Summary findings

A Canadian asset manager part run by green finance champion Mark Carney cleared thousands of football fields worth of tropical forest in Brazil, our investigation can reveal

An estimated 9,000 hectares (ha) of deforestation, the legality of which could not be proven by Brookfield Asset Management, took place on eight farms owned and managed by Brookfield’s soybean farming empire.

The forest clearance took place in the Cerrado, Brazil’s tropical savannah, between 2012 and 2021, according to analysis of satellite imagery from Brazil’s space institute, before the properties were sold off in late 2021 in a slash and sell move.

The empire also owned a farm whose managers sought to evict Indigenous Peoples from land they claim their own.

Brookfield’s involvement in deforestation and human rights abuses contrast with its own environmental, social and governance (ESG) policy and Mr Carney's public image.

“We operate with the highest ethical standards, conducting our business with integrity,” Brookfield wrote in its latest annual report.

But Brookfield’s owner-operator-investor model means it could have profited three times from forest destruction in Brazil – from the sale of commodities, from the sale of financial instruments derived from these commodities and from fluctuations in the price of its resale assets such as farms.

Brookfield and its biggest banking backers, HSBC, Deutsche Bank and Bank of America, signed up to the Glasgow Financial Alliance for Net Zero (GFANZ) in April 2021.

The alliance commits its signatories to taking immediate action to reach net zero greenhouse gas emissions by 2050.

Yet deforestation on Brookfield farms released an estimated 600,000 tonnes of CO2 in the nine years to June 2021, destroying parts of a crucial carbon sink and biodiversity hotspot.

In September, GFANZ leaders, including Mr Carney, wrote to members urging them to stop financing deforestation, warning "the world will not reach net zero by 2050 unless we halt and reverse deforestation within a decade."

At that point, all GFANZ members were required to follow criteria set by the UN's Race to Zero campaign to "ensure credibility and consistency," including achieving deforestation-free supply chains by 2025.

However, in late October 2022, GFANZ announced it was no longer mandatory for its members to adhere to Race to Zero targets.

This happened shortly before Race to Zero planned to introduce independent monitoring controls with the power to evict non-performing financial institutions from the alliance, raising questions about the willingness of GFANZ members to be held accountable to their pledges.

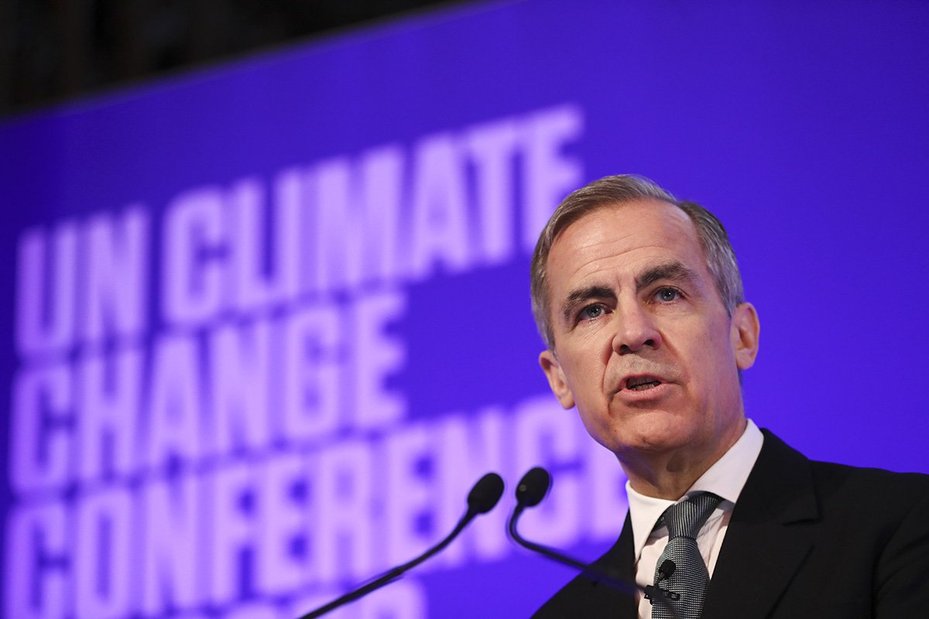

Mark Carney, former governor of the Bank of England, speaks at the launch of the COP26 Private Finance Agenda in 2020 in London. Bloomberg / Getty

Mark Carney is one of the founders and public faces of GFANZ and has been Head of Transition Investing at Brookfield since August 2020.

The deforested farms were sold off in 2021 and Carney was promoted from Vice Chair to Chair of the firm in December 2022.

Mr Carney was appointed special adviser to then-Prime Minister Boris Johnson for COP26 in January 2020, and he has been a UN Special Envoy on Climate Action and Finance since 2019.

Brookfield faces allegations of clearing trees from climate-critical forest land to make way for cash crops while seeking to evict Indigenous Peoples from the heart of the Amazon to make way for cattle and mining opportunities.

A ranch which Brookfield attempted to sell in January 2022, after the asset was frozen by a local court, battled for years to evict an endangered Indigenous community from their ancestral land.

And in another alleged human rights abuse, a firm controlled by Brookfield was fined R$800,000 ($163,000) in December 2021 for slave labour offences at a different farm.

Brookfield’s deforested farms were controlled through a network of investment funds and subsidiaries linked to the asset manager’s entities based in Toronto, Bermuda and London, some of which were sold off in 2021.

Some of the soy produced in the properties that contained deforestation were sold to the controversial commodity trader Cargill, a company exposed many times for its links to forest clearance, and subsequently could have found its way into British supermarket chicken.

At least two British financial institutions, the Lancashire County Council Pension Fund and the London Pension Funds Authority, have invested directly in Brookfield’s Brazilian agricultural fund.

Soy warehouse in Mato Grosso state, Brazil. Brazil is the second largest soy producer worldwide. Paulo Fridman / Corbis via Getty Images

Brookfield’s “slash and sell” tactics should not absolve it from responsibility for the environmental abuses committed on its farms.

Its ability to cash in on deforestation underlines the need for governments to legislate to stop the financing of forest destruction, rather than relying on voluntary net zero initiatives such as GFANZ.

In response to these allegations, the company said it “unequivocally refute[s] the specific allegations made by Global Witness – Brookfield has always acted in accordance with all applicable laws and regulations.

"Brookfield is committed to the highest standards of ethical behaviour across all our global investments, and we move quickly to address issues when they arise.

"We have been invested in Brazil for over one hundred years and we have been proud to support the country build and operate vital infrastructure. While we are no longer active in farming, timber or mining in Brazil, we continue to operate assets in a range of sectors and we look forward to continuing supporting the country on its development towards a Net Zero and thriving economy.”

Brookfield Asset Management (BAM) indirectly controlled each farm named in this report, through Brazilian investment funds and subsidiary companies. Where the name “Brookfield” is used in the report this refers either to the Toronto headquartered BAM, to the Rio de Janeiro-headquartered company Brookfield Brasil Ltda, which BAM held a majority stake in via Brookfield Participacoes and Brkb Participacoes II, or to Brookfield Agricultural Group, the brand name used by Brookfield Brasil in some cases. The relationships between firms in the Brookfield corporate umbrella named in this report is detailed in Annexe C (please see the PDF version of the report for details).

Slash and sell

Brookfield's links to tropical deforestation

Early one October morning, trustees of a San Diego pension fund gathered at their headquarters on the outskirts of town to hear a pitch for an investment with an unusually high rate of return: 20-25%.

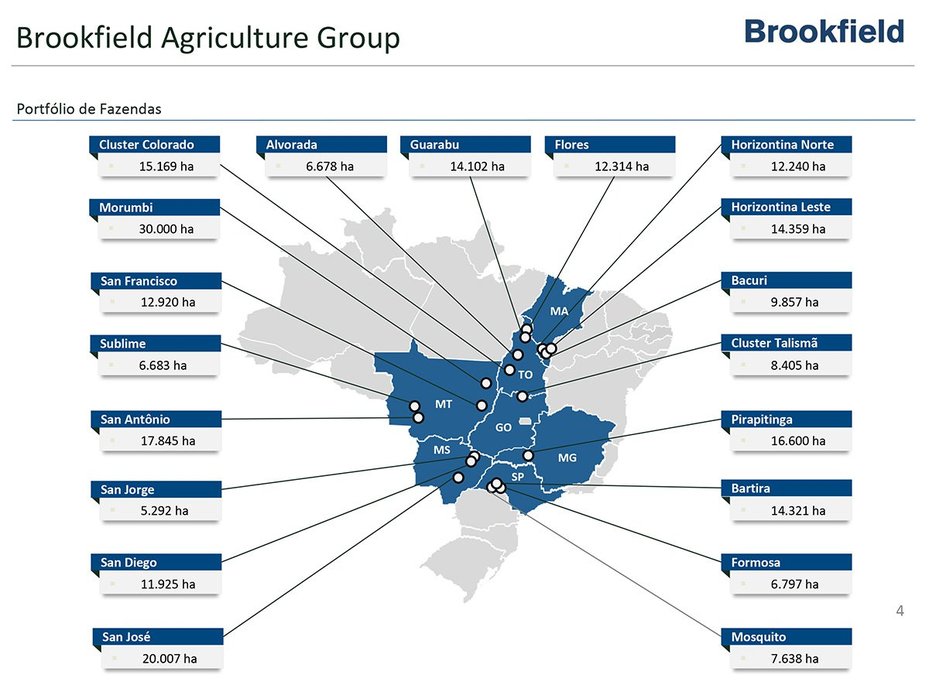

It was 2010, and the directors of Brookfield Agriculture Group and Brookfield Brazil were cycling through a PowerPoint presentation outlining how Brazilian cash crops could help grow the pension savings of San Diego county’s teachers and civil servants.

It took them just over an hour to convince the San Diego County Employees Retirement Association to invest $75 million in the Brookfield Brazil Agriland fund, more than a fifth of the fund’s final value.

A flock of rheas is seen in a soybean field in the Cerrado plains near Campo Verde, Mato Grosso state, western Brazil. Yasuyoshi Chiba / AFP via Getty Images

While Brazil’s recession of 2008 had led to banks foreclosing on farming estates and driven land prices down, global demand for soybeans was rising fast, Brookfield directors said in their presentation to the San Diego Pension Fund.

A boom in commodities like soy, corn, sugar, livestock and timber meant alternative asset managers could earn money both by selling these goods and by speculating on land prices. Crops planted in the biodiverse Cerrado tropical savannah region would be particularly lucrative investments.

Brookfield would acquire nearly 100,000 ha of farmland through this fund over the next three years, including at least five of the eight farms where we have identified forest subsequently being destroyed to make way for crops, the legality of which state authorities and Brookfield could not verify.

Brookfield told the San Diego trustees who invested in its first Agriland fund that it was “a leader in environmental stewardship.”

Others eventually invested in this fund too, including the Lancashire County Council Pension Fund and the London Pension Funds Authority in the UK, according to data shared by the Anti-Corruption Data Collective, potentially exposing council staff in the UK to deforestation linked to Brookfield’s properties.

Agriland’s larger successor, Agriland II, which San Diego pensioners also invested in, allowed Brookfield to further expand its agricultural holdings after 2016.

Aerial view showing a native Cerrado (savanna) surrounding an agriculture field in western Bahia state. Nelson Ameida / AFP via Getty Images

Brookfield first entered Brazil in 1899 as the owner of a small private utility company and built São Paulo’s first electric trams and first streetlights.

It now holds immense energy, infrastructure and agricultural holdings in Brazil – from natural gas pipelines to hydroelectric and nuclear power plants, shopping malls, railways and a vast network of farms.

By the end of 2020 it had nearly doubled its agricultural land holdings to 267,000 ha dedicated to soybean, sugar, rubber, corn and cattle across 22 farms in seven states compared to just 150,000 ha of agricultural land a decade earlier, selling 14,500 heads of cattle a year.

Its timber plantations spanned a further 275,000 ha, and it sold more than 3 million cubic metres of logs and 16,200 tons of charcoal, according to its latest annual report.

Brookfield’s Brazilian assets were worth $22 billion in 2021 – including R$8 billion ($1.6 billion) in forestry and agricultural assets – out of $391 billion in global consolidated assets.

Satellite evidence

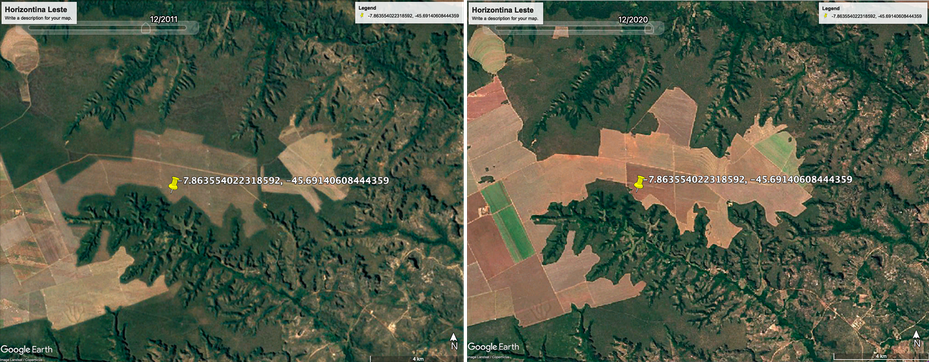

Left: East side of Horizontina Leste farm, December 2011, shortly before purchase by Brookfield. Right: East side of Horizontina Leste farm, December 2020, shortly before being sold by Brookfield. Google Earth

From the air, green tufts of soybean form dark geometrical shapes in otherwise bald patches of tropical savannah. The boundaries between forest and cleared land on Brookfield farms are so straight they could only be human-made. Zoom in closer and satellite images of giant steel silos appear to confirm this.

Once harvested, the crop could be used as protein-rich feed for Chinese or British chicken, pork or beef, or will be turned into vegetable oil.

Nearly a decade’s worth of satellite images and corporate filings show Brookfield’s soybean empire is responsible for vast swathes of deforestation across three states in central-eastern Brazil.

We found evidence of forest clearance on eight Brookfield “fazendas” in Tocantins, Maranhao and Mato Grosso do Sul, namely the farms Horizontina Norte, Horizontina Leste, Nebraska, San Diego, Nazare, Alvorada, Colorado and Onça Branca.

In total, around 9,000 ha of deforestation took place on these properties between 2012 and 2021, according to our analysis of data from Brazil’s National Institute for Space Research (INPE) and its land management system (SIGEF – see Annex A in the PDF version of the report for details).

The size of this clear-felled land is the equivalent of 11,000 football pitches.

After the deforestation, the farms were sold off to firms, including another investment fund in 2021, in an apparent “slash and sell” strategy (see Annexe C in the PDF version of the report for details).

Giant anteater (Myrmecophaga tridactyla), in portuguese known as tamandua-bandeira, Bananal Island, Brazil. Jose Caldas / Brazil Photos/LightRocket via Getty Images

The eight farms are all in the Brazilian Cerrado, a climate-critical biodiversity hotspot bordering the Amazon, the rapid destruction of which could already be accelerating the pace of global warming.

Studies have shown it may store between 13.7 to 29.7 billion tonnes of carbon dioxide. The lower estimate is similar to the level of annual emissions by China, the world’s biggest emitter.

Roughly the size of western Europe, this living and breathing carbon sink is known as the “upside down” forest because its roots reach up to 15 metres below ground level.

Its ecosystem promotes stable rainfall over the neighbouring Amazon rainforest and it feeds most of Brazil’s river basins. It is home to endangered species including the jaguar, armadillo and giant anteater.

The San Diego Pension Fund was offered comment on these issues twice but did not respond.

In contrast the London Pension Fund Authority replied saying it took its “commitment to responsible investment seriously” and that the fund was coming to its final stage of liquidation, but that it was “not appropriate for us to comment on a fund manager’s behalf.”

The Lancashire County Council Pension Fund also replied, stating that it “is committed to protecting the long-term financial interests of all its clients” and that it maintains “a responsible investment approach,” taking “accusations of this kind very seriously.” It encouraged us to “speak to Brookfield directly.”

Brookfield denied the allegations, stating it “unequivocally refute[s] the specific allegations made by Global Witness – Brookfield has always acted in accordance with all applicable laws and regulations.

"Brookfield is committed to the highest standards of ethical behaviour across all our global investments, and we move quickly to address issues when they arise. We have been invested in Brazil for over one hundred years and we have been proud to support the country build and operate vital infrastructure.

"While we are no longer active in farming, timber or mining in Brazil, we continue to operate assets in a range of sectors and we look forward to continuing supporting the country on its development towards a Net Zero and thriving economy.”

When pressed on what evidence they had that could substantiate its alleged refutation of the allegations, it did not reply.

Brookfield’s involvement in clearing the Cerrado’s climate-critical forests is not only environmentally damaging, but occurred at a time when a variety of studies found the majority of the deforestation there to be of uncertain legality.

Clearing of Cerrado vegetation of the subtropical savanna biome by burning in Minas Gerais State, Brazil. Jose Caldas / Brazil Photos/LightRocket via Getty Images

Lack of information and transparency on permitted deforestation

Despite filing freedom of information requests to relevant state authorities, we were unable to obtain permits that are needed to authorise deforestation under Brazilian law for at least seven of the eight Brookfield farms identified.

Our analysis found around 6,700 ha of deforestation at these farms between June 2012 and June 2021 – equivalent to 8,205 football pitches or more than half the size of San Francisco.

But Brazilian authorities were unable to provide information – meant to be publicly available – on whether this was legal.

Fazenda Nebraska was the only farm for which state authorities could share permits covering the time deforestation took place.

Environmental bodies are meant to publish information about deforestation permits in an official gazette easily available to the public under Brazil’s environmental transparency law of 2003.

But the legality of clearing at the seven farms could not be verified because state authorities either failed to provide information or declined to answer our freedom of information requests for the deforestation permits.

Some even cited privacy concerns and said the farms’ owners would have to provide the information.

When we pressed Brookfield for evidence it had that might show the legality of the forest clearance, it did not provide that information.

Combines harvest soybeans near Tangara da Serra in the Cerrado part of Mato Grosso, Brazil. Paulo Fridman / Bloomberg via Getty Images

Neither Brookfield nor its Brazilian arm appear to have a corporate policy committed to eliminating deforestation from its farms or supply chain, making it unusual among major soy producers.

Brookfield Brazil’s latest annual report explains it is a member of several external environmental or standards schemes.

This is despite well-established links between soy and deforestation in Brazil, which produces around a third of the world’s soy.

The Cerrado, where the eight Brookfield farms we identified are located, is a particular deforestation hotspot for soy and reportedly the site of 90% of deforestation linked to soy cultivation in Brazil.

The majority of national production has shifted to this savannah land since soy producers vowed in 2006 to stop cultivating soy in the Amazon.

The omissions in Brookfield’s environmental policies are particularly glaring because of its scale in Brazil, controlling an $8 billion timber and agribusiness empire.

Slave labour concerns

Fazenda Colorado, a soybean farm in Tocantins state, was the site of 126 ha of deforestation between September 2012 and July 2018, primarily in 2012 and 2014, according to our analysis.

Police found 42 farm workers living in slave-like conditions inside the farm in 2014, 28 of whom were housed in a 70m2 square house with no toilets or showers, according to court papers from November 2021 and local newspaper reports.

The Brookfield-controlled firm Brookfield Brasil Participacoes (BBP) was fined $800,000 for slave labour offences at Fazenda Colorado, in a ruling upheld by a regional labour court in December 2021.

The region between the states of Maranhão, Tocantins, Piauí and Bahia, known as MATOPIBA in Brazil, is considered the showcase of Brazilian agribusiness. Fernanda Ligabue / Greenpeace

A Labour court in Tocantins ruled in 2014 that both Brookfield Brasil Participacoes (BBP) and Indaia Agronegocio (Indaia), Fazenda Colorado’s direct owner, were jointly liable for allegations of workers being held in “slave-like” conditions at the farm in 2014.

The firms were condemned to pay a R$800,000 ($163,000) fine – a ruling they both appealed.

Despite their argument to the contrary, Indaia was controlled by BBP according to the court.

Renato Cassim Cavalini, who at the time was CEO of both Brookfield Agricultural Group and Vice-President of Brookfield Asset Management, was director and controlling shareholder of both Indaia and BBP, the court said.

Brookfield Brasil Participações 010 and Brookfield Brasil Participações 011 are both listed as “companies under common control” of Brookfield Brasil Asset Management Investimentos (BBAMI) in a document filed to the CVM, Brazil’s securities and exchange commission, in 2015 and updated in April 2021.

BBAMI is an investment fund directly controlled by Brookfield Brasil Ltda and indirectly controlled by Brookfield Asset Management in Canada and BHAL Global Corporate Ltd in the UK, among others, according to this document.

BBP had previously argued it did not share direction, control, administration or partners with Indaia. But in December 2021, a regional court upheld a judgement that recognised both companies as an economic group, ordered them to pay the amounts jointly and rejected the appeal.

Indaia denied being responsible for the working conditions, said it complied with labour standards and argued it was not responsible for the work done, which had been merely to clean the soil, and that labourers had been free to choose where to sleep.

BBP denied corporate ownership or responsibility for Indaia, according to court documents from November 2021.

Both Indaia and BBP appealed the decision in the Superior Labour Court (TST) and in June 2022 were awaiting a decision.

Brookfield expanded its British modern-day slavery and human trafficking policy in 2021 to cover its operations globally.

The modern slavery statement referenced in its latest ESG report says: “Our strategies to prevent modern slavery are designed to be proportionate to the risks identified and are addressed and mitigated taking into account the nature of the risks and of the assets and operations to which they apply, the geographic location and sector, the economic, political and regulatory environment, and our assessment of the benefits to be derived from such mitigation measures.”

These commitments appear to stand in contrast to its actions in the ongoing slave labour case.

In response to these allegations, Brookfield said: “in 2014, we became aware of a contractor contravening labour laws when working on one of our sites. We took immediate and decisive action.

"Despite a court ruling recognizing that these were not our employees, we chose to honour the contractor’s compensation obligations (while maintaining our right to claim against it) and worked to put considerably stronger safeguards in place thereafter.”

When asked if denying corporate ownership of the property constituted “decisive action,” Brookfield did not reply.

A former slave labourer demonstrates how he cleared brush with his sickle, in Piauí state, Brazil. Mario Tama / Getty

A likely breach of membership rules

Brookfield appears to be in breach of the membership guidelines of the Round Table on Responsible Soy (RTRS), a Swiss voluntary certification scheme. Brookfield Brasil highlights its farms’ membership of the RTRS in its annual report for 2020-2021.

The RTRS prohibits the clearing of any “natural land” for soy in Brazil after 2016, including any land with natural vegetation such as Cerrado land. It endorsed the “Cerrado Manifesto” in 2017, a zero-deforestation pledge.

But 1,900 ha of deforestation took place at eight Brookfield farms on Cerrado land between the start of 2016 and June 2021, our analysis of official data suggests. All of these farms were registered with soy production as their primary aim, according to unofficial corporate data available online.

Despite this, the asset manager highlights its certification by the RTRS and explains the voluntary organisation seeks to guarantee that soy comes from an “environmentally sound” process.

Companies controlled by Brookfield combined to make this group the sixth largest soy producer to be actively registered with the RTRS in Brazil, producing 118,967 tons of soy registered with the scheme in 2020. Overall it produced 208,000 tons of soy, according to its latest annual report.

At the time Brookfield had executive ties to the certification organisation. In 2019, the director of Brookfield Agricultural Group, Luiz Iaquinta, was made treasurer and a member of the RTRS’s executive board.

While working for Brookfield he also served as chairman of the RTRS’ taskforce in charge of its communications and spoke at one of its panel discussions in 2020.

When informed of these allegations the RTRS said it was “pleased to see an extensive report dedicated to this important topic.”

It went on to say that “Brookfield is not a member of RTRS. A company mentioned in your report 'Bartira Agropecuária S/A' is, however, both RTRS member since 2015 and the holder of a multisite certificate.

"Out of the farms mentioned in your report, only Horizontina Norte and Horizontina Leste are included within the scope of the certificate under the multisite type.”

RTRS added that “it sets the principles and indicators that must be complied with for a certificate to be issued” and that the audit “process is conducted by independent certification bodies which must have been previously approved by independent accreditation bodies. In the case of the certificate issued to certain farms operated by Bartira Agropecuária S/A, the certification body in charge of the process is Control Union Certificates.”

It further noted that in “all cases, RTRS President, Vice-presidents and also the Treasurer follow the instructions expressly given by the Executive Board.

"The fact that Bartira Agropecuaria S/A has been elected by the members of the association as Executive Board member and, subsequently, the members of the Executive Board elected Mr Iaquinta as Treasurer does not provide such member or individual with any special power or influence over the association.”

British supermarket chicken

Some of the chicken sold at British supermarkets in recent years may have been fed on soy originating from one of Brookfield’s deforested farms.

The commodity trader Cargill admitted in 2019 to buying soy from Brookfield’s Fazenda Nebraska, after a report from the NGO Mighty Earth identified deforestation and a forest fire at the farm. This farm was the site of 1,951 ha of deforestation between 2014 and 2021, according to our analysis.

Cargill is the United States’ largest private company by revenue, according to Forbes, and has reportedly led corporate resistance to a moratorium on soy production in the Cerrado. Cargill ships more than 100,000 tonnes of soya beans to the UK every year from Brazil’s threatened Cerrado savannah, according to an estimate by the Bureau of Investigative Journalism. Its analysis linked these beans to chickens sold at Nandos, Asda, Lidl and Tesco, via Cargill’s soy crushing plant in Liverpool and its poultry feed mills in Hereford and Banbury.

About a fifth of the soy imported to the European Union (EU) from the Amazon and Cerrado regions comes from illegally cleared land, according to a 2020 study in the academic magazine Science.

View of soybean terminal of Cargill corporation in a river port of Santarem. Matyas Rehak / Shutterstock

When informed of these allegations Nando’s stated it was “acutely aware of the devastating impact deforestation is having, not only on climate change, but also on ecological collapse.

"We work hard to ensure that our supply chain is not linked to deforestation and that all our soy is sourced under the Round Table on Responsible Soy (RTRS) or equivalent certification and now encourage mass balance soy purchases as a minimum standard.

"These commitments apply not only to the soy we use as a direct ingredient but also to our supply chain.”

It added that this year it had “also joined the UK Soy Manifesto, alongside our suppliers, further cementing our position to ensure all our soy is deforestation and conversion-free and setting expectations of this in our latest food policy for suppliers.

"Alongside this, we continue to work closely with experts and suppliers to research more sustainable alternatives to soy for use in animal feed.”

Lidl said it operated “with a fundamental respect for the human rights of the people we interact with and take this responsibility extremely seriously. As such, we are committed to implementing due diligence on this topic, improving working conditions and upholding human rights at all levels of the supply chain, in line with the UN Guiding Principles.”

Cargill stated it had “prioritized the adoption of policies across our supply chains, including our Policy on Sustainable Soy – South American Origins, and our Commitment on Human Rights. We strive to abide by these rules and expect the same level of commitment from our suppliers as detailed in our Supplier Code of Conduct.”

It went on to say it had “robust procedures in place to ensure we are respecting social and environmental restrictions – Slave Labor, Soy Moratorium, Green Grain Protocol and Embargoes (from federal and state agencies) – which includes respecting regulated indigenous areas, from which we do not source grains.

"We monitor our suppliers against these criteria and embargo lists and can confirm the farm in question is in compliance.

"As always, if we find any violation of our policies and commitments, the producer will be immediately blocked from our supply chain.”

Asda and Tesco did not reply to offers for comment.

Soya production in the Cerrado Region, Brazil. Harvest in the municipality of Riachão das Neves, in the state of Bahia. Greenpeace

Carbon footprint: Over a million red-eye flights

Brookfield claims to be a responsible and sustainable investor and, at the time of writing, the front page of its website showcased Mr Carney’s newspaper pieces and videos on green finance.

Our analysis estimates the deforestation found in Brookfield’s farms over nine years released 600,000 tonnes of carbon dioxide, equivalent to flying from London to New York 1.2 million times (1,217,038 flights at 493kg of CO2e per flight).

This analysis is based on an estimate of the tropical biomass present on the eight farms before deforestation took place (see Annexe A in the PDF version of the report for the methodology).

This poor track record raises questions about how Brookfield will meet its new commitment to net zero by 2050 as part of its GFANZ membership.

Tropical forests store vast quantities of carbon and their destruction accounts for the majority of carbon dioxide emissions that come from land use and land use change, according to the Intergovernmental Panel on Climate Change.

Brookfield Brazil says its own greenhouse gas inventory for agricultural operations showed its farms captured 309,000 tons of carbon “through biological sequestration” in the 2019/20 harvesting period.

It did not explain how this sequestration took place, or whether this considered deforestation, but said two of its farms were accredited with Cargill’s net zero programme.

Dr Ed Mitchard, a University of Edinburgh professor who specialises in mapping natural carbon stocks, advised on our carbon accounting. He warned against companies continuing to deforest tropical regions and reaching net zero by using offsets.

He said: “Fundamentally in Brazil we need to stop cutting down trees. Deforestation is already making temperatures higher, causing more drought, more fires, impacting more trees and we will get more of this vicious circle in the coming decade.”

“There was great fanfare at GFANZ’s launch but if it’s not trickling down to what high profile members are doing in terms of land ownership, that is very worrying and suggests these large corporations are intending to carry on with business as usual.”

Brookfield is no stranger to controversies over carbon accounting. In February 2021, six months after he was hired by Brookfield, Carney claimed at a Bloomberg conference that his employer had a net zero emissions impact across its entire portfolio due to its “enormous renewables business that we've built up and all of the avoided emissions that come with that.”

He later retracted this claim, which had been based on a controversial method of offsetting emissions by measuring those emissions that were “avoided” through the consumption of green energy assets Brookfield has invested in.

Brookfield Asset Management’s Asia-Pacific headquarters. Lisa Maree Williams / Bloomberg via Getty Images

An opaque ownership structure

Foreign companies are banned from owning more than a quarter of the land in any Brazilian municipality, under a 2010 legal interpretation of existing restrictions on foreign ownership of Brazilian land.

This includes firms registered in Brazil but ultimately controlled from abroad, like Brookfield.

“Brookfield’s elaborate financial strategies are interesting because these have traditionally been used to circumvent Brazilian laws on foreign land ownership,” said Junior Aleixo, a sociologist at the Federal Rural University of Rio de Janeiro, who wrote his thesis on Brookfield’s land ownership model in 2019 as part of GEMAP, a public policy and agribusiness research group.

Aleixo added: “These strategies facilitate control of the land while making its ownership deliberately difficult to pin down.

“The ecological impact is very high, as most of these funds are more concerned with the fluctuation of land and commodity prices than with the economic redistribution and socio-environmental impact of their investments.”

Because Brookfield does not publish an up-to-date list of its direct and indirect farm holdings in Brazil, it is not possible to establish how close its farm holdings come to this limit and whether they exceed it.

One of Brookfield’s strategies has been to invest in farmland through investment funds. Brookfield Brasil Asset Management Investimentos (BBAMI) and Brookfield Brazil Agriland fund indirectly controlled the farms Horizontina Leste, Nebraska and Horizontina Norte until 2021, according to sale documents provided to the Brazilian securities and exchange commission, the CVM.

It also indirectly controlled Caiapo Agronegocio and Macaubapar Participacoes, linked to the Nazare Group of farms, Alvorada and Talisma.

A Brookfield-controlled firm called Agripar Participações, of which the Agriland fund was a shareholder as of 2012, indirectly controlled a number of farms – Horizontina Norte, Horizontina Leste, Alvorada, Talismã and Colorado – according to a 2017 presentation by the asset manager.

Extract from a Brookfield presentation on Fazendas Bartira

Another indirect acquisition strategy has been the issuance of Certificates of Agribusiness Receivables (CRAs), tradable credit instruments which pay investors a monthly fee and are backed by agricultural land. Brookfield’s Brazilian farm holding group Bartira Agropecuária raised R$70 million in 2016 through issuing CRAs, according to Aleixo’s research.

Brookfield reportedly bought these securities from Bartira – which it already owned – via a financial services firm, then transferred the funds back to Bartira, which in turn used the money to buy more land through Brazilian-registered farming companies.

The 2017 presentation shows that Bartira controlled the deforestation-linked San Diego farm, where we found 545 ha of cleared forests.

Brookfield has also used debt-to-equity swaps to control its farming empire, where it buys debts in a Brazilian company which are then transformed into stocks.

In 2017, the Agriland fund, reportedly bought debentures, a type of loan agreement, in Embaúba Participações, the Brazilian indirect owner of Fazenda Nebraska, on the condition these would be converted into shares as soon as Embauba was able to acquire rural properties.

We found 1,952 ha of deforestation at Fazenda Nebraska between 2014 and 2021.

Sell-off

Brookfield’s CEO Bruce Platt has said in interviews that the company buys distressed assets during crises and sells them once the price has gone back up.

“We’re in the business of owning the backbone of the global economy,” he told the Financial Times in 2018. “[But] what we do is behind the scenes. Nobody knows we’re there, and we provide critical infrastructure.”

He went on to describe the company’s strategy in Brazil: "… there was an enormous void of foreign direct investment into Brazil, therefore we bought a lot of things at what we deemed to be fractions of the replacement cost.”

Filings to the CVM show that Brookfield sold off many of the indirect owners of its Cerrado farms in August 2021, including those of Horizontina Leste, Horizontina Norte, Nebraska, Nazaré, Alvorada and Talisma.

It reportedly sold 100,000 ha of farmland to the real estate fund Terrax FII in August 2021, after selling another 130,000 ha earlier in the year.

The Cerrado is a tropical savannah covering 23% of the surface of Brazil, or 2 million km2 – half the size of the EU. It has lost about 50% of its natural vegetation. Marizilda Cruppe / Greenpeace

The financialisation of Brazil’s climate-critical land could be set to continue. In 2021 the Brazilian senate approved a new tax-efficient category of investment fund, known as FIAGRO, which makes it easier for foreign financial institutions to invest in Brazilian agriculture.

It has specific provisions to encourage lenders, insurers, venture capitalist and financial technology companies to invest in rural land without breaking foreign ownership rules by acquiring shares in funds which hold titles to these lands.

As Brazil seeks to attract more investments into its land use sector, Brookfield’s failings show how regulation in the UK, the US and the EU is required to ensure the financial sector carries out continuous due diligence on deforestation before and after entering into such ventures.

Deutsche Bank, Bank of America and HSBC: Complicit in Brookfield’s forest destruction?

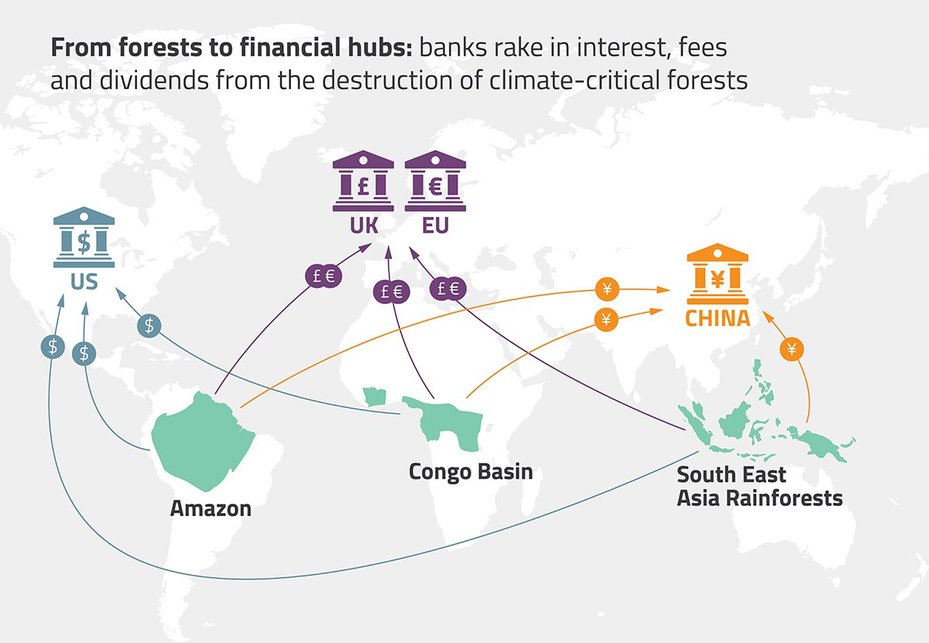

Brookfield Asset Management could not fund its operations, including forest destruction, without the backing of some of the world’s biggest financial institutions, including Deutsche Bank, Bank of America and HSBC, according to our analysis, published in 2021.

Our dataset drew on publicly available financial data, compiled by the Dutch non-profit Profundo, to identify which financial institutions were providing crucial shareholdings, bond holdings, loans, revolving credit facilities and underwriting services to 20 of the world’s most notorious agribusinesses linked with forest destruction between 2016 and 2020.

Deutsche Bank declined to comment when contacted by us in 2021 about its investment in 19 agribusinesses accused of deforestation, including Brookfield.

It has signed the UN Principles for Responsible Banking, which commits banks to the Paris Climate Agreement Goals, and has also said it will not finance the destruction of primary forest, High Conservation Value or peatlands, illegal logging, and uncontrolled or illegal use of fire where there is clear and known evidence of any of these harms taking place.

But it stopped short of prohibiting the financing of all deforestation and implied some forest loss would be acceptable if offset through tree-planting.

Deutsche Bank AG’s headquarters in Frankfurt, Germany. Martin Leissl / Bloomberg via Getty Images

In response to the allegations about Brookfield, Deutsche Bank said “as a matter of policy we do not comment on client relationships – not even potential or former ones,” but that it had a “clear set of guiding principles and requirements that we apply to our client and business selection processes in order to promote sustainable agribusiness.

"As part of this approach, we require clients to participate in certification schemes and expect them to publicly demonstrate their commitment to No Deforestation standards.

"We do not knowingly finance activities that result in the clearing of primary forests, involve illegal logging or conversion of High Conservation Value, High Carbon Stocks forests or peatlands. Where we work with conglomerates, we make a significant effort to ensure our financing is only directed to activities that are in line with our policies.”

Bank of America, with whom Brookfield had the second most significant banking relationship by size of combined lending, investing and underwriting, says it supports reforestation projects in dozens of US cities.

Its most recent forest policy says it will not underwrite bonds where proceeds are specifically used to clear primary forest or for the unauthorised clearance of high conservation value forests.

It also says it will not finance operations in areas where Indigenous land claims are not settled.

Our data suggests Bank of America funnelled an estimated £1 billion into Brookfield between 2016 and 2020, primarily by under-writing bond issuances. When offered comment on these allegations, it did not reply.

Asset managers Citigroup, Vanguard and Blackrock, all US-based, were some of Brookfield’s biggest investors.

Two years ago, Blackrock’s chief executive Larry Fink wrote to clients that he considered climate risk an investment risk and that the firm would make sustainability its new standard for investing.

When contacted in 2021 about its exposure to firms accused of deforestation, including Brookfield, Blackrock told us it does not provide direct financing or lending facilities to individual companies and does not control the strategic decision-making of businesses in which it is a minority shareholder.

It said 90% of its equity holdings are through index funds or Exchange Traded Funds in which clients choose where to allocate their assets. When offered comment on the allegations against Brookfield in this report, none of these investors responded.

The third largest banking relationship was with HSBC, the British bank, which channelled £880 million to Brookfield, also primarily in the form of underwriting its bond issuances.

HSBC made a public commitment to stop financing firms accused of deforestation in 2017. In 2021, the bank told us its relationship with 19 destructive agribusinesses, including Brookfield, were either not linked to forestry, palm oil or cattle, or that the relationship had ended or was in the process of ending.

The bank said in some cases it had only indirect relationships with the agribusinesses as nominal manager of its shares on behalf of a customer, meaning it had no beneficial interest in or direct influence over the underlying agribusiness.

HSBC has been linked with several controversial agribusinesses and has been involved in deals with top deforesters worth an estimated $6.85 billion since 2016. Global Witness

On the Brookfield allegations and its financial link to the company, HSBC stated it could not “confirm whether or not a customer relationship exists” and was therefore not “able to comment on this company directly.”

It added that it “recognise[s] the importance of protecting forests and Indigenous peoples and this is incorporated in HSBC’s approach to deforestation and related issues which is set out in our Sustainability Risk policies on Forestry and Agricultural Commodities, which incorporate No Deforestation, No Peat and No Exploitation requirements, and the use and support of credible independent certification schemes.

"For investments, our Asset Management business has Engagement policies including one dedicated to Biodiversity related issues.”

These banks and asset managers have all featured in previous Global Witness reports on deforestation.

Other British financial institutions had significant exposure to Brookfield too. The Lancashire County Council Pension Fund and the London Pension Funds Authority have both invested directly in Brookfield’s Brazilian agricultural fund.

Deutsche Bank, Bank of America and HSBC joined the Net-Zero Banking Alliance that sits under GFANZ in April 2021, after the financial analysis discussed in this section was published by Global Witness last year.

This analysis demonstrates the scale of investment by GFANZ members in carbon intensive, deforestation-linked businesses, including Brookfield.

Net zero promises

Mark Carney, UN Special Envoy on Climate Action and Finance, and Co-Chair of GFANZ, speaks during the Net Zero Delivery Summit at the Mansion House. PA Images / Alamy Stock Photo

Mark Carney: A poster boy for green finance

Mr Carney’s best-selling book Values and speeches as UN Special Envoy on Climate Action and Finance preach a simple idea: climate change can be stopped if large banks, pension funds and asset managers voluntarily change their investment habits to reduce carbon emissions.

“Finance is no longer a mirror that reflects a world that’s not doing nearly enough. It’s become a window through which ambitious climate action can deliver the sustainable future that people all over the world are demanding,” Carney said in a keynote speech at COP26 in November 2021. “It will help end the tragedy on the horizon.”

Mr Carney’s financial experience, network of political contacts and UN Special Envoy status give credibility to the idea that financiers can be trusted to act on climate change.

After more than a decade as head of the Bank of Canada and then the Bank of England, Mr Carney was appointed financial adviser to the UK government for COP26.

He also launched an international taskforce on carbon credit markets, to help companies use controversial “carbon offsets” to reach net-zero emission goals.

Mark Carney leaves 10 Downing Street. Leon Neal / Getty Images

“The personal clout of men like Carney is remarkable because they provide a way to lend the credibility of ‘we understand business and finance’ to the climate space and make it a business issue rather than a hippy green issue,” said Adrienne Buller, a green finance researcher and senior fellow at the thinktank Commonwealth.

“But their framing of climate commitments around net zero is a get out of jail free card because it only zeroes in on a portion of their assets.”

Mr Carney’s decision to accept a position at Brookfield while acting as UN Special Envoy on Climate Action and Finance, as well as special adviser to the UK government on COP26, raises important questions about his role in promoting weak voluntary schemes that do not effectively prevent the financing of deforestation or other environmentally damaging businesses and activities.

Mr Carney was appointed Vice-Chair and head of sustainable investing at Brookfield in August 2020, a year before any of the nine farms highlighted in this report were sold off.

His base salary at Brookfield is thought to be well above the £879,000 he earned as governor of the Bank of England and the asset manager openly says it gives senior leadership team “significant” stakes in the firm. He became Chair of the firm in December 2022.

When offered comment on these responses, Brookfield replied stating the “allegations refer to periods of time long before Mr Carney joined Brookfield and to businesses in which Mr Carney had no involvement.

"Moreover, Mr Carney has demonstrated considerable leadership in Brookfield’s transition investing strategy since its launch in 2021, including spearheading the fundraising and deployment of the world’s largest climate impact fund.”

Glasgow Financial Alliance for Net Zero (GFANZ): Flawed by design?

GFANZ is central to Mr Carney’s climate and finance vision. Launched in April 2021, GFANZ aims to "broaden, deepen and raise ambition" to meet the Paris Agreement by creating a united financial sector-wide net zero alliance.

It currently represents 450+ member firms, with more than $130 trillion in assets under management and advice.

The Eiffel Tower was illuminated in green to celebrate the ratification of the COP21 climate change agreement in Paris. Geoffroy Van Der Hasselt / Anadolu Agency / Getty Images

Individual financial institutions belong to GFANZ through industry-specific subgroups.

For example, Brookfield is a member of the Net Zero Asset Managers initiative, and its backers Deutsche Bank, Bank of America and HSBC are members of the Net-Zero Banking Alliance.

GFANZ signatories originally signed up to mandatory criteria set by the Race to Zero, the UN standard setter for non-state net zero commitments, including a commitment to halve their emissions by 2030 and reach net zero by 2050.

Deforestation became a key aspect of the Race to Zero criteria in June 2022, with new and existing members – including Brookfield – required to pledge to achieve and maintain operations and supply chains free of deforestation by 2025 at the latest.

In September 2022, GFANZ co-chairs, including Mark Carney, issued a press release warning that broader net zero targets are unattainable without immediate action to end the financing of deforestation, with the need to end all land conversion by 2030 at the absolute latest to limit global temperature rises to 1.5°C.

The Science Based Target initiative (SBTi) – which assesses and certifies private sector emissions targets – also requires companies have a target date of eliminating deforestation by 2025 or earlier for a target to be scientifically validated.

In line with this, GFANZ's guidance on transition plans recommends financial institutions should have deforestation policies and embed their net zero targets into all investment decision-making tools and processes.

While this guidance recognises that ending deforestation financing is an urgent priority, GFANZ itself does not have the power to compel its members to meet their voluntary targets and the alliance appears to be reducing, not building, credible monitoring and accountability controls.

In October 2022, GFANZ announced it would no longer be mandatory for its member alliances to adhere to the UN Race to Zero targets and criteria, citing that all of its sector-specific alliances "are independent initiatives subject only to their individual governance structures," with "sole responsibility" for changes to their targets and membership criteria.

Prior to this, the alliance described itself as "anchored" in Race to Zero to ensure "credibility and consistency."

GFANZ expects financial institutions to set targets that align with 50% emissions reductions by 2030 and support an end to deforestation by 2025

GFANZ split from Race to Zero shortly before the planned introduction of an "independent compliance mechanism" by that body, with multiple media reports claiming some financial institutions threatened to quit the alliance over anti-trust concerns related to more stringent fossil fuel phase-out criteria issued by the UN.

GFANZ members must now only "take note" of the advice and guidance issued by Race to Zero, with sector-specific alliances free to set their own standards and targets in the absence of any independent monitoring and accountability functions.

This episode demonstrates how easily voluntary initiatives governed by the financial sector can succumb to internal pressure to roll back climate targets and standards.

GFANZ itself has no capacity or resources dedicated to monitoring and verification, and although some sector-specific alliances have designed their own so-called "accountability mechanisms", these procedures lack transparency and independence.

For example, the Net Zero Asset Managers initiative to which Brookfield belongs requires the submission of an annual report to a group known as the "Network Partners", which is made up of a further six alliances, demonstrating the labyrinthine complexity and lack of transparency in the governance model of the Race to Zero and GFANZ.

By contrast, the Net-Zero Banking Alliance, which describes itself as a "bank-led initiative", is ultimately governed by a Steering Group made up of 12 financial institutions, including high level representatives of HSBC and Bank of America, who are historic backers of companies such as Brookfield, as discussed above.

That GFANZ is co-chaired by Mark Carney – who is in turn Chair of Brookfield – demonstrates the contradictions and conflicts of interest that arise when governments rely on the financial sector to design and implement pledge-based voluntary schemes with no fully transparent monitoring or accountability mechanisms.

Brookfield denied the allegations, stating it “unequivocally refute[s] allegations of a conflict of interest between Mr. Carney’s outside interests and his connection to these historical allegations.”

In response to these allegations, GFANZ said in August 2022 it expected all of its “members, including Brookfield, to meet the requirements of their sector-specific alliances and Race to Zero.”

It went on to add that although it could not “comment on specific allegations made about member firms, we can observe that thus far, Brookfield has adhered to all relevant NZAM and Race to Zero policies.

"Brookfield has adopted targets for one-third of its assets under management, committing to reduce emissions by two-thirds from these assets by 2030. We will continue to support all financial institutions in establishing robust plans, targets, and metrics that align with net zero.”

It clarified that the “GFANZ Recommendations and Guidance on Financial Institution Transition Plans, which are currently out for consultation with the intention of being finalised by COP27 this November, recommends that financial institutions establish rigorous policies for ending the financing of carbon-intensive activities such as deforestation.

"Grounded in the requirements of Race to Zero, GFANZ expects financial institutions to set targets that align with 50% emissions reductions by 2030 and support an end to deforestation by 2025.”

It concluded that it appreciated the “scrutiny and high expectations civil society has for GFANZ.”

Race to Zero did not reply to an offer for comment.

Financial institutions have netted $1.74 billion in interest, dividends and fees from financing the parts of agribusinesses groups that carry the highest deforestation risk. Global Witness

Governments are missing in action

Existing financial regulation and voluntary schemes have failed to prevent the financing of the destruction of climate-critical forests, mainly due to the same lack of monitoring and accountability highlighted above.

Instead, new laws are needed to meet 2025 deforestation targets by preventing and remedying the financing of forest clearance and human rights abuses.

Clearer climate-related legislation is, in fact, already supported by GFANZ. Responding to us, GFANZ stated it would “like nothing more than for governments to make net zero transition planning mandatory and transparent, but are stepping in absent government action.”

At COP26, over 140 governments representing 90% of the world’s forests pledged to halt and reverse forest loss and land degradation by 2030, including through the "alignment of financial flows with international goals to reverse forest loss and degradation." This necessitates a new preventative approach to financial regulation.

Ahead of COP27, GFANZ called on G20 governments to "Translate commitments to safeguard nature and prevent deforestation into tangible government policies that can cascade through the private and financial sectors."

To date, however, governments in key financial centres including the UK, EU and US have relied on inadequate voluntary certification schemes and financial-sector initiatives, rather than introducing new regulations to stop institutions from making such investments in the first place.

Neither the EU, UK nor the US have legislation requiring financial institutions to conduct due diligence specific to deforestation risk.

Greenpeace campaigners cover the EU Commission’s headquarters with giant image of Amazon fires. Tim Dirven / Greenpeace

In the UK, under Section 17 of the Environment Act, it will soon be illegal for large businesses to use commodities such as soy if they were grown on illegally deforested land, yet financial institutions will continue to profit from these deals with impunity.

The EU recently agreed similar legislation requiring traders to conduct due diligence to check if commodities were grown on deforested land. That law commits to a forthcoming review of the role of European financial institutions in driving deforestation.

In the US meanwhile, the Fostering Overseas Rule of Law and Environmentally Sound Trade (FOREST) Act has received bipartisan support for banning agricultural commodities produced on illegally deforested land from entering the US market, but also fails to introduce due diligence for the financial sector.

Without action to introduce or extend new regulations to prevent financiers from bankrolling deforestation, these commodity-focussed pieces of legislation are severely undermined from the outset, jeopardising the Paris Agreement’s objective to limit global temperature rises to 1.5°C.

Land-grabbing in the heart of the Amazon

Rubber tappers hungry for latex to waterproof shoes and cloaks were the first to invade traditional Kayabí territories on the banks of the Teles Pires river in the 19th century.

Gold miners and hydroelectric dam builders followed in the 20th century to make a quick buck off the south-eastern Amazon’s energy and soil wealth in Mato Grosso and Pará states.

A dam being built in the Teles Pires river. Greenpeace

All over Brazil, faraway foreign investors are pressuring Indigenous groups to leave the land their ancestors have occupied for hundreds if not thousands of years

The Amazon is home to some 300 Indigenous groups including 80 groups of “uncontacted peoples,” who have had limited contact with the outside world.

Just a few hundred Kayabí people still live along the Teles Pires river’s banks in Mato Grosso and Pará states on a protected corridor of land meant to preserve a slice of history and stem agricultural expansion into the Amazon.

The latest threat to this endangered Kayabí community’s land appears to be an asset manager headquartered in Toronto nearly 4,000 miles away.

Until January 2022, Brookfield Brazil was the direct owner of Agropecuaria Vale do Ximari (Ximari), a farming company that claimed it bought the rights to cattle farming, mining and timber logging on the land in 1998, incorporation documents show.

While these investors may see the Amazon as a way to extract resources and generate wealth, land grabs strip Indigenous groups of their constitutional rights to places they consider sacred, where their ancestors are buried and where they hope to bring up their children

Under Brazil’s Constitution and the 1973 Law for the Protection of Indigenous Peoples, lands on which Indigenous Peoples have historically lived and which are in the process of being certified cannot be sold.

The Kayabí have lived in fear of eviction since Ximari obtained an injunction ordering police to clear all inhabitants from 75,000 ha of land in 2018.

The Indigenous community living on this farm – understood to be made up of at least six families and eight children – use the charcoal-rich land to farm nut, corn and cassava varieties as well as hunting its wild pigs, tapirs and the occasional jaguar.

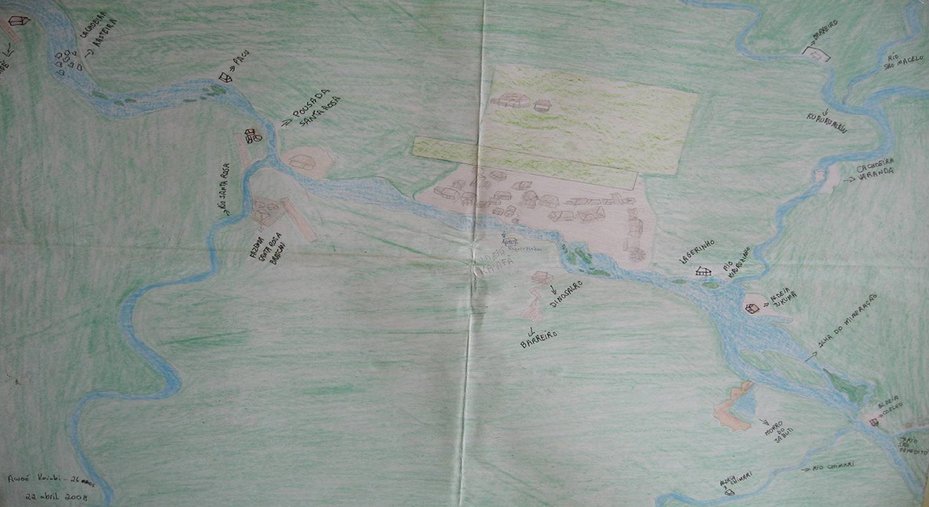

Kayabi hunting lodge near Lake Jabuti. Dr Oliveira

The decades-long conflict over land between the Brookfield-owned farm and the Kayabí Indigenous community has unfolded on land containing rare biodiversity in the world’s largest rainforest.

Scientists published in the Nature Climate Change journal in 2022 wrote that the destruction of the Amazon could have “profound implications for biodiversity, carbon storage and climate change at a global scale.”

Forest loss in the Amazon in 2022 has risen to its worst rate for 15 years, according to Brazil’s national space research institute INPE. Scientists have warned the biome could soon reach a tipping point where it stops being able to sustain attacks and its trees start dying en masse.

Implementing the eviction order and removing the Kayabí could set a dangerous legal precedent, paving the way for more mining projects backed by international asset managers on previously protected Amazon land.

Living with the threat of eviction

A bloody river battle would take place if the police executed the court injunction to clear two Kayabí villages, according to a letter from an operational commander in the Mato Grosso military police force, Abel Rodrigues Pereira, to his superior in June 2018, obtained by us.

The villages are on just 40 ha of land overlooking the Teles Pires, located a car and boat journey of more than 100km from the nearest town of Apiacas along roads and treacherous rapids.

The Kayabí community living there has in the past told justice officials that it had no intention of leaving.

Indigenous villages dotted around the river could be inclined to show solidarity, the letter said.

Two dozen police officers, six four-by-four cars, five boats, a garrison of firefighters and aerial back-up in the form of a helicopter would be required over seven days for the eviction operation.

Female medical staff would need to accompany the battle squad in anticipation of injury of Indigenous women who they said were particularly likely to fight back.

Mato Grosso’s state military police have refused to clear the land of people, citing lack of capacity and reputational risk, and asked the federal police to do so instead.

The eviction order was still pending after the sale of the farm four years later in May 2022, despite repeated pleas from Ximari for it to be enforced.

Ancient land rights

The Kayabí’s presence along the Teles Pires river has been carefully documented since the early 20th century through interviews by anthropologists.

Research commissioned by the Brazilian government body for the protection of Indigenous rights, FUNAI, confirmed this.

Large-scale deforestation of the Amazon started with the construction of a Brasilia to Belem highway in 1960, linking Brazil’s new capital to the resource-rich interior. Xingu National Park was created in 1961 in an effort to preserve Indigenous Peoples' way of life.

But the park was soon used as a pretext for a mass eviction effort by loggers, ranchers, rubber tappers and miners moving deeper into the rainforest.

Gold miners on land claimed by Ximari put the Kayabí under increasing pressure to leave their homes and arranged for two flights to transfer hundreds of Indigenous people out of the forests.

A view from above of the Parque Nacional do Xingu. Greenpeace

The families now living on land claimed by Ximari say they are descended from more than a dozen Kayabí who went into hiding in the forest for two months in the late 1960s after resisting attempts to move them 300 miles from their home.

Within a year they were joined by relatives who made the eight-month journey back to Teles Pires from the national park on foot.

Despite this the Mato Grosso state land agency Intermat sold off vast swathes of land in the area in the 1970s and 1980s in lots of 3,000 ha of what it judged to be “empty land”.

From 2006, federal prosecutors advised the remaining Kayabí to occupy the areas they and their ancestors had previously lived on so as not to lose their land rights.

Villages and agricultural spaces were set up including on land claimed by Ximari, including a village called Aldeaia Dinossauro from 2002 onward, and another called Aldeia Ximari. Dinossauro’s founder told anthropologist Francisco Stucci the village had been built on the site of his grandfather’s village.

Only 2,100 people speak the Kayabí language throughout Brazil, according to the Joshua Project, a Christian missionary group, while only a few hundred are thought to live along the Teles Pires river.

Sacred spaces

The conflict with Ximari centred on the sacred Lake Jabuti or ypi 'aweté, "true lake", in Kayabí language. Locals we interviewed said that Ximari employees visited the lake in March 2022. They believe this was to assess limestone mining deposits.

The lake is on land known as the most charcoal-rich and fertile, and the best hunting ground for wild pigs. Kayabí elders are buried around the lake and a shaman, or spirit, is thought to live in one of its caves.

“When I arrived here, it felt like I was daydreaming,” a Kayabí man born in Xingu told the anthropologist Dr Oliveira about the lake.

“That’s the kind of place it is, very famous and very sacred to us, because a lot of the things we respect are there.”

He had grown up hearing stories about Lake Jabuti from his grandfather and had returned to the Teles Pires area at his request.

Both the identity of the Kayabí and their food security is intrinsically tied to their close agricultural and spiritual relationship with the land around the Teles Pires river, the anthropologist argued.

Youngsters are taught that when a kutap frog starts singing by the river it is time to start sowing local varieties of banana, watermelon, corn or manioc.

No species is more prized than the nut tree, which is highly concentrated around Dinossauro and Jabuti but absent in Xingu, where some Kayabí were forced to move.

Nut milk is used to cook game, fish or porridge, or as a hair dye. The nut tree’s lifecycle is used to mark the passage of time.

Clearing in Dinossauro village with charcoal-rich “black earth” common to the Amazon basin. Dr Oliveira

National attacks

Indigenous people’s rights to their ancestral land were enshrined in Brazil’s 1988 Constitution but are under threat all over Brazil ahead of President Bolsonaro’s re-election bid in October 2022.

A new constitutional interpretation put forward by agricultural groups would require Indigenous Peoples to prove they physically occupied contested land in 1988, at a time when many groups had already been dispossessed and displaced.

In June 2022 a Supreme Court ruling on the case could set a precedent affecting ongoing land demarcation cases for some 197,000 Indigenous people occupying 11 million ha of land, including the Kayabí.

Bolsonaro is trying to rush a series of laws through Congress which would put the Amazon and its inhabitants more at risk than ever. Known as the “destruction package”, the laws would give a wholesale green light to hundreds of mining, logging, cattle and energy projects by removing protections for Indigenous peoples and their forest land.

Around 160,000km2 of Amazon rainforest would eventually be swallowed up by mining projects if these laws were to be successfully passed, according to the NGO Amazon Watch.

It found 2,500 active mining applications overlapping Indigenous land in November 2021, covering an area nearly the size of England.

Asset managers Capital Group, BlackRock and Vanguard gave more than $14 billion in financial backing to the mining groups who filed the licence applications noted by Amazon Watch.

An Indigenous person takes part in a protest on the day of Brazil's Supreme Court trial of a landmark case on Indigenous land rights in Brasilia, 15 September 2021. Adriano Machado / Reuters

Overlapping legal attacks

The land claimed by Ximari was part of a vast land area belonging to Kayabí communities, first established by presidential decree in 1982.

In 1999, after an anthropological survey showing the Kayabí had historically been present there, alongside two other Indigenous communities, FUNAI stated that the borders of the area included both land in Pará state and in Mato Grosso state, including the area claimed by the Ximari farm.

Despite this, the farm has launched several parallel legal cases against the Kayabí for possession of the land. Ximari’s attempts to annul Indigenous claims to the land based on having owned it since the 1980s was rejected in 2011 as both the court and FUNAI considered the Indigenous community’s rights pre-existent. Ximari appealed the decision.

The Kayabí’s land borders were officially registered by President Dilma Rousseff in April 2013, spreading across 1.05 million ha of land.

Mato Grosso’s state government sought to annul Rousseff’s land registration just seven months later, arguing the Kayabí did not live on the full stretch of land attributed to them.

Federal prosecutors and the government’s Indigenous administration body, FUNAI, both argue the land has been historically occupied and owned by Indigenous Peoples.

Ximari launched a new repossession case for the same land area in the federal court of Sinop in 2015, arguing the Kayabí had used Rousseff’s contested decree as justification for an “illegal invasion” onto the farm.

The case was initially dismissed for being too similar to a previous one the farm had unsuccessfully filed in 2007.

After an appeal, judge Kassio Nunes granted Ximari an injunction in a federal court to remove the Kayabí people.

Judge Nunes has since been named as one of Bolsonaro’s two appointees to Brazil’s 11-member Supreme Court and has voted in favour of reinterpreting the Constitution’s Indigenous rights provisions.

Mato Grosso’s injunction to reverse the registration process of the Indigenous land was still under appeal by FUNAI and by the federal government in May 2022.

A conciliation process between the Indigenous community and the state had been postponed due to the pandemic.

Mining potential

Brazil’s national environmental watchdog Ibama accused Ximari of carrying out illegal deforestation on small patches of its land in 2019.

The farm denied this in court filings and said the deforestation had been carried out by the Indigenous inhabitants themselves.

Around half of the farm was made up of legally protected land which cannot be deforested, according to its registration documents.

Previous Ibama research has shown more than 30,000 ha of forest was deforested between 1995 and 2005 in the Mato Grosso part of the Kayabí’s Indigenous territory.

A Birkbeck University thesis on deforestation in the area based on satellite data analysis argues farmers were responsible for this.

The river is our market, the forest too. If we don’t have land, we’ll become beggars

One reason Ximari may have been interested in the land is mineral extraction. A man understood to manage Ximari’s farm was listed as director of a local mining firm specialising in precious and semi-precious gems, according to unofficial corporate data.

“It is the land that will guarantee our culture,” a Kayabí leader was reported to have explained at a Supreme Court hearing about the suspension of Rousseff’s demarcation case in 2014.

“The river is our market, the forest too. If we don’t have land, we’ll become beggars.”

In a letter delivered at the hearing, another leader explained that Kayabí people’s absence from these lands was caused by “deferred expulsion, maliciously devised."

He wrote: “Perhaps there were no Indians on those lands in 1988, but there was certainly the memory of our ancestors."

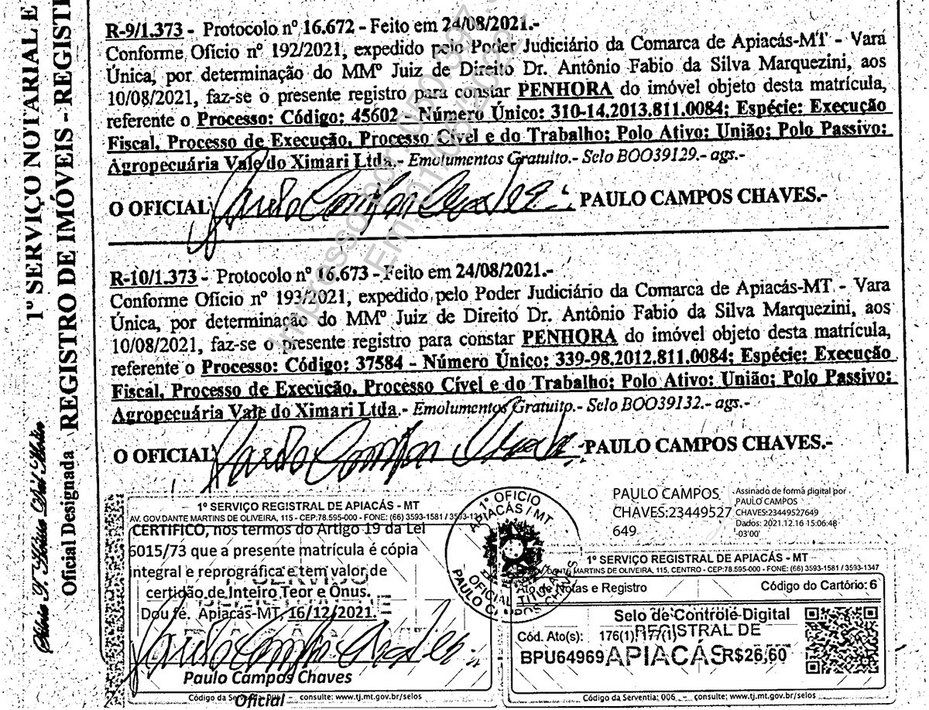

Farm sale

Court documents show the farm was prohibited from being sold and was held as collateral by an Apiacas court in August 2021 due to some unresolved issues described as “Tax Enforcement, Enforcement Proceedings, Civil and Labour Proceedings”.

Extract from registration document, signed December 2021

Despite this Brookfield sold the farm’s holding company Agropecuaria Vale do Ximari to an investor in January 2022, according to an update to the firm’s articles of incorporation in May 2022.

Rio Tocantins Participações, a Brazilian company, bought the business for R$12,983,954 (£2.16 million).

The buyer filed documents to the Supreme Court in May 2022 explaining it was aware the farm was within land demarcated for the Kayabi Indigenous group and wished to register an interest in the ongoing dispute over the demarcated territory between the state of Mato Grosso and the Federal government.

Brookfield said it “unequivocally refute[s] the specific allegations of human rights abuses towards indigenous tribes” claiming that these were “baseless allegations”.

When pressed for evidence to substantiate why it thought these claims were “baseless”, Brookfield did not reply.

Brookfield’s chequered track record elsewhere in Brazil

Brookfield Brasil, formerly known as Brascan, has been linked to a whole host of other environmental and social harms.

Newspaper reports from 1989 suggest the group has a long history of facing deforestation allegations. That year a tin mine it jointly owned with British Petroleum was accused of destroying at least 40% of the Jamari National Forest in Rondônia.

A World Bank report calculated the mine had “affected” 90,000 ha of this rainforest in western Brazil due to mining, road clearance, soil dumping or river diversion, according to an Ottawa citizen report.

The Brazilian forestry service put this at 100,000 ha, though Brascan told the newspaper the mine had not damaged more than 25,000 acres (10,117 ha).

Signs of dying forest are everywhere

An undercover Sunday Times reporter who was sent from London to visit the mine at the time wrote: “Inside the security cordon, verdant-Amazonian rainforest is rapidly being transformed into a moonscape of cratered, open-cast mines.

"Signs of dying forest are everywhere ... Not even scrubs grow, and no attempt has been made to repair the damage by replacing topsoil and replanting.”

Brascan said it had not undertaken any reforestation work – and nor was it planning to.

Brookfield Brasil’s current-day energy projects in Brazil also face a host of governance and environmental issues.

A leak at a hydroelectric dam owned by the asset manager’s Brasil branch may have been behind floods that devastated the eastern city of Raul Soares in January 2020, according to an investigation by the Organised Crime and Corruption Reporting Project (OCCRP).

The floods impacted 800 homes and left at least 3,000 people homeless, according to February 2020 filings by a lawyer at a public hearing.

The states of Bahia and Minas Gerais, in the northeast region of Brazil, suffer from floods that began in November 2021 and continue to wreak havoc in early 2022. Isis Medeiros / Greenpeace

The João Camilo Pena plant in Minas Gerais state had been operating for more than a decade without an environmental licence, according to the state prosecutor’s office.

The company failed to alert authorities in the city so people at risk from floodwater could be evacuated, according to a technical report commissioned by the prosecutors.

Brookfield denied responsibility for the disaster, saying the plant was too small to have an impact on floods.

The asset manager said it was in the process of obtaining an environmental licence for the plant.

The OCCRP has reported that residents say they have been harassed by Brookfield employees for speaking out about the impact of another Brookfield plant on their livelihood, the Barra do Brauna Hydroelectric Power Plant.

One protester says he and his wife received death threats from Brookfield employees. State police opened two probes in January and August 2019 into these alleged threats, according to files seen by us.

Brookfield’s subsidiary Elera Renováveis said the protester had sued the company to obtain “an undue financial advantage” after his compensation claim was rejected, and that he had harassed company employees.

View of a bridge almost consumed by flood water on the border of the municipalities of Diamantina and Olhos DAgua in Minas Gerais state, Brazil. Nilmar Lage / AFP via Getty

Elsewhere in Minas Gerais, a major Brookfield electricity project failed to engage with 10 local communities who have lived in the area for more than seven generations, according to a letter by community leaders published by the Margarida Alves human rights collective in 2019.

Brookfield has concessions for the operation and construction of electricity transmission lines worth more than a billion pounds through its company Quantum.

Quantum’s Mantiqueira electrical transmission project is building hundreds of towers stretching across a 195km transmission line known as Janaúba-Araçuaí.

Each tower requires 40 square meters of forest land to be cleared, according to De Olho nos Ruralistas, an outlet focused on Brazilian land disputes, as well as a security perimeter of a further 70 square meters in which the company prevents animals or native geraizeiros, traditional farmers, from moving around.

These community and land conflicts risk exposing Brookfield to breaches of its human rights policy, which states: “Brookfield is committed to conducting its business in an ethical and responsible manner, including by carrying out our own business activities in a way that respects and supports the protection of human rights… we embed these standards in our core business activities.”

Brookfield again said it “unequivocally refute[s] the specific allegations on flood damage in Minas Gerais" and that they were “baseless”.

It also said that in the “face of a number of industry-wide issues facing mining operations in Brazil, Brookfield chose to implement a restoration plan that has been recognized by the Brazilian environmental agency as one of the most advanced in the country, and has voluntarily continued with these restoration efforts well beyond our sale of the assets in 2005.”

Conclusion: A call to action

The allegations detailed in this report demonstrate that the financial sector cannot be trusted to police itself to net zero. Voluntary initiatives such as GFANZ, launched with fanfare, are riven with contradictions and conflicts of interest.

As UN Special Envoy, climate finance adviser to the UK government and co-Chair of GFANZ, Mark Carney has significantly raised the profile of climate change as a threat to financial stability.

But Brookfield’s track record presents yet another case study of how the financial sector can use voluntary schemes as a smokescreen for inaction.

This report – with its details of deforestation, slave labour and attempts to evict indigenous groups – shows he has made much less progress on voluntarily delivering good environmental and social governance under his own corporate roof, despite the organisation’s pledges.

COP26 in Glasgow. Global Witness

Carney joined Brookfield in August 2020, at least a year before any of the farms discussed in this report were sold and nearly two years before its Amazon property was sold.

As tropical deforestation rates rise and the financing of destructive agribusiness continues apace, existing financial regulation and voluntary initiatives such as the Race to Zero and GFANZ have already shown themselves to be woefully insufficient.

This is epitomised by GFANZ’s decision to dump mandatory compliance with Race to Zero just weeks before the body’s planned introduction of an independent compliance mechanism.

What is needed now is not further weak voluntary initiatives, but new laws.

Brookfield’s attempts to distance itself from these farms does not absolve the company of its culpability.

Its own annual reporting suggests it sets out to control the assets it invests in, stating: “In most cases, we invest in ways that allow us to have a degree of influence or control over the asset or business, known as 'control positions'. This enables us to bring our experience and influence to bear, including on ESG matters.”

The route to success is clear. To reach net zero and ensure a just transition, governments must introduce mandatory environmental and human rights due diligence for the financial sector.

This would result in no additional regulatory burden, since financial institutions should already conduct such due diligence if they are genuinely committed to their voluntary Race to Zero pledge.