesian subsidiaries has even won an award for its payment of taxes.

Yet our investigation reveals that Adaro has seemingly followed the practice of many Western multinationals by channelling some of its earnings into, and holding assets in, tax havens - in ways which may help it to avoid or minimise tax it pays in Indonesia.

Tax avoidance is not usually illegal but it is increasingly frowned upon around the world as it can significantly reduce the amount of revenue that governments collect and therefore have available to spend on their countries’ economic and social development

Key recommendations

Recommendations for the Indonesian government

- Refer all matters raised to the Indonesian tax authorities for them to consider a review.

- Drastically reduce the number of coal-fired power stations planned in the electricity generation plan (RUPTL).

- Create a plan for an energy transition away from coal, towards renewable energy, in line with the Paris Agreement goals.

Recommendations for private and publicly-owned banks

- Adopt coal policies that exclude project finance for new coal mines and coal-fired power plants in Indonesia.

- Adopt coal policies that exclude general corporate financing and advisory services to Indonesian companies that are highly dependent on coal power.

- End their exposure to Indonesian companies involved in coal, creating a time bound plan to achieve this.

Taxing Times For Adaro

Download ResourceRead this page in