- Santander and BlackRock have ramped up investment in beef giant Minerva despite recently published evidence showing the company’s links to deforestation.

- We have also obtained further evidence that meatpacking giant Minerva is complicit in the devastation of 5,000 football pitches of Indigenous land.

Financial institutions Santander and BlackRock have increased their investments in beef giant Minerva despite being provided with evidence earlier this year that the company has been buying cattle from devastated Indigenous forest in Paraguay.

The increase in investments – in Santander’s case more than a doubling of support – has occurred since March this year, despite us informing them in January of the problems with the big meat company. The detailed allegations against the company of deforestation and failure to respect indigenous lands rights are contained in our Cash, Cattle and the Gran Chaco report.

Since publishing the report, Minerva have confirmed to us that they have indeed been purchasing from Caucasian SA. This rancher has previously been accused of illegally deforesting the equivalent of 5,000 football pitches worth of Indigenous land in Paraguay in order to graze cattle.

Financial institutions must now call on Minerva to drop the rancher Caucasian SA and make reparations to the Indigenous group affected, the Ayoreo people. Any profits they have made on such investments should also contribute to such reparations. These institutions should make any future investments in Minerva contingent on the company developing a supplier policy that recognises Indigenous land tenure and rights. They should also impress on Minerva the need to carry out enhanced due diligence on suppliers across all jurisdictions to ensure that they have engaged in free, prior and informed consent with local communities.

“For years, unethical ranchers in Paraguay have destroyed Ayoreo Totobiegosode Indigenous lands in the [Patrimonio Natural y Cultural Ayoreo Totobiegosode] PNCAT, despite having precautionary measures from the Inter-American Commission on Human Rights,” says Taguide Picanerai, a young Indigenous man from the community.

"We have a message for the big banks that finance Minerva: tell them to stop sourcing cattle raised on deforested land in our ancestral home. No more deforestation on Indigenous lands!”

Financing the Chaco’s destruction

We analysed new financial data available in June this year. Santander’s total investment in Minerva now stands at $1.76 million, more than double the $770,000 they had invested only a few months ago when we initially contacted them with our findings in “Cash, Cattle and the Gran Chaco”.

This seems to fly in the face of a recent announcement by Santander that claims the company is undertaking an impact assessment of how their loan portfolio relates to biodiversity loss. Santander was named in the report as having supported the issuing of a $1.4 billion bond sale to Minerva in March 2021.

BlackRock’s total investment now stands at $5.11 million – up from the $4.78 million as stated in the report. Santander’s response to these allegations can be found at the bottom of this article. BlackRock did not comment when contacted by Global Witness regarding their increased investment in Minerva.

Clearly, new laws are needed to compel financial leaders to carry out proper due diligence when presented with credible, publicly available evidence of deforestation.

Minerva’s denial and our response

Minerva responded to our request for comment when we contacted them regarding the original claims we made in 'Cash, Cattle and the Gran Chaco'. Our investigation and subsequent communication with Minerva found new evidence supporting allegations concerning the company’s sourcing from two unethical ranchers. The first is the aforementioned Caucasian SA, a rancher accused of illegal deforestation in Ayoreo lands, including beyond the Paraguayan forest ministry’s cut-off date of 2018 for no new conversion. Earthsight accused Minerva of buying cattle from Caucasian in their 2020 report, Grand Theft Chaco.

The second is Yaguarete Pora, a rancher with a long history of deforestation on Ayoreo indigenous land in northern Paraguay.

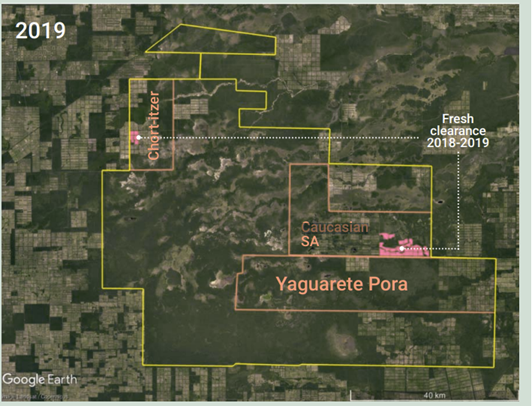

These ranchers and their overlap with indigenous territory and satellite evidence of deforestation are shown in the map below.

The Ayoreo Totobiegosode are South America’s only known remaining partially uncontacted tribe outside of the Amazon. In 2021, an estimated 150 members of the Ayoreo still remained in voluntary isolation. They are fighting to maintain their ancient territory and way of life against farmers – such as those involved in this case - missionaries and the Paraguayan government's failures to defend their land. They live in small communities, hunt in the forest and cultivate melons, beans and squash. Many have been forced to enter into contact with the outside and change their way of life due to deforestation and encroachment on their lands. Others have been forced to work as labourers on ranches that have emerged in their territory.

Their treatment is not only an abuse of their rights, but it also undermines their own and global efforts to protect nature. Indigenous peoples of Latin America are by far the best guardians of the regions’ forests, according to a UN report, with deforestation rates up to 50% lower in their territories than elsewhere.

You can see Minerva’s full response here.

The new admission – buying cattle grazed on indigenous land – Caucasian SA

We had evidence of Minerva’s alleged supplier relationship with Caucasian up to 2020 but for the first time the meatpacking giant has admitted that they buy from Caucasian. Their communication with us now shows that they continue to source from the rancher in 2023.

Minerva sent us a map which they say shows that Caucasian SA’s ranchers didn’t overlap with Ayoreo Indigenous recognised land. However, their map is based on data taken from the official Paraguayan Catastro – which only includes officially titled or “registered” land.

Yet, deforestation of officially titled lands was never the complaint made by either Global Witness or Earthsight, an NGO that has also reported on this matter. Our references to Indigenous land refer to the Patrimonio Natural y Cultural Ayoreo Totobiegosode (PNCAT). The government recognises the PNCAT as official Indigenous land, but it has not had the funds or institutional strength to carry out the legal procedures necessary to officially title it. PNCAT was recognised by the Paraguayan state in 2001 and designated a protected area by the Inter American Commission on Human Rights (CIDH) in February 2016. Minerva, a huge meatpacking firm operating in a sensitive area, should abide by these rulings.

The map sent by Minerva confirms that the company does indeed buy from a supplier who graze cattle within PNCAT land. It is also a damming indictment of its ESG function that, despite the available evidence, they have not identified that Caucasian SA had deforested Indigenous land within the PNCAT area - or have chosen to ignore this fact.

The demonstrates an inadequate commitment to respect customary rights to land, resources and territory as well as an inadequate commitment to testing free, prior and informed consent. This finding is sadly aligned with its low scores in the latest iteration of the Forest 500 report.

Minerva told us: "In relation to both Est. San Miguel ranch and Est. Augusta ranch, which belongs to Caucasian S.A., we inform that neither ranch’s maps overlap into PNCAT lands or environmental protection areas. Therefore, the ranches are in compliance with Minerva Foods cattle purchase criteria. As seen below, both ranches’ perimeter is registered in SNC’s database (“Sistema Nacional de Catastro”)."

Sadly, the issue of titling is not only applicable to Paraguay. Only a small percentage of Indigenous land worldwide is officially “titled” or registered in national land registries. It doesn’t mean that the land doesn’t belong to the peoples who have been living there for many generations under customary systems.

The Yaguarete Pora ranch. Is someone lying to the UN or to us?

Minerva denies purchasing from Yaguarete Pora, saying: “the aforementioned provider is not registered in the Minerva Foods database, and there were never purchases of the referred rancher.”

However, this denial flies in the face of what Yaguarete Pora itself has said. In 2021, they stated in a report submitted to the UN Global Compact that the company had sold products to Athena Foods in 2021, a subsidiary wholly owned by Minerva. We asked Minerva whether they would be taking action against Yaguarete Pora if these claims to the UN were false, but we received no response. There’s also no way to rule out that Yaguarete Pora’s cattle enters Minerva’s supply chain indirectly; Minerva’s supplier monitoring in Paraguay currently only covers their direct suppliers.

The urgent need for transparency

This isn’t the first time that Minerva have denied our allegations of sourcing from suppliers linked to deforestation. We’re happy once more to stand behind our research.

Of course, meatpackers could avoid this back and forth by openly listing their suppliers in all jurisdictions. For years, we’ve called on big agribusinesses to publish full, accessible and publicly available data on their supply chains – including all direct and indirect suppliers.

None of the “big three” Brazilian meatpackers – Minerva, JBS and Marfrig – currently share this information. None conduct full supply chain monitoring which includes all indirect suppliers.

These companies will face significant challenges when the EU’s new deforestation law enters into force this year. To export to the EU, their direct and indirect supply chains cannot be associated with deforestation that took place after 31 December 2020. A similar law known as the FOREST Act has been proposed in the US.

The banks named in our report – BNP Paribas, Santander, Bank of America, HSBC, JP Morgan, BlackRock and Vanguard, and those invested in JBS and Marfrig – have significant leverage on companies and should use their influence to call for the meatpackers to make their supplier lists open to public scrutiny.

This information is crucial to understanding their client’s exposure to deforestation and therefore the level of risk associated with financing them.

Patchy progress shows new financial due diligence laws are needed

Some financial institutions are waking up to the climate, human rights and regulatory risks of backing deforesting businesses, but progress is extremely patchy.

For example, in late 2022, the Dutch pension giant ABP divested at least $13.7 million from Minerva and stopped backing Marfrig on sustainability grounds. Yet ABP still had $29 million in shares and $92 million in JBS bonds on its books at the end of last year, despite that company’s devastatingly bad track record of deforestation in Brazil.

Financial institutions should not be able to cherry-pick when to take a stance on sustainability. New laws are needed to stop the financing of deforestation by agri-business. Such proposals are gaining traction in the UK and EU. In its recent deforestation regulation, the EU has committed to explore whether to extend mandatory due diligence to financial institutions, and in the UK, the House of Lords have voted in favour of a new law which would force UK banks and asset managers to carry out checks on clients operating in forest-risk sectors.

It’s vital that the financial flows contributing directly and indirectly to deforestation are stopped.