The Abu Dhabi National Oil Company

Before last year, most people would have been forgiven for not knowing the Abu Dhabi National Oil Company (ADNOC). Founded in the early 1970s at the start of the United Arab Emirates’ oil boom, ADNOC has, throughout most of its history, been a purely domestic concern, owning and operating oil and gas assets in the UAE.

In 2016, it appointed Sultan Al-Jaber as CEO before embarking upon a years-long public relations campaign that culminated with the UAE being awarded the COP28 climate summit in 2021.

The conference was scheduled in Dubai for the end of 2023 as part of the ongoing, UN-led climate process aimed at capping global temperature rises.

Al-Jaber’s appointment in January 2023 as the de facto head of international climate policy was greeted with a mixture of derision and anger by environmental groups, and prompted dozens of EU and US lawmakers to sign open letters demanding he step down.

"Having a fossil fuel champion in charge of the world’s most important climate negotiations would be like having the CEO of a cigarette conglomerate in charge of global tobacco policy. It risks undermining the very essence of what is trying to be accomplished," wrote 27 US Senate and House members at the time.

Fossil fuel phase-out protest outside of the Brazil pavilion at COP28, on 6 December 2023, in Dubai, UAE. Jasmin Qureshi / Global Witness

Having a fossil fuel champion in charge of the world’s most important climate negotiations would be like having the CEO of a cigarette conglomerate in charge of global tobacco policy

In response, political allies including US climate chief John Kerry pointed to Al-Jaber’s experience as CEO of Masdar, the renewable energy company founded in Abu Dhabi in 2006.

Al-Jaber, a career diplomat and key UAE point person in crises such as Egypt and Yemen, took to the role as custodian of global climate diplomacy with calm assurance. He repeatedly stressed the need for companies and countries to slash emissions in order to keep the Paris Agreement temperature goal of 1.5°C within reach.

He called for companies to factor in Scope 3 emissions – that is, the emissions produced by burning the oil and gas that firms sell, which typically account for the vast majority of an organisation’s carbon footprint – into their business model.

Al-Jaber also regularly called for rich polluting nations to pay for the loss and damage their carbon-intensive development had inflicted on communities at the front lines of the climate crisis.

Yet as its CEO spent the year as the world’s climate czar, ADNOC itself spent much of 2023 drastically increasing its capacity to produce oil and gas.

The fossil fuels COP

COP28, which took place in Dubai in late 2023, was the largest of its kind since the foundation of the UN Framework Convention on Climate Change in 1994.

The conference brought unprecedented scrutiny on Al-Jaber and ADNOC, and the months leading into the summit saw organisers battered by a string of leaks and allegations.

These included reports that ADNOC had installed top company executives on the COP28 organising committee, or that its employees had reportedly been reading emails intended for UN staff. ADNOC tasked a US PR firm to tamp down the negative headlines.

In late November 2023, just days before Al-Jaber was officially appointed COP28 president, documents leaked to the BBC and the Centre for Climate Reporting appeared to show that the Al-Jaber’s team had sought to lobby on oil and gas deals in the lead up to the summit.

The documents, the authenticity of which was verified by the BBC, feature a list of 16 target nations including specific companies, relevant ministers or delegates, as well as a number of talking points for each country.

Action against the presence of fossil fuel lobbyists at COP28. Jasmin Qureshi / Global Witness

Caught in a maelstrom of negative media coverage, Al-Jaber eventually denied the reports.

“These allegations are false, not true, incorrect and not accurate,” Al-Jaber told a news conference in Dubai.

"Every meeting I have conducted with every government or any other stakeholder has always been centred around one thing and one thing only: that is my COP28 agenda and how we can collectively for the first time ever, adopt a mindset that is centred around implementation and action to keep 1.5°C within reach,” Al-Jaber said.

I hope the younger generations can forgive us for what we have done

This investigation sheds light on the deals that ADNOC pursued during 2023 – the UAE’s year as COP host. It looks at potential dollar values, production and export volumes, as well as the number of fossil fuel lobbyists from key target countries who registered for the talks in Dubai.

It also seeks to calculate the greenhouse gas emissions some of those deals will lead to through the use of ADNOC’s oil and gas products.

Our conclusion is that ADNOC used its time in the spotlight of climate policymaking to secure its status as a global fossil fuel player.

Furthermore, working under the diplomatic cover provided by ambiguous language in the COP28 decision text, ADNOC plans to produce vast amounts of oil and gas for decades to come.

In the year that the UAE hosted COP28, ADNOC sought oil, gas and petrochemical deals potentially worth close to $100 billion, a five-fold increase on what it pursued in 2022 and significantly more in dollar terms than in the previous four years combined.

Our analysis shows that ADNOC sought or closed deals in 2023 with firms owned by or domiciled within 12 countries, including 11 of the 16 nations targeted in the leaked COP28 country briefing documents.

In all, ADNOC and its subsidiaries either clinched or targeted at least 20 deals with international firms in 2023.

The ADNOC speaking points were actually being used to make deals

As for Al-Jaber’s denial that the leaked documents were used as talking points for oil and gas deals in the run up to and during COP, Global Witness contacted more than a dozen officials who were involved in negotiations.

One official said they were present on multiple occasions in the UAE when deals were openly discussed by senior ADNOC officials and even by Al-Jaber himself.

They said that the leaked talking points “were included in every brief throughout the lead up to COP28, pre-COP and even during COP28 itself."

The official said they had email records, to which they lost access once their contract ended, showing that the documents leaked by the BBC and CCR had been circulated to country delegations and to company officials by ADNOC.

“What I could get from the email threads is that the ADNOC speaking points were actually being used to make deals,” the source said.

Inside the plenary at COP28, with COP28 President Sultan Al Jaber on the stage, on 30 November 2023, Dubai, UAE. Lai Yun / Global Witness

The source agreed to provide testimony to Global Witness on condition of anonymity for fear of professional reprisal. Global Witness has done its utmost to corroborate their testimony while protecting their identity.

Their account adds to the body of evidence suggesting ADNOC did in fact use the UAE’s COP28 presidency as an opportunity to pursue business deals.

Global Witness presented ADNOC with the findings of this report. While it did not address or dispute the substance of most of this investigation’s findings, in response to the claim that ADNOC used COP28 to pursue business deals, a spokesperson said: “This allegation is completely baseless and false.”

Negotiators felt like they were being used as props

With media scrutiny increasing, sources close to negotiations said the COP28 organising team were progressively shut out from key meetings and increasingly replaced by ADNOC officials.

"It became this really select group of people in meetings,” said one source. “Negotiators felt like they were being used as props for certain conversations, but didn’t even know discussions had already been finalised.

“There was just a very small group of people running what was really happening and making deals.”

Discussions reportedly left multiple negotiators exasperated, with one seasoned diplomat overheard exclaiming, “I hope the younger generations can forgive us for what we have done.”

An ADNOC spokesperson said: “This latest report by Global Witness attempts to recycle old allegations, and make negative, misleading, and inaccurate statements. We are focused on working to ensure a secure, reliable, and responsible supply of energy to support a just, orderly and equitable global energy transition.”

A COP28 spokesperson said: “Made up allegations about conversations that never took place and attempt to discredit the hard work and tremendous accomplishments of the Presidency do not merit consideration.”

Permission slip for pollution

The influence of oil and gas was a recurring theme at COP28. Analysis of conference attendees conducted by the Kick Big Polluters Out coalition found that a record 2,456 fossil fuel lobbyists were granted access to the Dubai negotiations.

Further scrutiny of the attendees list revealed that Al-Jaber’s team – despite his insistence that his firm was not using the summit to pursue deals – invited the heads of at least 17 oil and gas producers to Dubai, who appeared on the COP28 provisional participants list as part of the “Host Country Guests” delegation.

The oil and gas those firms plan on producing will see them collectively produce 265 billion barrels of oil by 2050. This was the fossil fuels COP.

A COP28 spokesperson said: “The allegations made by Global Witness are baseless, without merit and demonstrate a disappointing lack of knowledge of global climate diplomacy.

“COP28 delivered the biggest climate breakthroughs since the Paris Agreement. Guided by the science and underpinned with full inclusivity, COP28 secured unprecedented climate progress in both the negotiated text and the Presidential Action Agenda, keeping 1.5°C within reach and leaving no one behind.

“Such historic progress could not have been achieved without engaging every stakeholder, including the energy sector.”

One of the fossil fuel executives in attendance at COP28, at Al-Jaber's invitation, was BP interim CEO Murray Auchincloss. Kamran Jebreili / AP Photo

Among the 17 senior executives invited by the UAE to attend was BP interim CEO Murray Auchincloss. ADNOC and BP would go on to announce in February a $1.5-billion joint venture to “focus on development of gas assets in Egypt” – one of the countries targeted in the leaked COP28 country briefing.

Four senior employees from Austrian petrochemical firm OMV, including its CEO Alfred Stern, were also listed as Host Country Guests. ADNOC would go on to finalise its purchase of a 24.9% stake in OMV in February 2024.

The two firms are currently negotiating a merger of their chemicals arms, formal talks for which were launched in July 2023.

An OMV spokesperson said: “We can confirm that several senior managers of OMV attended COP28 last year alongside other representatives of the energy industry.

BP did not respond to a comment request.

Several senior managers of OMV attended COP28 last year alongside other representatives of the energy industry

Throughout the two-week summit, the UAE presidency issued several eye-catching announcements presented as major wins for climate action. These included a voluntary pledge by some 50 oil and gas producers, the Global Decarbonization Charter, which committed the signatories to achieve net zero emissions from operations by 2050.

But a subsequent Global Witness analysis found that the emissions from signatories’ oil and gas production would use up more than 60% of Earth’s remaining carbon budget – that is, the amount society can pollute and still keep the Paris Agreement 1.5°C temperature goal within reach.

Nonetheless, COP28 was messaged publicly as a near unqualified success. The final decision text mentioned the need for countries to “transition away from fossil fuels in energy systems,” suggesting an acknowledgement that oil and gas production cuts were needed.

But the text stopped short of explicitly calling for a “phaseout” or “phasedown” of fossil fuels.

Al-Jaber, to a rousing standing ovation from delegates, hailed the COP28 outcome as a “historic package to accelerate climate action.”

Comment pieces heralded the “end of fossil fuels.” The New York Times went as far as to suggest that Al-Jaber had “won a climate summit deal on moving away from oil.”

UAE's state owned ADNOC plans to continue expanding its oil and gas output – in spite of calls from the UN to dramatically reduce emissions. Kamran Jebreili / AP Photo

Several sources close to negotiations told Global Witness that major oil producing nations including the UAE and Saudi Arabia, rejected the inclusion of language referring to fossil fuel use in petrochemicals and agricultural systems.

This, and the final decision text wording of “fossil fuels in energy systems”, implies that major oil and gas exporters are gearing up to increase production levels, while appearing to comply with what former chief UK scientific advisor David King labelled “feeble” wording in the COP28 outcome.

ADNOC itself is preparing to increase its oil and gas output by 42% by 2030. This is the date by which the UN says emissions must have fallen over 43% to keep 1.5°C viable, a fact Al-Jaber repeatedly acknowledged last year.

It is also pursuing an aggressive expansion into international gas production, in line with COP28 decision text wording that “recognises that transitional fuels can play a role in facilitating the energy transition while ensuring energy security.”

And so, our analysis shows that in the year that the UAE hosted COP28, ADNOC sought oil, gas and petrochemical deals with a potential value close to $100 billion, and considered deals with firms domiciled in 11 of the 16 nations targeted for contract negotiations in the leaked COP28 documents.

Not all deals ADNOC targeted in 2023 were completed. Nevertheless, the dealmaking and investment ADNOC committed to in 2023 amounted to a massive increase in business activity. The question is: how much of this was linked to COP28?

ADNOC in 2023

2023 was in many ways an unprecedented year for the Abu Dhabi National Oil Company. As well as white hot media scrutiny on its business model, it turns out 2023 was also a significant outlier in terms of ADNOC’s international business dealings.

Our analysis shows that ADNOC and its subsidiaries pursued or closed at least 20 oil, gas and petrochemical deals with international firms in 2023.

With a potential eventual market value of some $98.6 billion, contracts, takeovers, joint ventures and mergers pursued by ADNOC last year represent nearly five times more than the potential value of deals it pursued in 2022.

The 20 deals sought in 2023 compares with 15 deals (worth an estimated $19.3 billion) pursued in 2022, and just 10 deals (worth $12.7 billion) in 2021.

2023 even stands out compared with 2019, the last pre-pandemic year, when ADNOC Group attempted 13 oil and gas deals worth a potential $23.7 billion with foreign firms.

In one of those deals, ADNOC agreed to a joint equity stake to produce gas from Azerbaijan’s Absheron gas field, its first major upstream project outside of the UAE.

This wasn’t just business. The deal represents a highly symbolic moment, the passing of the torch from one petrostate COP host to the next.

It’s an indication that Azerbaijan is also likely to replicate ADNOC’s COP playbook to develop its international business ties; the state-run oil and gas company SOCAR is to be partially privatised, with its downstream and petrochemical subsidiaries made available to help attract foreign investments.

Global Witness contacted SOCAR for comment for this investigation.

ADNOC and BP have announced plans to drill for gas together in the Mediterranean. WAM via AP

In the weeks after the COP28 summit closed, ADNOC also launched a joint venture with BP to drill for gas in the eastern Mediterranean.

A separate bid that ADNOC made with BP in March 2023 for concessions in Israeli fields – which would give it access to the huge Leviathan gas field currently operated by US major Chevron – is currently on hold due to regional tensions.

ADNOC now has upstream interests in as many as 14 countries, up from just one – the UAE – as recently as December 2022 .

But ADNOC also used 2023 to consolidate its mid- and downstream market presence.

ADNOC attempted to purchase stakes in several major chemicals manufacturers, including a deal to buy a 50% stake in Dutch firm OCI NV’s fertiliser segment for $3.6 billion.

ADNOC and OMV also continue to be engaged in open-ended negotiations about the potential creation of a new combined petrochemicals holding entity

In late 2023, a few days after COP finished, Reuters reported ADNOC and Austrian energy giant OMV were close to merging two petrochemical entities to create a chemicals behemoth worth a reported $30 billion.

ADNOC issued a statement in February 2024 finally confirming its purchase of a 24.9% stake in OMV, which was originally announced in December 2022, a few weeks before Al-Jaber was nominated COP28 president.

“ADNOC and OMV also continue to be engaged in open-ended negotiations about the potential creation of a new combined petrochemicals holding entity, through the proposed merger of their respective existing shareholdings,” it said.

An OMV spokesperson said: “We can confirm that we are in ongoing, open-ended negotiations with ADNOC regarding a potential combination of Borouge and Borealis. We are conducting these negotiations in the best interests of OMV, taking into account the interests of our shareholders and employees.”

This appears to be another string to ADNOC’s strategy of diversifying its business portfolio in a way that can shore up demand for its upstream oil and gas products for decades.

In October 2023 Bloomberg reported that ADNOC was planning to establish a trading office in Geneva that would allow it to “take advantage of the hole left by Europe’s pivot from Russian fuels.”

The report quoted people close to the company’s plans saying the move was aimed at “pursuing term contracts for crude, refined fuels and liquified natural gas,” particularly in the European and African markets.

This branching out into fossil fuel trading – rather than the production and export of products that has been ADNOC’s core business since its foundation – coincided with the UAE’s, and particularly Dubai’s, emergence as the main facilitator of Russia oil and gas sales since Moscow’s invasion of Ukraine in February 2022.

Only weeks before COP28, ADNOC used an energy conference to announced billions worth of contracts to develop a massive new gas project. Christopher Pike / Bloomberg

While it oversaw global climate diplomacy, the UAE also courted unprecedented investment from international firms in its domestic oil and gas production.

In September, as part of its $150 billion investment boost in its oil and gas businesses, ADNOC announced plans to bring forward a production capacity increase, allowing it to pump up to 5 million barrels per day by 2027.

Overall, ADNOC, which is set to be the second largest oil producer globally by 2050, could have exported 630 million barrels of oil in 2023, according to Global Witness analysis of Kpler ship tracking data.

Once consumed within energy systems as refined products such as gasoline or jet fuel, this oil alone will contribute a quarter of a billion tonnes (249.5 million tonnes) to global carbon emissions.

ADNOC was the second largest spender on greenfield – that is, brand new – oil and gas expansion in the world last year.

It oversaw some $20 billion investment on new oil and gas projects in 2023, according to Rystad Energy. The United Nations Environment Programme and the International Energy Agency say that no new oil and gas is 1.5°C-compatible.

ADNOC’s Hail and Ghasha gas project, where it ramped up work last year, contains some 1.7 billion barrels of oil equivalent of gas and condensate. According to Global Witness analysis of Rystad Energy data, ADNOC and concession holders are set to produce some 260 billion cubic metres of gas and condensate from it by 2050.

Do you think the UAE or myself will need the COP or the COP presidency to go and establish business deals or commercial relationships?

Just weeks before COP28 began, ADNOC used an energy conference in Abu Dhabi to confirm the signing of $17 billion worth of engineering, procurement and construction (EPC) contracts to two Italian engineering companies to develop offshore facilities at Hail and Ghasha.

Several international oil companies (IOCs) and petrochemical firms are stakeholders in Hail and Ghasha. These include Eni (10% ownership as of April 2024, down from 25% previously) Wintershall Dea (10%), Lukoil (5%) and OMV (5%).

The project is forecast to earn them each a share of $20 billion revenue within a decade.

ADNOC also said it was doubling its planned carbon capture utilisation and storage (CCUS) capacity to 10 million tonnes annually by 2030.

In a first, it disclosed its emissions from its operations – that is, the emissions produced in extracting oil and gas, so called Scope 1 and Scope 2 emissions.

Given ADNOC’s status as a state-owned corporation, it is difficult to estimate its income in 2023. However, two of its publicly listed arms – ADNOC Distribution and ADNOC Drilling – both posted record earnings in 2023.

ADNOC Distribution, which mainly provides gasoline and diesel for domestic consumption, earned $1 billion EBITDA. ADNOC Drilling meanwhile raked in a record $1 billion profit last year.

In April 2024, ADNOC Gas reported full year results showing it had signed some $12 billion worth of LNG supply contracts to international firms.

Its shareholders approved a $3.25-billion dividend, with Al-Jaber hailing “robust financial and operational results in 2023” by “capitalising on the increasing global demand for LNG as a transition fuel.”

Although he publicly stressed the need to reduce emissions, Al-Jaber is said to have discussed new oil deals at the Summit for a New Global Financing Pact. Liu Bin / IMAGO

In his press conference at the beginning of COP28, Al-Jaber dismissed claims that his firm was using his role as conference president to strike deals.

"Do you think the UAE or myself will need the COP or the COP presidency to go and establish business deals or commercial relationships?" said Al-Jaber. "This country over the past 50 years has been built around its ability to build bridges and to create relationships and partnerships."

However, the anonymous official insisted that Al-Jaber had used his year as COP28 president and president-elect to pursue deals.

In June 2023, Al-Jaber was a key invitee at the Summit for a New Global Financing Pact, organised by French President Emmanuel Macron. Al-Jaber delivered an address at the summit venue, in which the ADNOC CEO once more mentioned the need to reduce emissions by 43%.

The source said that Al-Jaber was due to meet former Bank of England governor Mark Carney at the summit to discuss the latter’s Taskforce on Scaling of Voluntary Carbon Markets.

“Instead of attending the Mark Carney task force meeting, Dr Sultan spent almost the entire afternoon talking with oil and gas (representatives) at the conference trying to make deals,” the source said.

ADNOC declined to comment on this particular claim.

Dr Sultan spent almost the entire afternoon talking with oil and gas (representatives) at the conference trying to make deals

Al-Jaber’s denials aside, the deals ADNOC pursued during the UAE’s year as COP28 will have a profound bearing on the climate for decades to come.

If the assets involved in some of these deals were fully operated, they would involve the projected sale of some 5.46 billion barrels of oil equivalent by 2050 – equivalent to around a sixth of ADNOC’s total output by mid-century. The associated carbon pollution from the production and consumption of gas and condensate would be more than 1.79 billion tonnes of CO2.

When asked about this, the ADNOC spokesperson said: “Global Witness continues to present inaccurate analysis that does not make any distinction between ADNOC’s production capacity and actual production.”

Global Witness’s analysis of Rystad Energy data deals with projected production volumes – that is, the annualised rate of projected hydrocarbon extraction – and not with projected production capacity, figures for which are publicly available in the case of ADNOC.

Azerbaijan

Azerbaijan, which has been conducting a long-running conflict against ethnic Armenians in the disputed Nagorno-Karabakh region, was finally confirmed as COP29 host in December 2023 after months of uncertainty.

The decision represented something of a passing of the torch from one petrostate to another.

Azerbaijan relies on oil and gas production for almost half of its GDP and more than 92.5% of export revenues.

As with the UAE’s presidency, Azerbaijan’s will be presided over by a long-time oil executive. COP29 president Mukhtar Babayev, now Azerbaijan’s minister for ecology, spent nearly two decades in senior positions with SOCAR, Azerbaijan’s state-owned energy company.

A COP29 spokesperson said Babayev left SOCAR in 2018, after which “any executive role with the company ended.”

COP29's president, Mukhtar Babayev, previously held senior positions in SOCAR. Thomas Traasdahl / Scanpix

And the handover of control of climate diplomacy from one oil and gas producing nation to another was cemented by the UAE’s first ever deal for international gas production, in partnership with Azerbaijan’s state-run oil company.

Azerbaijan’s prominence as an energy provider for Europe emerged following Russia’s invasion of Ukraine. With Brussels desperate to fill the supply shortfall a pivot from Russian fuels would entail, it approached Baku and struck a deal to double Azeri gas imports to 20 billion cubic metres a year by 2027.

To fulfil its contract, Azerbaijan has resorted to importing Russian gas for domestic consumption as it exports most of what it produces currently to the EU.

If it is to make good on its commitment to double EU gas flows within the next few years, it will need to significantly expand production capacity. And, thanks to ADNOC, that’s precisely what it is doing.

In August 2023, ADNOC announced it was to acquire a 30% equity stake in Azerbaijan’s Absheron gas field in the western Caspian Sea.

In partnership with SOCAR and France’s TotalEnergies, ADNOC’s investment in the project “aims to create a substantial growth position as it enters the international gas market, and reinforces the energy partnership between the United Arab Emirates (UAE) and Azerbaijan,” according to a company statement.

Azerbaijan has risen to prominence as a key energy provider for Europe following Russia's invasion of Ukraine. Nick Wiseman / Art Directors

Soon after the announcement, ADNOC’s executive director of low carbon solutions and international growth Musabbeh al-Kaabi said the deal was part of a strategy to internationalise the company’s production capacity.

"We are executing a strategy that complements our strength," said Kaabi. "We are a significant player in LNG historically and [there is] the expansion in Abu Dhabi now. We would like to complement that with a sizeable position globally."

It also appears to be in line with language in the final COP28 decision text, which states that the international community “recognises that transitional fuels can play a role in facilitating the energy transition while ensuring energy security.” Fossil gas has for many years been presented by industry as being a transitional fuel.

Although the value of the ADNOC-SOCAR-Total deal was not made public, Rystad Energy estimates the initial transaction to be worth at least $1.25 billion.

The Absheron field is vast – it has reserves of some 1.54 billion barrels of oil and gas and its phase 2 drilling operations, facilitated by ADNOC’s investment, is set to start in 2031.

According to Global Witness analysis of Rystad Energy data, ADNOC is set to cumulatively produce some 63.9 billion cm of gas from Absheron by 2050 – which when consumed for energy will produce some 120 million tonnes of CO2e.

ADNOC is likely to make more than $7 billion profit from gas sales from Absheron by then, while the project as a whole is projected to generate $20 billion over the next decade.

ADNOC's sizeable stake in Azerbaijan's Absheron field could boost the state's ambitions in the EU. Eddie Gerald / Alamy Stock Photo

On Azerbaijan, the leaked COP28 documents stated that “Azerbaijan is uniquely placed to act as a secure energy hub for Europe” and that the UAE was “eager, through Masdar and ADNOC, to support Azerbaijan in realising this vision.”

The documents specifically listed Toghrul Feyziyev, Azeri minister of ecology and natural resources, who UN attendance records showed was present in Dubai during COP28.

Global Witness asked ADNOC if Feyziyev had met with Al-Jaber during COP28. It didn’t respond.

On December 5, 2023, when COP28 was entering its final week, ADNOC announced a further deal with Azerbaijan, this time collaborating with SOCAR on a range of “low carbon technologies”.

“ADNOC and SOCAR will explore opportunities to work together to advance blue hydrogen, carbon management and geothermal technologies that can accelerate the decarbonisation of energy systems in the UAE, Azerbaijan and other key markets and support their net zero ambitions,” said a joint statement.

ADNOC has made a point of investing billions since the start of 2023 on “low carbon solutions”. However, blue hydrogen, derived from fossil gas, has been shown in a peer reviewed study to be potentially even more emissions intensive than getting power from natural gas alone.

According to analysis conducted by Kick Big Polluters Out, Azerbaijan sent 17 fossil fuel lobbyists to COP28, 10 of which were employees of SOCAR. SOCAR President Najaf Rovshan was invited to host COP28 by Al-Jaber, according to the provisional participants list.

Country fossil fuel delegates at COP28: 17. SOCAR delegates: 10.

Brazil

Brazil, home to the Amazon Rainforest, is a crucial actor in climate negotiations. Its state-run Petrobras is one of the largest oil and gas producers in the world and is planning on expanding production more aggressively than any other comparably sized energy major, globally.

Petrobras holds a 32.15% stake in Braskem, Latin America’s largest producer of petrochemicals, and which was a major target for ADNOC’s international expansion.

In May 2023, reports emerged that ADNOC had submitted an initial, non-binding $7.6-billion bid for Braskem, as part of a joint takeover offer with US-based asset manager Apollo Global Management. This offer valued Braskem at almost double its market share at the time, with the chemicals firm having just posted a sharp fall in profits.

Then in November 2023, Braskem announced ADNOC had submitted a fresh bid, this time on its own, to buy out the stake of Novonor – Braskem’s principal owner – in a deal valued at the time at $2.14 billion.

Weeks later, Brazil was confirmed as the host of COP30, due to take place at the end of 2025. As such, Brazil sent the largest delegation of any single country to COP28, a 3,081-strong team of negotiators that even outnumbered the 2,456 fossil fuel lobbyists granted access to the talks.

The documents allegedly circulated by organisers showed how ADNOC “has identified Brazil as a strategic country for investment.” It identified the Brazilian environment minister, Marina Silva, as a key point person in helping to get the Braskem deal over the line.

“Securing alignment and endorsement for the deal at the highest level is important for us … Ask: your support in facilitating a call with the appropriate minister,” the documents said.

"Petroleum is energy regression" reads a placard brandished by Indigenous protestors in Brazil. Brazil, one of the largest oil and gas producers in the world, has been named COP30's host country. Cícero Pedrosa Neto / Global Witness

ADNOC did not comment when asked whether or not any meeting took place between Silva and its employees, although Silva did attend COP28.

She appeared on stage alongside Al-Jaber and Brazilian President Luiz Inacio Lula Da Silva at the summit on 2 December and was as part of a panel on climate action in Dubai on 10 December, 2023.

She also met directly with Al-Jaber at the G20 Environmental and Sustainability ministerial meeting in Chennai on 27 July. Global Witness approached Silva for comment.

Three weeks before COP28 began, Brazil’s government news service announced that the Minister of Mines and Energy, Alexandre Silveira, had held talks with Klaus Froehlich, a former Morgan Stanley executive who is now ADNOC’s director of investment.

“At the meeting, investments in the biorefineries sector and the strategic importance of Brazil in the production of renewable fuels were discussed,” said the Brazilian report, adding that “refineries integrated with petrochemical assets” were “a promising market for investment” in language that closely mirrors that of COP28 organisers in the leaked documents.

Just days after the final decision was reached at COP28, reports emerged that Petrobras was eyeing up increasing its stake in Braskem in order to facilitate a sale to foreign investors.

The official alleged that Petrobras' then CEO Jean Paul Prates was flown out to Abu Dhabi and met with Al-Jaber at ADNOC’s Abu Dhabi headquarters in early September. This was while discussion around ADNOC’s purchase of Braskem equity was still progressing, and just weeks after Prates and Al-Jaber met during the sidelines of the Amazon summit in August.

The leaked documents name Brazil's environment minister, Marina Silva, as a key player for ADNOC's dealings with Braskem. Rafiq Maqbool / AP Photo

Prates was in Abu Dhabi on 3 September signing a deal with Emirati state investment fund Mubadala to “develop joint studies on future business in the downstream segment,” according to a post on his official X account.

Global Witness approached Petrobras for comment, asking it to confirm whether Prates met with ADNOC officials in Abu Dhabi in September. The company did not respond. ADNOC did not respond to questions specifically on this alleged meeting.

In May 2024, ADNOC announced it had dropped its bid for Novonor’s stake, causing Braskem’s shares to fall sharply.

Analysis of the COP28 provisional attendees list showed that 54 fossil fuel lobbyists attended on behalf of Brazil, including 16 from Petrobras and six from Braskem.

Global Witness analysis of Kpler data shows that ADNOC could have sold more than 7.8 million barrels of petroleum products to Brazil since Al-Jaber was announced as COP28 president in January 2023.

Al-Jaber has since sought to bolster UAE-Brazil relations, declaring the two countries, along with COP29 host Azerbaijan, as a “climate troika” ensuring the Paris Agreement temperature goal of 1.5°C is kept within reach.

Country fossil fuel delegates at COP28: 54. Petrobras employees: 16. Braskem employees: 6

China

In late 2022, just weeks before Al-Jaber was named COP28 president elect, ADNOC announced it was bringing forward a planned production capacity increase to 5 million barrels of oil a day, from 2030 to 2027.

As part of this push, ADNOC Onshore, a state-owned ADNOC subsidiary, struck a deal with China Petroleum Engineering and Construction (CPEEC) worth a reported $490 million, announced in August 2023, to enhance production from the UAE’s mature oil fields by 20%.

Another agreement between CPEEC and ADNOC Onshore followed weeks later, this time concerning increased production in the UAE’s Bab and Bu Hasa oilfields.

In September, CPECC was reportedly handed a $325-million contract by ADNOC Onshore to further enhance production and processing capacity at Bu Hasa, before signing another agreement with ADNOC Onshore to build a sixth processing station at Bu Hasa, worth a reported $300 million.

All told, ADNOC could have sold more than 43 million barrels of oil and products to China in 2023, per Global Witness analysis of Kpler shipment tracking data.

ADNOC has signed a number of LNG supply and oil field services deals with Chinese firms. Sipa US / Alamy Live News

ADNOC also completed major liquified natural gas (LNG) deals with Chinese companies in 2023. In April 2023, reports emerged that ADNOC Trading – a subsidiary founded in 2020 – had completed a trade with PetroChina in yuan for LNG.

Although the value of the transaction was not publicly divulged, PetroChina and ADNOC Gas announced a deal worth up to $550 million to supply LNG to the Chinese state-owned energy giant.

In a statement accompanying the deal, ADNOC said that “natural gas plays a crucial role as a transitional fuel, generating lower-carbon emissions compared to other fossil fuels,” language that was later replicated in the COP28 final decision text.

In December, ADNOC signed a 15-year deal with ENN LNG, a subsidiary of China’s ENN Natural Gas, for the delivery of at least one million metric tonnes of LNG annually. The value of the contract was not disclosed.

Rashid Al-Mazrouei, ADNOC’s senior vice president of marketing, said most of the LNG will be sourced from ADNOC’s Ruwais LNG project in Abu Dhabi. Deliveries of LNG are expected to begin in 2028, according to the state-owned Emirati WAM news agency.

ADNOC’s Ruwais Industrial City, the jewel in the crown of the UAE’s LNG strategy, was included in a $3.6 billion project last year to increase the UAE’s gas processing capacity.

Another key person named in the leaked documents was China's vice minister for ecology and environment, Zhao Yingmin. Lu Yang / Xinhua / Alamy Live News

The leaked COP28 documents showed that ADNOC made $15 billion in the sale of crude and other petroleum products to China “in the past 12 months.”

Although not mentioning either CPECC or PetroChina by name, they nevertheless described Chinese companies as “among our most strategic partners,” highlighting “their equity participation in Abu Dhabi’s upstream assets.”

The documents also stressed the role China can play in helping the UAE to produce and sell more fossil gas: “We are willing to jointly evaluate international LNG opportunities (Mozambique, Canada, Australia).”

They identified Zhao Yingmin, China’s vice minister of ecology and environment, as the key individual to pursue. Zhao met Al-Jaber in Beijing in September and in Dubai at the pre-COP summit a month later.

ADNOC declined to comment on whether any of its executives met with Zhao during the COP28 summit, but he did attend.

KPPO analysis of COP28 participants found that China registered 82 fossil fuel lobbyists to attend (the joint most of any nation). PetroChina and CPECC registered eight employees for Dubai.

Country delegates: 82. PetroChina + CPECC (subsidiary of China National Petroleum Corporation): 8

Egypt

In December 2022, Egypt hosted the COP27 UN climate summit in the Red Sea resort of Sharm al-Sheikh. Although he was yet to be named as president of COP28, Sultan al-Jaber attended the conference as part of the UAE’s official delegation.

Al-Jaber has a long history with Egypt, stretching back as far as 2013, where he was installed as the UAE’s point man to deal with the post-coup administration of the then Egyptian general – now president – Abdel Fattah al-Sisi.

Al-Jaber was the chairman of the Coordination Office of UAE-funded Development Projects in Egypt, a group that oversaw the transfer of some $10 billion worth of investments to Egypt in the years immediately following Sisi’s coup d’etat.

Al-Jaber continued to play a significant role in stimulating Egypt’s economy, and he is credited with helping some companies resolve problems inherited from decades of kleptocratic rule under ousted leader Hosni Mubarak.

In particular, Al-Jaber was named as a key facilitator in a 2015 agreement reached between UAE domiciled Dana Gas, the region’s largest publicly traded gas firm, and the Egyptian state, to which it owed some $5.5 billion.

ADNOC is actively working with its strategic partners to progress projects in Egypt

In 2023, the year during which it hosted COP28, the UAE appears to have redoubled its investment in Egyptian oil and gas infrastructure. ADNOC Distribution – ADNOC’s gasoline and diesel delivery arm – began the year by finalising a deal to purchase a 50% stake in TotalEnergies Marketing Egypt for a reported $200 million.

As part of that venture, it launched its first branded service stations in Egypt in September 2023, and now jointly operates over 240 service stations across the country. ADNOC Distribution posted record profits topping $1 billion in 2023, selling close to 12% more fuel than in 2022, according to company reporting.

And in February this year, ADNOC announced it had signed a joint venture with BP to develop natural gas in Egypt.

ADNOC will hold a 49% stake in the deal, which includes concessions in the Shorouk, Zohr, Bellatrix-Seti East, North Damietta, North El Burg, North El Tabya and North El Fayrouz fields.

Zohr has a maximum production capacity of 90.6 million cm of fossil gas per day, according to Rystad.

Mussabeh al-Kaabi, ADNOC’s head of low-carbon solutions and international growth, said the deal “represents a significant step forward as ADNOC builds its international natural gas portfolio.”

The joint venture with BP appears to closely match the strategy laid out in leaked COP28 documents, which mentioned: “Participation in Egypt’s upstream resources, where ADNOC is actively working with its strategic partners to progress projects in Egypt.”

This year, ADNOC added developing liquified natural gas in Egypt to its ever growing portfolio. Tom Carpenter / Alamy Stock Photo

While the value of the joint venture was not publicly disclosed, news reports said BP was investing $1.5 billion in it. BP will "contribute its interests in three development concessions, as well as exploration agreements,” while ADNOC will provide “proportionate cash contribution” to the deal, according to a joint statement.

The leaked COP28 country briefing documents said that ADNOC had made $225 million in “sales and trading” with Egypt in the previous year, some 89% of which came from petrochemicals trade.

In the days following the BP deal announcement, Al-Kaabi reportedly told an energy conference in Cairo that ADNOC’s strategy would now be “anchored around gas.”

Along with major concession purchases in Azerbaijan, ADNOC’s joint venture with BP in Egypt gives the UAE giant access to Mediterranean gas that could be supplied to Europe, at a time when the European Union is actively seeking non-Russian fuels and a crisis in the Red Sea is causing disquiet on international markets.

While fossil gas is less carbon-intensive than coal or oil when consumed for energy, it is a major source of emissions of methane, a greenhouse gas that is more than 80 times more potent than CO2.

Global Witness analysis of Kpler shipping data shows ADNOC could have exported 1.9 million barrels of crude oil to Egypt in 2023.

Country fossil fuel lobbyists at COP28: 15

France

ADNOC and France’s TotalEnergies struck a number of deals in 2023, such as ADNOC’s purchase of a 30% stake in the Absheron gas field from Total and Azeri NOC SOCAR (see Azerbaijan section above for more information).

In May 2023, ADNOC Gas announced it had struck a $1 billion, three-year deal with TotalEnergies to supply the French major with LNG. Commenting on the deal, ADNOC Gas CEO Ahmed Alebri said it “represents another significant milestone in our strategy to expand our global reach and strengthens our position of the LNG export partner of choice for leading global energy businesses.”

Bloomberg reported that the deal was struck in the context of European markets seeking to supply more non-Russian fuel following Moscow’s invasion of Ukraine.

Activists staged a "die-in" in protest against multiple new oil and gas projects being explored by TotalEnergies, including the purchase of liquified natural gas from ADNOC. Alain Pitton / NurPhoto via Getty Images

TotalEnergies has a decades-long history of involvement in oil and gas projects in the UAE, including concessions in ADNOC Onshore, ADNOC Gas, and ADNOC LNG.

Global Witness analysis of Kpler shipping data shows ADNOC could have sold more than 12 million barrels of oil and petroleum products to French firms throughout 2023.

Leaked documents showed ADNOC made $318 million in sales and trading with France it the past year, when it delivered 987,000 tonnes of diesel to French distributers.

“We are proud of our strategic partnerships with French companies, including TotalEnergies and EDF,” the notes said, while highlighting “new opportunities for our respective companies to partner and invest in projects in the UAE, France and internationally.”

TotalEnergies registered 12 employees, including Pouyanné, to attend COP28, according to KBPO analysis. EDF (Electricité de France) Group registered 18.

Fossil fuel delegates at COP28: 26. TotalEnergies: 12. EDF: 18

Germany

In September 2023, German chemicals and plastics giant Covestro announced it was considering a formal takeover approach from ADNOC valued at $12 billion, following initial reports in June that ADNOC had submitted a proposal.

"We are in open-ended discussions with ADNOC. Open-ended refers to both the content and the timeframe," the spokesperson told Reuters.

Days before COP28 got underway in Dubai at the end of November, reports emerged that ADNOC was also targeting the acquisition of a 70% stake in European energy major Wintershall Dea from German petrochemical giant BASF.

The potential offer was valued at $10.6 billion, according to the reports.

Were the purchase to go through, ADNOC’s involvement would boost Wintershall’s annual production by 670,000 barrels of oil a day in 2024, according to analysis from Rystad Energy. About 50% of this production increase would come from Wintershall’s Russian portfolio.

Ultimately, the deal did not materialise. Virtually all of Wintershall Dea’s upstream assets were purchased by Britain’s Harbour Energy for $11.2 billion.

Though ADNOC allegedly pursued a substantial stake in Wintershall Dea, the deal ultimately failed to go through. Ronald Wittek / Alamy Stock Photo

Days after COP28 concluded, ADNOC made headlines once again by increasing its bid for Covestro. This appears to fit with its potential purchase of Brazil’s Braskem, as ADNOC seeks to diversify its business model.

COP28’s decision text called for a “transition away from fossil fuels within energy systems,” which would free ADNOC to reroute more of its crude towards petrochemicals while continuing to pursue increased production.

Global Witness approached ADNOC for comment on this point; it did not address it.

As ADNOC’s capacity increases, we stand ready to continue our LNG supplies to Germany… there is much more to be done

Germany’s delegation for COP28 did not include any confirmed fossil fuel lobbyists. The leaked document noted that ADNOC had made $304 million in sales and trading of refined products with Germany in the past year.

It also noted that ADNOC had delivered its first shipment of LNG to Germany in 2023.

“As ADNOC’s capacity increases, we stand ready to continue our LNG supplies to Germany … there is much more to be done,” it said.

Global Witness analysis of Kpler shipping data meanwhile found that ADNOC could have sold 5.4 million barrels of petroleum products to Germany in 2023 – more than four times the 1.2 million barrels exported in the previous five years combined.

Fossil fuel lobbyists at COP28: N/A

Kenya

Kenya, one of Africa’s largest economies, could have imported some 14 million barrels of oil products from ADNOC in 2023 (mainly diesel, gasoil and jet fuel).

The leaked COP28 country briefing documents said ADNOC had conducted $1 billion worth of sales and trading, mainly in refined products, with Kenyan firms “in the past 12 months.”

In March 2023, ADNOC, in partnership with Saudi Aramco and the Emirates National Oil Company (ADNOC’s Dubai equivalent), struck a deal to provide Kenya with diesel and jet fuel for an undisclosed sum.

The leaked COP28 country briefing documents mention the deal, as well as potential talking points for negotiating it further.

For example, the Kenya section specified that, under the deal, ADNOC would supply Kenya with roughly 50% of its gasoil and jet fuel demand.

ADNOC is open to consider amending the premium only if the Kenyans agree to extend the term contract by one more year

Having been asked by Kenya to reevaluate the deal’s premium since the market slowed, the document states: “ADNOC is open to consider amending the premium only if the Kenyans agree to extend the term contract by one more year (until December 2024).”

This has been interpreted by some commentators as ADNOC having “baited” Kenya into accepting a longer deal than it initially agreed to.

In September 2023, Kenya agreed to extend the deal until December 2024, according to the head of the country’s Energy and Petroleum Regulatory Authority.

ADNOC did not comment when Global Witness put this point to it.

Fossil fuel delegates at COP28: 13

Mexico

While few if any deals between ADNOC and Mexican firms materialised in 2023, the leaked COP28 country briefing documents suggest that ADNOC is eyeing up an increase on the $76,000 it made in petrochemical trade with Mexico in the year leading up to COP28.

They state that “ADNOC is expanding its LNG activities outside the UAE and would be open to LNG trading opportunities (Mexico is a LNG importer).”

As such, there could have been potential implications for Mexico if ADNOC’s Wintershall purchase had gone ahead.

According to asset analysis by Rystad Energy, “Latin America forms an important part of Wintershall Dea portfolio, with Mexico showing maximum growth potential.”

ADNOC has its eye fixed on Mexico, another importer of liquified natural gas, according to the leaked documents. Mauricio Palos / Bloomberg via Getty Images

It said that production out of Mexico was expected to increase five-fold from around 10,000 barrels of oil equivalent per day (BOEPD) currently to 50,000 by the end of the decade, including from yet-to-produce fields such as Repsol’s Polok, and Chinwol and Pemex’s Zama.

In April 2023, Wintershall Dea announced the Kan-1 discovery, its first operated asset offshore of Mexico. Kan-1 is estimated to hold between 200 million and 300 million barrels of oil.

Martin Jungbluth, Managing Director of Wintershall Dea in Mexico, said: “The discovery … is the next important milestone for Wintershall Dea in Mexico … We look forward to contributing to the further development of the Mexican energy sector."

Fossil fuel lobbyists registered for COP28: 3

The Netherlands

In April 2023, Netherlands-based geotech firm Fugro announced it had been awarded contacts by ADNOC to conduct “extensive offshore surveys” on behalf of ADNOC.

“Commencing April 2023, Fugro will perform a series of offshore surveys including geophysical, geotechnical and remotely operated vehicle inspections supported by advanced engineering and geo-consulting studies to help inform the front-end engineering [and] design,” the company said.

Fugro said the project consisted of around 600km of pipeline route assessment, which appeared to be part of ADNOC’s planned increase in production capacity.

The ink was barely dry on the final COP28 texts when ADNOC announced it was buying fertiliser manufacturer Fertiglobe from Dutch chemicals giant OCI in a blockbuster $3.6 billion takeover.

“This important transaction supports ADNOC’s ambitious chemicals growth strategy and accelerates our plan to establish a global growth platform for ammonia and clean ammonia,” said Khaled Salmeen, ADNOC’s director of downstream marketing and trading.

Fertiglobe is the world’s largest seaborne exporter of ammonia and urea, nitrogren-based fertilisers that are derived from fossil gas.

A peer-reviewed study in late 2023 found that global use of nitrogen fertilisers, which account for 5% of global greenhouse gas emissions, was twice as high as what Earth’s natural systems can accommodate.

The European Commission approved the Fertiglobe takeover in April 2024.

Nitrogen fertilisers are created from fossil gas, and contribute 5% of global greenhouse has emissions. Keith Turrill / Alamy Stock Photo

Bloomberg reported in December that ADNOC was mulling a bid to purchase all of OCI. Although a formal bid has, at the time of writing, not yet materialised, individuals familiar with the state of negotiations say any takeover would be valued around $5 billion.

Leaked COP28 country briefing documents revealed that ADNOC made $2 billion in sales to the Netherlands in the previous year, predominantly in the form of refined products.

Global Witness analysis of Kpler trade data shows ADNOC could have exported some 9.4 million barrels of oil and products to The Netherlands in 2023.

They also mentioned Shell, the British-Dutch energy major as a “top importer of ADNOC products to the Netherlands."

KPPO analysis of the Netherlands’ COP28 delegation identified five fossil fuel lobbyists registered to attend.

Fossil fuel lobbyists at COP28: 5

Norway

ADNOC has conducted limited business with Norway, another one of the nations allegedly targeted at COP28 for deals.

In January this year, ADNOC said it had acquired a 10% stake in Britain-based carbon capture and storage (CCS) company Storegga, which has a 30% stake in Norway’s Trudvang project.

ADNOC said the deal was part of its initially $15 billion budget allocation for “low carbon” projects, which it announced less than a week before Al-Jaber was named COP28 president in January 2023.

CCS is a controversial technology which is currently not operating at anywhere close to the scale its proponents claim it can achieve. Norway in particular has seen a number of CCS projects fail due to leakage of captured carbon or because they failed to achieve the sought capture rate.

In September, Norwegian state oil firm Equinor struck a long-term agreement with Austrian energy provider OMV to supply some 12 terawatt hours’ worth of fossil gas annually.

Merger talks between ADNOC and OMV’s chemicals arm are ongoing as of the time of writing.

Equinor initially denied that CEO, Aners Opedal, met Al-Jaber at a climate finance summit in Paris – they in fact attended the same lunchtime meeting. Ole Berg-Rusten / NTB

The anonymous official said they believed Al-Jaber had lunch in Paris during President Macron’s climate finance summit in June 2023 with officials from Equinor, among others.

Global Witness asked Equinor if any executive ate lunch with Al-Jaber on either 22 or 23 June (the days of the conference). It initially denied CEO Anders Opedal had attended the summit.

But when presented with the agenda of France’s then minister of energy transition Agnes Pannier-Runacher, showing Al-Jaber participated in a lunchtime meeting with Equinor’s Opedal at the summit venue on 22 June, a spokesperson confirmed Opedal and Al-Jaber both participated in that “multi-lateral” meeting.

They denied Opedal or any other executive met with Al-Jaber separately.

ADNOC did not comment on the alleged meeting.

Global Witness analysis of Kpler shipping data showed Norway could have purchased 345,000 barrels of petroleum products from ADNOC in 2023.

Fossil fuel lobbyists at COP28: 12. Equinor: 14

Russia

While COP27 took place in the shadow of Russia’s war on Ukraine, Russian delegates at COP28 likely received a warmer welcome in Dubai.

The UAE has, since February 2022, become a key conduit for Russian petroleum products. Dubai is now the leading trader in Russian crude oil, for example.

While ADNOC itself did not make any money from oil and gas sales to Russia in 2023, it is among the Middle Eastern national oil companies that pivoted towards cheaper Russian fuel as Moscow sought new buyers in the wake of sanctions and an EU oil embargo.

ADNOC itself could have imported 2.3 million barrels of crude and dirty feedstocks from Russia in 2023, according to Global Witness analysis of Kpler shipping data.

The UAE as a whole imported 70 million barrels of crude oil and petroleum products from Russia in 2023, further strengthening economic ties between the two nations.

Russian President Vladimir Putin, who visited Abu Dhabi during COP28 in December 2023, declared the UAE to be Russia’s “main trading partner in the Arab world.”

Two months earlier, ADNOC awarded $17 billion worth of contracts to firms to develop the Hail and Ghasha gas field offshore of Abu Dhabi – its largest ever.

It announced Lukoil as a concession holder in Hail and Ghasha, which will have a free cashflow value of around $45 billion throughout its 40-year lifecycle.

Lukoil was implicated in a Global Witness investigation before COP28 that showed Bulgaria was exploiting EU sanctions to purchase Russian crude oil, providing the Kremlin with a €1.1 million windfall.

On a visit to Abu Dhabi during COP28, Putin affirmed Russia's special trading relationship with the UAE. Sipa US / Alamy Stock Photo

In one of the most high-profile deals struck during the first week of COP28, conference organisers announced the creation of the Oil and Gas Decarbonization Charter, also known as the Oil and Gas Decarbonization Accelerator (OGDA).

Despite its implications for the planet, 50 national and international oil and gas companies readily signed on to the initiative, including Lukoil.

The leaked COP28 country briefing documents’ section on Russia highlighted, as a key talking point, “the participation on (sic) Russian energy companies in the OGDA would send a powerful signal regarding the industries’ (sic) ability to self-regulate.”

The leaked COP28 country briefing documents identified Russia’s Special Presidential Representative on Climate Issues Ruslan Edelgeriev, as a key contact for ADNOC.

They noted that Russia had “indicated strong preference for Azerbaijan to host COP29” and that it was “against increasing donor base for the $100 billion” – reference to the annual climate finance provision pledged by rich polluters over a decade ago.

Al-Jaber met at COP28 with Edelgeriev, where they discussed “advancing the COP28 action agenda and securing positive outcomes on key climate topics,” according to the official COP28 Twitter/X feed.

Al-Jaber met with Russia's Special Presidential Representative on Climate Issues, Ruslan Edelgeriev, during COP28. Kamran Jebreili / AP Photo

Out of the 70 fossil fuel lobbyists registered to attend COP28 on Russia’s behalf, 12 were Lukoil employees or shareholders, including Vagit Alekperov, who stepped down in 2022 after 29 years as chief executive after he was targeted by international sanctions.

Russia’s delegation was implicated in an alleged campaign to include wording in the final COP28 decision text referring to natural gas as a “transitional fuel” – something branded by one negotiator from Antigua and Barbuda as a “dangerous loophole.”

Fossil fuel delegates at COP28: 70. Lukoil: 12

Saudi Arabia

Although recently at odds with each other over OPEC’s production plans, the UAE and Saudi Arabia facilitate a great deal of oil and petroleum products trading between them.

The leaked COP28 country briefing documents showed ADNOC made $90 million from petrochemical sales to Saudi Arabia in the year up to COP28.

ADNOC could have sold 340,000 barrels of petroleum products to Saudi Arabia in 2023, according to Global Witness analysis of Kpler data.

A Global Witness investigation this year found that ADNOC and Aramco are also key backers of an oil refinery accused of giving rise to government oppression of local communities in India’s Maharastra state.

If the project, in which ADNOC has a 25% stake, goes ahead as planned, the Ratnagiri Refinery would be capable of processing up to 1.2 million barrels of oil a day.

Consumption of the refinery’s annual output could release an estimated 177 million tonnes of CO2 a year – equivalent to the annual emissions of the Netherlands or Argentina.

Mansi Bole is a protestor against a planned oil refinery in Maharashtra, India, which is part backed by ADNOC and Aramco. Ashish Vaishnav / Global Witness

ADNOC Distribution has had a presence in the Kingdom since 2018, and in October 2023 announced it was increasing its expansion plans with a portfolio of 67 fuel distribution stations.

Although Saudi Arabia did not disclose a single fossil fuel lobbyist on its official COP28 delegation, a Global Witness investigation found that at least 15 current or former Aramco employees were registered as part of its national delegation.

The leaked COP28 country briefing documents identified Saudi energy minister Abdulaziz bin Salman as a key point person between ADNOC and the Kingdom.

Abdulaziz met Al-Jaber in Riyadh on 8 October, 2023, for talks focused on “regional climate leadership, alignment on environmental priorities and advancing the energy transition,” according to the official COP28 Twitter/X and Instagram accounts.

The two met again during pre-COP at the end of October.

Bin Salman was among the most vocal opponents to language involving a phase down of fossil fuels appearing in the final COP28 decisions texts.

Fossil fuel lobbyists at COP28: N/A

Switzerland

Switzerland, another country allegedly targeted by COP28 organisers for oil and gas deals, paid ADNOC $2 billion in the year leading to the Dubai summit, according to the leaked COP28 country briefing talking points.

Switzerland has long been a key commodities hub, with energy trading giants such as Vitol – which documents show is ADNOC’s top importer of products to Switzerland – Trafigura and Glencore all having offices in and around Geneva.

The COP28 talking points confirmed that ADNOC received “acceptance by Swiss counterparts for ADNOC to open a trading office in Geneva.”

Global Witness analysis of Kpler data shows that Vitol could have been involved in the trade of some 35 million barrels of Emirati oil and petroleum products in 2023.

Global Witness approached Vitol for comment. On the 30-million-barrel figure, a spokesperson said it “does not comment on commercial relationships” while noting that Vitol trades 7.3 million barrels of oil a day.

Fossil fuel lobbyists at COP28: N/A

UK

In March 2023, ADNOC and BP announced their intention to launch a joint venture to take control of a 50% stake in Israel’s NewMed Energy.

The deal, which would see both BP and ADNOC invest a reported $2 billion, would be “focused on gas development and international areas of mutual interest including the East Mediterranean,” the companies said at the time.

The Leviathan field holds some 3.5 billion barrels of oil equivalent of fossil gas, according to Rystad Energy.

On 2 October, 2023, Reuters reported that a NewMed panel established to review the offer had recommended raising the asking price by 10%, which prompted BP to issue assurances they were both committed to the deal.

Israel's Leviathan field holds an estimated 3.5 million barrels of oil equivalent of fossil gas, which BP and ADNOC previously sought a stake in. Ariel Schalit / AP Photo

However, after Hamas’ deadly 7 October attacks in southern Israel and Israel’s subsequent destruction of Gaza, the deal is currently on hold. NewMed issued a statement on 13 March saying the deal had been officially suspended.

The Israeli company said that both BP and ADNOC had “reiterated … interest in the proposed transaction,” while sources close to the negotiations told Reuters that all three firms hope to complete the transaction “once things calm down” in the region.

Reuters reported in April 2024 that ADNOC had even “spoke directly” with BP in recent months and had “sought advice from investment banks” on a potential takeover of the British major.

Citing “people familiar with the matter,” Reuters said talks did not advance far, however, as ADNOC decided that taking control of BP “would not be the right fit for its strategy.”

ADNOC did not answer a comment request on this point.

ADNOC was reportedly exploring a takeover of BP, but ultimately chose to go in another direction. Helene Rogers / Art Directors & TRIP

In June, ADNOC awarded a $700-million contract to UK-based engineering and construction giant Petrofac to work on a new gas compressor plant at its Habshan Complex, west of Abu Dhabi.

One of the largest engineering, procurement and construction contracts ever signed by ADNOC, Petrofac said its work on three new gas compressor trains, associated utilities and power systems would “support ADNOC to substantially increase gas output from the Habshan Complex.”

Two senior former Petrofac executives are accused by Britain’s Serious Fraud Office of offering bribes to UAE officials in return for $3.3 billion worth of contracts between 2012-2018.

ADNOC suspended Petrofac from bidding on its projects in March 2021, but reinstated the British firm a year later.

Both executives have denied the charges.

Kpler data analysed by Global Witness showed that ADNOC could have sold 15 million barrels of crude oil and petroleum products to the UK in 2023.

The leaked COP28 country briefing documents noted “sales and trading of $4 bn in the past 12 months (100% refined products)” between ADNOC and the UK. ADNOC did not respond to questioning on this point.

KPPO analysis of the COP28 provisional participants list showed BP registered 11 employees to attend the conference. Newly installed CEO Murray Auchincloss was invited to attend as a Host Country Guest.

Fossil fuel delegates at COP28: 20. BP: 11

USA

In August, US oil giant Occidental signed a memorandum of understanding with ADNOC to conduct a feasibility study on constructing a Direct Air Capture (DAC) facility in the UAE, the first of its kind outside the US.

The project aims to have an installed capacity of 1 million tonnes of CO2 annually, and is part of ADNOC’s strategy to have 10 million tonnes of carbon removal capacity operational by 2030.

In January this year, ADNOC Drilling completed the purchase of a 25% stake in Louisiana-based drilling company Gordon Technologies for an estimated $180 million.

This purchase makes up part of a $1.5-billion joint venture announced last year with UAE-based Alpha Delphi to invest in companies providing oil field services.

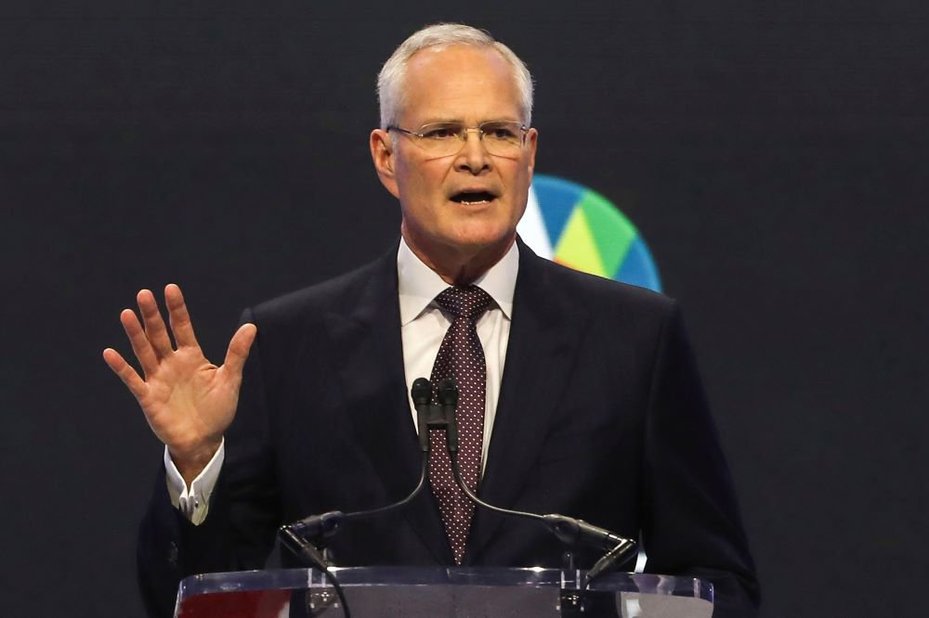

ExxonMobil CEO Darren Woods, who previously complained that climate conferences focus too much on renewable energy, was one of Al-Jaber's invitees to COP28. Jessica Christian / San Francisco Chronicle via AP

Although no fossil fuel lobbyists were present on the US's official COP28 delegation list, several US-based oil CEOs, such as ExxonMobil’s Darren Woods and Oxy’s Vicki Hollub, were invited to attend by Al-Jaber.

Woods complained in Dubai that climate conferences focus too much on renewable energy, while Hollub has previously stated on record that the Paris Agreement will fail if oil and gas executives are excluded from COPs.

ADNOC did not comment when asked why fossil fuel executives were invited to attend COP28. Global Witness approached COP28 organisers for comment.

Analysis of Kpler trade data shows that ADNOC could have exported more than 6.4 million barrels of crude and other products (mainly jet fuel and blending comps) to the US in 2023.

Fossil fuel lobbyists at COP28: N/A

Venezuala

Venezuela has the world’s largest proven oil reserves with over 300 billion barrels, and has fossil gas reserves of over 5.5 billion cubic meters, the seventh largest globally. But the OPEC member state has been under US sanctions since 2019, severely limiting its ability to export oil and gas.

Yet a deal struck in October with the Biden administration ahead of elections this year saw those sanctions eased significantly. Although ADNOC did not seek or conclude any publicly disclosed deal with Venezuela in 2023, it appeared to lay the ground for future cooperation, particularly on gas.

“Gas will play an important role in the energy transition and the relaxing of US energy sanctions is an important step to support investment in your associated gas resources,” said the leaked COP28 country briefing.

Gas will play an important role in the energy transition

It said that lifting US sanctions would help in “paving the way for additional exports of crude oil,” adding that “we are open to working with Venezuela on evaluating initiatives of mutual interest, including gas capture and methane abatement.”

The briefing also disclosed that ADNOC “has been exploring potential monetisation of Venezuelan resources,” and hinted it was looking at “the potential to export gas from Venezuela to Trinidad and Tobago where there is LNG export capacity.”

The anonymous official said that Al-Jaber met with Venezuela’s official delegation in Dubai during COP28.

“If you start to track the meetings Dr Sultan selected, there would be no other need to engage with Venezuela for the action agenda aside from oil and gas,” they said.

“He had discussed a matter with Venezuela and I had seen Venezuela essentially confirming the conversation had happened in the email and asking for a follow-up meeting.”

If you start to track the meetings Dr Sultan selected, there would be no other need to engage with Venezuela for the action agenda aside from oil and gas

Global Witness has been unable to fully corroborate the assertion that Al-Jaber met with Venezuelan officials to discuss oil and gas deals during COP28.

But it has established that the official named in the leaked talking points – Josue Lorca Vega, Venezuela’s minister of popular power for ecosystems – did attend COP, delivering an address to delegates on December 9.

“The capitalist model continues destroying and making it increasingly dangerous to live on Mother Earth, maintaining the systematic annihilation of nature, the destruction of the habitat of thousands of species and endangering life as such,” said Lorca.

Lorca also met with Al-Jaber at the pre-COP28 event in Abu Dhabi on 29 October.

Global Witness approached ADNOC and Lorca’s ministry for comment specifically on these alleged exchanges. Neither offered a response.

Fossil fuel lobbyists at COP28: 2

A playbook to follow?

The dust had barely settled on the final COP28 outcome when countries who agreed to the “transition away from fossil fuels” wording started voicing second thoughts.

Saudi Arabia’s energy minister Abdulaziz bin Salman appeared to suggest that the final agreement to move away from fossil fuels was optional, telling a conference in Riyadh that decarbonising energy system was one of several “choices” from an “à la carte” menu of options.

Vitol’s CEO Russel Hardy told participants at International Energy Week in February that global oil demand would not peak until the early 2030s, contradicting prognosis by the International Energy Agency’s Fatih Birol that predicted peak demand this decade.

Meg O’Neill, CEO of Woodside Energy, told the CERAweek conference in Houston – billed as the “Superbowl of energy” – that support for the energy transition had become “emotional”, insisting that the move to net-zero emissions cannot “happen at an unrealistic pace."

Jean-Paul Prates, CEO of Petrobras at the time, told the same conference that – far from the sweeping and rapid decarbonisation demanded by climate science – the energy transition must be carried out “gradually and responsibly.”

Paul Belisario, Coordinator of the Indigenous Peoples Movement for Self-Determination and Liberation (IPMSDL) and representative of Asia-Pacific Network of Environmental Defenders (APNED), speaks at a Global Witness event in Brasília, Brazil. Cícero Pedrosa Neto / Global Witness

Global Witness approached Petrobras, Woodside, Vitol and the Saudi Arabian energy ministry for comment for this investigation.

Vitol said that Hardy’s comment on peak oil demand “were a statement of fact, not a statement of intent or positioning.”

“Vitol’s observation that peak oil demand will not occur until the 2030s is based on our factual analysis of data relating to the underlying drivers of oil demand,” said a spokesperson.

“If Mr Hardy had said that oil demand will peak in the late 2020s it would 1) have been untrue given our observation of the data, and 2) would not alter the underlying facts.”

As for ADNOC, it wasted little time in following through on some of the deals it was negotiating in the run up to – and, if the anonymous official is to be believed – during COP28.

In February 2024, it confirmed it had completed the purchase of a 24.9% stake in Austrian petrochemical giant OMV, paving the way for a potential merger valued at a reported $30 billion.

They attempted to name the employees of COP as "information services and support" – nothing related to COP28, but essentially a trojan horse to get COP28 back into the ADNOC building

Since COP28 closed, ADNOC subsidiaries have signed long-term LNG deals with Germany’s SEFE and India’s GAIL, and is reportedly in talks to partner with Saudi Aramco in the purchase of US LNG assets.

ADNOC did not provide any comment when asked about specific deals and dealmaking.

The official said that ADNOC was able to retain dozens of COP28 staffers at its Abu Dhabi headquarters long after the curtain came down on the conference.

“The entire staff moved back to the ADNOC building on March 11 and all passes had to be turned in and new badges for the ADNOC building given,” they said.

“They (ADNOC) attempted to name the employees of COP as ‘information services and support’ – nothing related to COP28, but essentially a trojan horse to get COP28 back into the ADNOC building.”

ADNOC declined to comment on this claim.

Office building of ADNOC (Abu Dhabi National Oil Company) on Corniche Street in Abu Dhabi. Llewellyn / Alamy Stock Photo

With the COP presidency passing, albeit informally for now, to Azerbaijan, recent developments suggest Baku might be seeking to replicate the UAE’s playbook in using the climate conference to strike oil and gas deals.

Just after COP28 finished, SOCAR, the state oil company, finalised a deal to buy back Equinor’s stake in the massive Azeri-Chirag-Gunalshi (ACG) gas field, as well as the Norwegian major’s concession in a major gas pipeline and in the Karabagh field.

This was the trigger for BP, which has interests in Azerbaijan going back to shortly after the state’s foundation, to kick off its “biggest ever” study of Azeri deepwater fields in an investment round worth some $370 million.

In February, Azeri energy minister Parviz Shahbazov confirmed an agreement with the US to expand the Southern Gas Corridor in a move reportedly aimed at boosting Azeri gas exports to the European Union.

Even as the world gears up to COP29, business interests in its host country's oil reserves appear to have increased. Jasmine Qureshi / Global Witness

Perhaps most significantly for SOCAR, whose president Rovshan Najaf is on the COP29 organising committee, Azerbaijan’s head of the State Service for Property Issues, Martin Elynullayev, announced in January plans to sell state-owned shares in the company to foreign investors.

“Local and foreign investors will be able to participate in the purchase of shares in production associations (PAs) and [closed joint stock companies] CJSCs, where currently 100% of the shares are state-owned,” Eynullayev was quoted as saying. “The state’s shares will be reduced.”

He said the sale was tied to a decree issued by Azeri President Ilham Aliyev “aimed at soliciting private sector investment in order to privatise state-owned firms,” and ordered officials to ready the sale by October. COP29 will begin on 11 November.

Global Witness approached both SOCAR and COP29 organisers for comment on these findings.

The reason why Azerbaijan had stepped up is because the UAE did say that they would provide a lot of support to them

The official claimed that Azerbaijan was convinced to host COP29 only after the UAE – Azerbaijan’s 1.5C Troika partner along with Brazil – indicated it would support Baku in staffing and organising the conference.

“The reason why Azerbaijan had stepped up is because the UAE did say that they would provide a lot of support to them,” said the source. “And I know that they have this taskforce [for] ongoing helping or guidance of certain things.

"The UAE is very intensely concerned with how their outcomes are going to be pushed forward and they want to make sure that there's a clear line of passage. The UAE consensus needs to be in everything and people need to recognize that only the UAE brought that about.”

ADNOC declined to comment when questioned specifically about this information.

We reject in the strongest terms the suggestion that Azerbaijan has a hidden agenda in its hosting of COP29

Just last week, US lawmakers penned an open letter to US Secretary of State Anthony Blinken and special climate adviser John Podesta saying they were “deeply concerned” about Babayev’s appointment as COP29 president.

The signatories said it will “be the second year in a row that COP is headed by a fossil fuel executive.”

“Given these conflicts of interest, we risk the process being co-opted by the same fossil fuel industry that is the greatest driver of our climate crisis,” they wrote.