Introduction

- The destruction of the world’s rainforest fuels the global climate emergency and comes at a devastating cost for forest communities, who defend and depend on them. Through their backing of agribusiness, financial institutions have bankrolled and profited from this destruction.

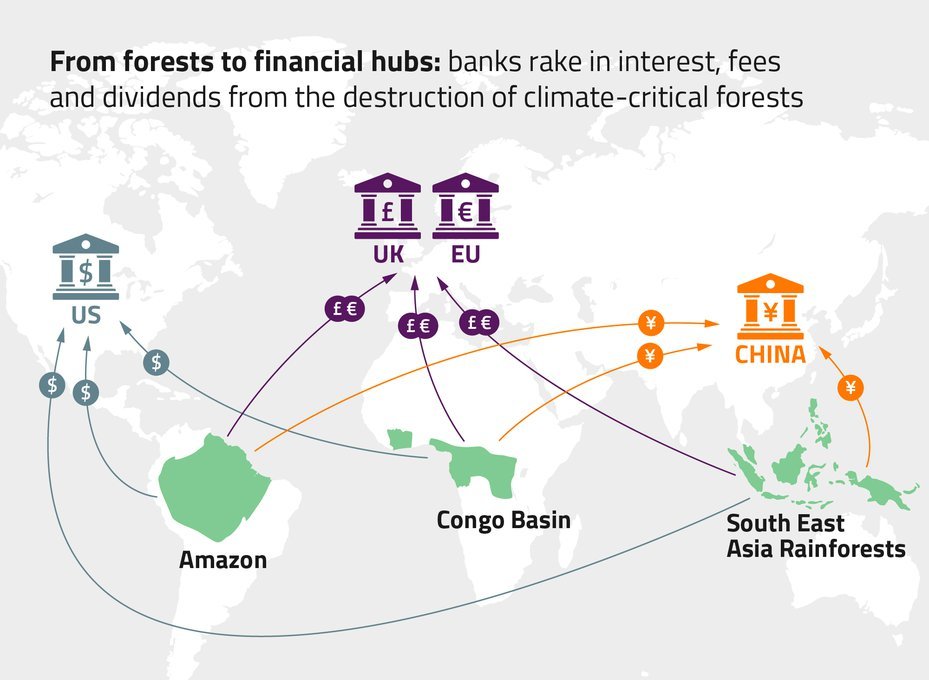

- Banks and asset managers based in the EU, UK, US and China have made deals worth $157 billion with firms accused of destroying tropical forest in Brazil, Southeast Asia and Africa since the Paris Climate Agreement, our investigation has found.

- These financial institutions have netted $1.74 billion in interest, dividends and fees from financing the parts of agribusinesses groups that carry the highest deforestation risk – primarily soy, beef, palm oil and pulp and paper – Global Witness estimates.

- As governments, shareholders and the public start to see profits made on the back of environmental and human rights abuses as illegitimate, these vast sums could become liabilities for banks. The first known case of a bank returning profits from a problematic deal has already taken place.

- Financial giants who have repeatedly profited from these deals include HSBC, Deutsche Bank, JPMorgan, BNP Paribas, Rabobank and Bank of China.

- The US bank JPMorgan has made deals worth an estimated $9.38 billion with firms accused of deforestation, making it the biggest deforestation lender in the US, EU, UK and China, according to our analysis.

- At the heart of the problem is a failure of voluntary commitments and a lack of accountability, which means banks can make problematic deals over and over again. Communities and NGOs are testing new legal boundaries to try to hold financiers to account. However, governments in major financial centres, including the EU, UK, US and China, need to effectively regulate financial institutions and companies to end their complicity in deforestation and their ability to profit from it.

Deforestation Dividends

Rainforests such as the Amazon play a crucial role in regulating the world’s climate and storing carbon, but intact patches such as this one in Acre state, Brazil, are dwindling fast. Lalo de Almeida / Panos / Global Witness

Rainforest loss has devastating consequences for the climate, for forest-dwelling people and for biodiversity.

Demand for land on which to produce palm oil, soy, rubber, beef and leather in the Amazon, Southeast Asia and Central Africa helped drive an estimated 23 million hectares of tropical forest loss between 2016 and 2020 – an area nearly the size of the United Kingdom.

Who profits from the destruction of these climate-critical ecosystems? And just how much money is being made from it?

A 2019 Global Witness report found more than 300 banks and investors had provided $44 billion of backing to six of the world’s worst deforesters over six years.

Our latest investigation reveals just how much cash banks such as HSBC, BNP Paribas and JPMorgan Chase & Co (JPMorgan) could have raked in from deforestation-linked deals.

Swathes of land

Finance is the crucial component agribusinesses rely on for their ever-expanding destruction of the world’s forest.

Without this backing, they could not buy vast swathes of land and machinery for cattle rearing or crop planting. Nor could traders buy and sell these products or ship them overseas.

While many banks have made efforts to burnish their green credentials, their commitment can only truly be judged by where they choose to put their money. Currently, banks face few if any consequences for their lending and investment to firms accused of deforestation.

A crunch point in global financial sector accountability has been reached. In 2020, the European Parliament called for a new deforestation due diligence law to apply to finance houses as well as agribusinesses’ supply chains.

In the UK, parliamentarians from across the political spectrum have supported calls for similar regulation of supply chains to cover financiers, echoing recommendations by the government-appointed Global Resource Initiative taskforce.

In China, the revision of laws governing commercial banks is seen as a chance to institute stronger forest safeguards.

The proposed Targeting Environmental and Climate Recklessness Act (TECRA) in the US, a marker bill intended to stimulate debate, would restrict access to the US financial system for environmental culprits in the same way that currently applies to firms accused of cybercrime, human rights abuses, corruption and wildlife trafficking.

High risk sector

More than two-thirds of tropical forest that is cleared for pasture or cropland is converted illegally, facilitated by corruption or poor enforcement of local laws, according to a May 2021 Forest Trends study.

Agribusiness is also a high-risk sector for the killing of land and environmental defenders and for egregious abuses of Indigenous rights.

Moreover, biodiversity and viral disease experts have singled out forest destruction as a risk factor for future pandemics.

Despite this, deals with agribusinesses involved in deforestation continue apace. These apparent due diligence failures suggest banks are either failing to conduct proper checks or knowingly providing cash to companies behind deforestation.

A girl carries Brazil nuts across a burnt tree in the southern part of the Amazonian state of Pará, Brazil, where cattle ranching is driving soaring deforestation levels. Dado Galdieri / Bloomberg via Getty

Growing liability

As governments start to see profits made on the back of environmental and human rights abuses as illegitimate, these vast sums could become liabilities for banks.

The first known case of a bank agreeing to return profits from a problematic deal took place in 2020. Australian bank ANZ said it would give land-grabbing victims the profits it had made from an estimated $40 million loan to a sugar company nine years earlier.

Hundreds of Cambodian farming families argued the loan had contributed to the sugar company perpetrating forced evictions, military-backed land seizures, destruction of property and child labour.

We may be approaching a tipping point in financial accountability.

For the first time, this report puts a figure on how much banks and asset managers in the UK, EU, US and China could have made from deals with some of the world’s most notorious agribusinesses linked with forest destruction.

What we did

The starting point for our analysis was a publicly available list of over 300 companies involved in beef, soy, palm oil, pulp and paper, rubber and timber supply chains.

According to Forests and Finance, a database run by a coalition of campaigning organisations, each of the firms listed are active in commodity sectors – such as palm oil – that impact natural tropical forests and the communities that rely on them in Southeast Asia, Central and West Africa, and parts of South America.

Global Witness

Global Witness chose just 20 of the most harmful and well-established firms from this long list, based on the quality and availability of evidence about prior deforestation allegations against them, and on the scale of financing they received over five years.[1]

We commissioned Dutch not-for-profit financial analysts Profundo to provide data on more than 70,000 deals struck between these 20 agribusinesses and all financiers headquartered in the EU, UK, US and China between 2016 and 2020.

Details of corporate loans, credit facilities, underwriting services and investments in shares and bonds were obtained from company reports and financial databases.

Based on the best available data, we developed a methodology for estimating how much income banks and asset managers could have made from these deals (see Methodology section for details).

Each agribusiness generated between $1m and $318m in deforestation-adjusted interest, fees and dividends for banks and asset managers between 2016 and 2020, our estimates suggest.

The firms range from Hong Kong-based commodity trader Noble Group, which held controversial palm oil investments until 2019, to soy giant SLC Agricola, which has been accused of clearing 30,000 hectares of forest and native vegetation in Brazil’s Cerrado between 2011 and 2017.

Each financing deal with an agribusiness should have raised major red flags for bank compliance teams researching deforestation and associated human rights abuses.

Deutsche Bank employees pose with a spade during a volunteering project to plant trees in Germany. Meanwhile, the bank has ploughed $4.5 billion over the past five years into some of the world’s worst deforesters. Deutsche Bank, April 2020

Nominee investments: Who profits?

It should be noted that banks and asset managers often hold bonds and shares on behalf of third-party investors, as well as on their own behalf.

The bank or asset manager will normally gain from the transaction taking place, earning a percentage of the invested value or a fee.

But not all of the income will be retained by the bank – some of the income associated with such deals will go to the ultimate owner of the bonds and shares rather than to the bank.

Nevertheless, holding shares in a controversial company on behalf of a third party does not entirely absolve a bank of responsibility for ethical risks.

In August 2021, the UN Office for the High Commissioner on Human Rights (OHCHR) issued legal advice saying that financial institutions are still responsible under the UN Guiding Principles on Business and Human Rights for any abuses committed by companies in which they are nominee shareholders.

Climate commitments

While this report gives total investment figures as they appear in public financial databases, we have adjusted revenues from these deals downwards to reflect the proportion of each agribusiness group’s focus on the trading or production of beef, palm oil, pulp, soy and rubber.

The relevant proportions were taken from estimates – called "segment adjusters" – provided by Forests and Finance.

These proportions suggest how much of a given investment could reasonably be expected to have financed the production or trade of a forest-risk commodity.

Similarly, these segment adjusters allow us to estimate the proportion of dividends, interest and fees made at the expense of forests and forest communities.

Although the harms caused by deforestation far exceed the revenue made from it, this figure is key to understanding the scale of the debts owed to the world’s forest communities by the financial sector.

Banks’ climate commitments must be weighed against what happens to the proceeds made from deals that should never have been made. As long as banks are accruing and keeping hold of these illegitimate gains, they will face a backlash for their contribution to forest destruction.

What we found

Financial institutions made an estimated $1.74 billion in deforestation-adjusted proceeds from deals with some of the world’s most harmful deforesters in the five years following the Paris Climate Agreement’s adoption in December 2015, our analysis suggests.

We estimate the total value of the deals with these deforesters at $157 billion.

Lenders based in the EU’s 27 countries have raked in an estimated $455 million (€401 million) in deforestation-adjusted proceeds on around $34.7 billion worth of deals with top deforesters since 2016.

Deal-making in the EU was dominated by big banks from the Netherlands, France, Spain, Germany and Italy.

British banks and asset managers, meanwhile, provided an estimated $16.6 billion, making an estimated $192 million (£147 million) from deforestation-linked financing along the way. This makes the UK the third largest investor country for the 20 deforesters we analysed, behind China and the United States.

Financial institutions based in European regions, including EU countries and the UK, raked in more revenue from investing in top deforesters than the US or China. They made a combined $646 million in deforestation-adjusted revenues.

Our data covers the period before the UK left the EU.

Deforestation lending patterns by region

Estimated deforestation-adjusted proceeds from deals with deforesters, broken down by financial institution and region. Data source: Profundo/Global Witness

The figures on this graphic are indicative estimates as it is impossible to know exactly how much of any given sum of financing, if any, directly funded deforestation, nor how profitable the deals were. By publishing the data in the above graphic, we make no claim that all banks named knowingly finance rainforest destruction or are guilty of any specific wrongdoing.

We wrote to the financial institutions that we estimate made over $20 million in deforestation-linked income (2016-2020). Their responses can be read in the Responses section of this report.

Chinese financiers raked in an estimated $554 million in deforestation-adjusted proceeds over the same period, and big commercial banking names dominate these deals.

Deforestation financing in the US is more dispersed between small investors, while large asset managers such as BlackRock play a more important role. American financial institutions made an estimated $538 million.

All regional revenue figures have been adjusted downwards to account for the portion of investments likely to have gone into forest-risk commodities.

Blackrock told Global Witness it has had “multi-year, in-depth discussions with [the Brazilian meatpacker] JBS,” in which it is a minority shareholder, about its risk management processes and commitments to deforestation-free supply chains.

The asset manager noted it does not provide direct financing or lending facilities to individual companies and does not control the strategic decision-making of businesses in which it is a minority shareholder.

It said 90% of its equity holdings are through index funds or Exchange Traded Funds in which clients choose where to allocate their assets.

Broken pledges

We focus on HSBC, BNP Paribas, Deutsche Bank, Rabobank, JPMorgan and Bank of China, six leading banks responsible for striking more than 5,000 of the 71,000 deals scrutinised.

These banks appear to be among the leaders in deforestation financing across the jurisdictions we look at and are household names for people living across these regions.

Our data suggests that deal-making with deforesters has continued apace since the start of 2016, despite most of these banks claiming to align investments with the goals of the Paris Climate Agreement and screen clients to curb impacts on forests and biodiversity.

This shows the failure of voluntary policies and the urgent need for action by governments to curb the financing of forest destruction before it’s too late.

Frequency of financing and investment deals involving selected banks and top deforesters (2016–2020)

Each line represents one deal

Frequency of loan, credit-facility, shareholding and bondholding deals struck between six focal banks and top deforesters. Some data for 2020 was unavailable at the time the dataset was prepared

HSBC: "Together we thrive"

| Deforestation-linked agribusinesses invested in (/20) | 19 |

| Value of deals | $6.85 billion |

| Estimated proceeds (adjusted) | $36.4 million |

| Most lucrative relationship | Olam International |

Estimated deforestation-adjusted proceeds from deals with selected agribusinesses 2016-2020. Data source: Profundo/Global Witness

The British bank HSBC is the UK’s biggest financer of destructive agribusiness and the second largest privately-owned bank in Global Witness’ dataset after JPMorgan, according to our analysis of transactions from the last five years.

It made deals worth an estimated $6.85 billion with some of the world’s worst deforesters – and likely pocketed around $36.4 million in proceeds from the deforestation-risk parts of their clients’ businesses, more than any other British financial institution.

HSBC, whose slogan is "Together We Thrive", made a public commitment to stop financing firms accused of deforestation in 2017.

It has announced it will reduce emissions from its portfolio of customers to net zero by 2050 and has been awarded “World’s Best Bank for Sustainable Finance” by the specialist publication Euromoney.

Yet the reality of HSBC’s business practices falls far short of these lofty claims.

Its investments account for more than half of all British deforestation financing analysed by Global Witness. And of the total income HSBC is estimated to have received, $20.2 million arrived in the years following its "no deforestation" commitment.

A starker illustration of why voluntary policies and commitments will not keep rainforests standing could scarcely be imagined.

Jardine Matheson: Pillar of the establishment

One of HSBC’s more lucrative financial relationships within our dataset is with the business empire Jardine Matheson, registered in London, Singapore and Bermuda.

Controlled by the Scottish Keswick family, it is the ultimate owner of the luxury Mandarin Oriental chain of hotels and reportedly counts former UK Prime Minister David Cameron among its ex-staff. Its former directors Sir Henry Keswick and Simon Keswick are major donors to the British Conservative party.

The group part-owns Indonesian conglomerate PT Astra International TBK, which grows and processes palm through its subsidiary Astra Agro Lestari (Astra) – and has a less illustrious history. Astra has come under fire for alleged deforestation in Indonesia, a country where around one million hectares of rainforest is cleared every year.

Subsidiaries owned by Jardine Matheson have paid HSBC an estimated $26.8 million in interest, fees and dividends since 2016 in exchange for corporate loans, revolving credit facilities and buying shares.

Once this figure has been revised downwards to account for the proportion of Jardine Matheson’s business focused on palm oil, HSBC’s estimated income from deals with the company is $4.09 million.

These deals should not have been made at all, regardless of the proportion of Jardine Matheson’s overall business dedicated to palm oil.

Up in flames

The company’s track record appears to be shocking. In 2016, around 300 hectares of forest were cleared in two palm oil plantations managed by Astra in cooperation with concession owners, according to satellite imagery analysed by the Dutch NGO Aidenvironment.

Jardine said no High Conservation Value or High Carbon Stock forest was cleared in palm oil plantations managed by Astra since 2015. It said it ended talks to acquire the two plantations in 2017.

Astra was also accused of poor fire prevention and mitigation techniques by Aidenvironment, which assessed the causes of devastating Indonesian forest fires.

Countrywide fires were responsible for around 100,000 deaths, according to a study by Harvard academics.

Aidenvironment’s report found there were 677 fire “hotspots” on Astra’s land concessions in Indonesia from July to October 2015.

Jardine contested this number, saying there had only been 164 hotspots, and explained it had strict protocols in place to prevent and mitigate fires, doing whatever was necessary to control them.

HSBC should also have acted on a succession of allegations of harm to Indonesia’s Indigenous communities – which make up about a quarter of the island country’s population – at the hands of Astra.

The Orang Rimba community in Jambi, Sumatra province, have had their traditional livelihood disrupted by the expansion of PT Sari Aditya Loka 1, a plantation belonging to Astra, on what they say is their ancestral land.

Jardine said this allegation was baseless.

Women from the Orang Rimba tribe gathered with children near their camp in Jambi province, Indonesia. Goh Chai Hin / AFP via Getty Images

Komunitas Konservasi Indonesia, an NGO which has worked with the Orang Rimba for more than two decades, estimated in 2017 that at least 750 community members were living in encampments in a plantation area ultimately belonging to Jardine.

"Life was better before"

“Life was better before [the company cleared the forest],” Maliau, an elderly Orang Rimba mother of nine children, told Human Rights Watch in 2018.

“Women could find many types of food. Some wove mats from leaves and baskets. We made lamps from gum resin. Now we cannot find materials to make these.”

Astra responded to these allegations with details of its education, health and economic support to Orang Rimba groups.

HSBC made an estimated $629,000 in relation to Jardine from revolving credit facilities and shareholdings in 2019 and 2020 after these allegations were made, Global Witness estimates.

As recently as 2020, Orang Rimba community members accused security guards in Jardine’s Sari Aditya Loka plantation of beating them when they tried to collect palm oil fruit to eat, according to interviews conducted by tribal rights organisation Survival.

The community claims the plantation was developed on its ancestral land, which Jardine denies.

Their dependence on palm oil fruit has intensified as coronavirus forced the closure of markets where they would usually sell wild boar.

Jardine told Global Witness that Astra had investigated the allegations and found them to be baseless. Orang Rimba communities were treated with utmost respect, a company spokesperson said.

They went on to say that all parties involved have agreed the reports of security guard beatings were a misunderstanding, and a reconciliation process had taken place.

The company said: “AAL has not been responsible for any deforestation since the introduction of its Sustainability policy in 2015, so there is no question of the company profiting from deforestation.

"Furthermore, AAL’s activities are governed by Indonesian laws, with which the company fully complies … The business practices of the Jardine Matheson Group comply with the standards required by the rigorous lending policies of HSBC and its other lenders.”

HSBC's Agricultural Commodities Policy states it will not provide financial services to customers involved directly in or sourcing from suppliers involved in illegal operations, deforestation of high conservation value areas and exploitation of people or communities.

HSBC said: “Where customers do not address credible grievances or recognise HSBC’s concerns, or continue to operate in a manner inconsistent with our Sustainability Risk policies, we exit such customer relationships.”

It said the number of clients in the palm oil sector which it provided banking services to had more than halved since 2014.

The island of Sumatra in Indonesia is the only place where tigers, rhinos, orangutans and elephants live together in the wild, according to the WWF. Sandy Brooks / Getty

JBS, Marfrig and Minerva

Beef giants complicit in the destruction of vast swathes of rainforest on the other side of the world have also helped line HSBC’s pockets.

Global Witness has previously shown that Brazilian agribusinesses JBS, Marfrig and Minerva are linked to tens of thousands of hectares of deforestation in the Brazilian Amazon’s Para state, with hundreds of the ranches they buy from directly involved in illegal forest clearance.

JBS said at the time that Global Witness’ analysis was flawed because it relied on monitoring tools that the company itself was not able to use and which diverged from Brazilian national monitoring policy.

Minerva and Marfrig also contested Global Witness’ findings.

An estimated $5.1 million was made from supporting beef trading and producing activities at these three firms since 2016. These earnings are primarily fees for underwriting bond issuances, where a bank provides a guarantee for a firm seeking to raise money on international bond markets.

These relationships with Brazilian beef companies appear to be in breach of HSBC’s agricultural commodities policy, which states that it will not knowingly provide financial services to customers responsible for deforestation, or source from suppliers who are.

HSBC told Global Witness it recognised requiring indirect customer suppliers to meet requirements on deforestation and human rights would provide the most protection but that traceability gaps made this difficult.

It said it engages with customers to promote sustainability and ends its relationship with them if concerns go unaddressed.

HSBC has been linked with several controversial agribusinesses and has been involved in deals with top deforesters worth an estimated $6.85 billion since 2016. Contributor via Getty / Bloomberg

Leaked report

There are further warning signs that the bank’s public pronouncements do not equate to action on the climate emergency. HSBC analysts discussed the poor practices of Brazilian meatpacker JBS on deforestation last year, according to a research report obtained by the Bureau of Investigative Journalism.

The bank’s research from August 2020 highlighted a report that JBS had moved cattle from a ranch accused of illegal deforestation in the Brazilian rainforest to a farm from which deforestation could not be traced.

Despite this, the HSBC report advised investors to obtain holdings in JBS. HSBC made an estimated $47,000 in deforestation-adjusted dividends from $2.62 million worth of shareholdings in the meat-packer’s beef business during 2020, Global Witness analysis suggests.

Global Witness previously found that HSBC underwrote almost $1 billion in bonds for beef-packer Minerva between 2013 and 2017, during which period it failed to monitor its beef suppliers for deforestation.

While its 2017 agricultural commodities policy stated that new palm oil clients must consent to being named by HSBC as a customer, the document failed to standardise this commitment for other forest-risk commodities such as beef.

HSBC still has not written this requirement into its sustainability policy.

HSBC told Global Witness in 2020 that it could not comment on specific beef companies.

HSBC has been previously singled out by the NGO BankTrack as most often citing "client confidentiality" as an obstacle to engaging on issues of concern linked to its financing.

HSBC told Global Witness its relationship with most of the agribusinesses was either not linked to forestry, palm oil or cattle, or that the relationship had ended or was in the process of ending.

The bank said in some cases, it had only indirect relationships with the agribusinesses as nominal manager of its shares on behalf of a customer, meaning it had no beneficial interest in or direct influence over the underlying agribusiness.

HSBC said that its management of assets for other financial institutions involved investing in indexes, the make-up of which could not be changed.

Its asset management sustainability policy on biodiversity includes a commitment to encourage investee companies to manage forests sustainably and exclude companies from its investments in certain cases where biodiversity targets are not being met.

It said that in some cases, its name appeared on company share registers because it is holding these on a custodial basis, not because it owns them.

HSBC may be the UK’s biggest financier of destructive agribusiness, according to our estimates, but it is far from alone.

Barclays, Standard Chartered and NatWest, the next biggest British banks by investment size in our data, bankrolled these firms by an estimated $3.66 billion, $2.94 billion and $568 million respectively.

Investment manager Schroders and pension fund Prudential also appear among the culprits. Their responses to the report can be read in the annex to this report.

BNP Paribas: Do green pledges stand up to scrutiny?

| Deforestation-linked agribusinesses invested in (/20) | 19 |

| Value of deals | $5.71 billion |

| Estimated proceeds (adjusted) | $37.3 million |

| Most lucrative relationship | Cargill |

Estimated deforestation-adjusted proceeds from deals with selected agribusinesses 2016-2020. Data source: Profundo/Global Witness

France’s largest bank came through the COVID-19 pandemic relatively unscathed in 2021, increasing its loans to crisis-hit corporations and cementing its place as the eurozone’s top lender.

Once seen simply as the go-to bank for the French establishment, the bank is nowadays said to hold more global aspirations, aiming to “become the dominant force in European investment banking ... and [to take] on Wall Street,” according to the Financial Times.

Alongside its commercial success, the bank has tried to burnish its green credentials since the start of 2021 by joining the Net Zero Banking Alliance.

It has also announced a new policy aimed at curbing its impact on the forests of the Amazon and Cerrado, though French environmentalists have criticised it for lack of ambition in not aiming to achieve zero-deforestation before 2025.

But the bank’s coffers over recent years have been boosted by money made from agribusiness clients accused of deforestation and land-grabbing in some of the world’s most threatened ecosystems.

Global Witness’ analysis now suggests the bank could have earned over $37.3 million in income from deals made since 2016 with agribusinesses responsible for deforestation.

This figure reflects the likely revenue relative to the scale of clients’ involvement in deforestation-linked commodities such as palm oil or soy.

France’s biggest bank has made seemingly lucrative deals with palm oil and soy traders. NurPhoto / Getty

Cargill: Biggest crop trader on Earth

The figure includes proceeds from a lucrative relationship with the commodities giant Cargill, the second largest privately held company in the US and the world’s biggest crop trader.

It is estimated Cargill supplied 2.6 million tonnes of Brazilian soy to the EU in 2018.

The bulk of this soy comes from the Cerrado, one of the most ecologically threatened regions of Brazil and home to 5% of the world’s biodiversity, including jaguars, giant armadillos and tapirs.

Expansion of soy production is thought to have led to the destruction of 17,000km2 of forest and other native vegetation in the Cerrado between 2006 and 2017.

As the largest trader of Brazilian soy, Cargill appears to have played a role in this devastation.

The company does not currently map all the farms where its soy is grown nor monitor them for deforestation, although it says it does not source from illegally deforested areas and that it is working to improve traceability in its soy supply chain.

When approached by Global Witness for comment, Cargill said it had completed a process of mapping its direct suppliers in Brazil's Matopiba region and aimed to map its direct suppliers across the whole Cerrado by the end of 2021.

"Evidence of irregularities"

In 2018, Cargill was fined close to US$1 million by Brazilian environmental agency Ibama for sourcing 600 tonnes of soy from illegally deforested areas in the Cerrado.

Ibama’s investigation found that the advance purchase of grain had financed the illegal land clearance.

Cargill told Global Witness that it had not paid these fines and was contesting them in detail with Ibama, saying: “Cargill did not purchase deforested soybeans.”

An official audit of Cargill’s supply chain in 2019 found over 50% of Cargill’s soy purchases in the Amazon state of Pará had "evidence of irregularities."

The audit was part of the "Green Grain Protocol", an agreement between soy producers, traders and government bodies, which aims to stamp out financing or sourcing of soy associated with illegal deforestation in the Amazon state of Pará.

Investigations by NGOs have also raised alarm bells. A 2020 exposé by Greenpeace and the Bureau of Investigative Journalism found 800 km2 of deforestation and more than 12,000 recorded fires had occurred since 2015 on land used or owned by a handful of Cargill’s soya suppliers in the Cerrado.

It has also been reported that alleged Cargill soy suppliers have been involved in occupying and blocking the demarcation of lands claimed by the Munduruku indigenous people in Planalto Santareno.

The Munduruku have been the “target of constant threats from farmers and land-grabbers” as their traditional lands have come under increasing pressure from agribusiness, according to a report by the Indigenous Peoples’ organisation Articulacao dos Povos Indigenas do Brasil and NGO Amazon Watch.

Despite these multiple red flags, the relationship between BNP Paribas and Cargill has been a lucrative one for the bank, which has provided Cargill with credit facilities and bond underwriting worth almost $4 billion in the last five years.

According to Global Witness’ data analysis, the most deforestation-linked parts of Cargill’s trading empire – chiefly soy and palm oil – could have netted the bank around $16 million in proceeds since 2016.

Forest fire in the Amazon, Mato Grosso state, Brazil, 2021. Greenpeace

Wilmar: "Dirtiest trader in the world"

Evidence of BNP Paribas benefiting from the destruction of the world’s forests does not end there.

The bank has a longstanding relationship with Wilmar, dubbed “the biggest and dirtiest palm oil trader in the world” by Greenpeace.

A 2018 report by Greenpeace alleged Wilmar was sourcing palm oil from 18 different companies responsible for deforestation.

When contacted by Global Witness, Wilmar said it had strengthened its "no-deforestation" policy since Greenpeace’s allegations were published and that controversial suppliers flagged by Greenpeace had been dealt with through the company’s grievance system.

In 2020, meanwhile, Wilmar walked away from a key industry initiative aimed at identifying forest areas to be protected from agricultural conversion known as the High Carbon Stock Approach (HCSA).

WWF Indonesia criticised the move, saying: “the timing of [Wilmar’s] resignation has been calculated to avoid [their] responsibilities.”

Wilmar told Global Witness that it remained committed to using the High Carbon Stock Approach in its operations, despite its resignation from the HCSA steering group.

Between 2016 and 2020, the bank provided almost $300 million in credit to the broader Wilmar empire. When adjusted to reflect the proportion of Wilmar’s business that is linked to palm oil or other forest-risk commodities, these deals could have brought in $6.04 million for BNP Paribas.

A wild baby orangutan, Sumatra, 2018. Palm oil development in south-east Asia has had a devastating effect on Orangutan habitats. Rita Enes / iStock

Olam: Flattened thousands of hectares

Another money-spinner for BNP Paribas has been its relationship with Olam International, which describes itself as “the world’s largest farmer.”

Olam is accused of razing 40,000 hectares of rainforest in Gabon between 2012 and 2017 to create rubber and palm oil plantations, prompting the Forest Stewardship Council (FSC) (the timber industry’s certification body) to launch an investigation last year that remains ongoing.

Olam said it strongly disagreed that its forest clearance was irresponsible or breached FSC rules and said its plantations had been developed on degraded or “secondary” forest as well as grassland.

The company promised to stop cutting down Gabonese forest in 2017 and said it has permanently protected more than half of the high-value conservation land in its Gabonese oil palm concession.

But a 2020 study led by the Gabonese NGO Muyissi Environnement reported that local people were still suffering from the loss of their land rights.

One villager told the NGO’s research team: “If a security agent of Olam finds you carrying something you hunted or tools used for fishing, they will confiscate the meat or expel us from the places we traditionally use to fish.”

Olam has dismissed these reports as “inaccurate and false” and said it is committed to obtaining Free, Prior and Informed Consent from communities for agricultural developments and that it invests in projects to improve local education, healthcare and access to water.

It said its plantations carefully balance Gabon’s need for economic development with the imperative to conserve the country’s forests.

Olam’s palm oil trading business has continued to attract controversy. In 2018, it was accused of sourcing palm oil from businesses previously accused of deforestation in Indonesia such as Bumitama, Jhonlin and Peputra.

Olam told Global Witness it had not sourced from these firms directly since 2017 and it requires suppliers to meet its no deforestation, no peat, no fire and no exploitation (NDPE) policy.

The deforestation-risk elements of Olam’s business could have generated over $7 million in proceeds for BNP Paribas since 2016, our analysis suggests, mostly through providing revolving credit facilities.

Given the concerns outlined above, the bank should not have done any business with Olam at all.

Other BNP clients with known links to deforestation include Brazilian beef giants Marfrig and Minerva, whose business has generated an estimated income of over $1 million from forest-risk commodities according to Global Witness analysis.

In 2020, a Global Witness report raised concerns about BNP Paribas and other French banks’ efforts to comply with France’s Duty of Vigilance Law, which requires French companies to identify and prevent human rights abuses and environmental harms in their operations.

When contacted by Global Witness, BNP Paribas said: “We can only regret and deny the assumption ... that BNP Paribas would profit from financing activities that destroy the world’s rainforests.”

A spokesperson added that the bank’s policies on palm oil and other deforestation-linked sectors are seen as “among the best practices among banks today,” pointing out that in 2021, Global Canopy’s Forest 500 ranked BNP Paribas in the top five out of 150 financial institutions assessed in terms of sustainable financing policies.

The bank went on: “BNP Paribas now only provides financial products or services to [agribusinesses] having a strategy towards zero deforestation in their production and supply chains by 2025.

"... BNP Paribas remains the sole bank to have seriously tackled the issue of deforestation and traceability in the soy and beef supply chains by setting such specific and timed criteria.”

Global financial institutions are funding harmful agribusiness companies and fuelling the destruction of our forests, our homes, our cultures

Profits with impunity or forest debt? How profits made at the expense of forest communities could become legal liabilities

Banks face few expectations of accountability on environmental or human rights issues, but the impunity surrounding deforestation profits is now being challenged in fundamental ways.

Global Witness believes the proceeds detailed in this report – which banks today are likely to see as no-strings-attached revenues – should in future be seen as an accruing “forest debt”.

Banks are likely to face increasing public, governmental and even legal pressure to hand over this money to affected communities.

A debt to the forest

The concept of “ecological debt” was developed by academics and activists in the 1990s as a way of addressing the plundering of natural resources in the Global South by the Global North.

Global Witness is not seeking to put a numerical value on the ecological debt behind each case examined, but rather is estimating how much money has been made from deals to alleged deforesters.

Indigenous and local communities living in rainforests in Brazil, the Congo Basin and Southeast Asia continue to be first affected when land is deforested and suffer disproportionately from retribution attacks when they seek to protect it.

On average, four environmental defenders were killed every week between the adoption of the Paris Climate Agreement in December 2015 and the end of 2020, Global Witness has found.

Many more were targeted with non-lethal violence or criminalised as a result of peaceful protest activities.

Forced evictions

The first known case of a bank returning profits from a problematic deal took place in 2020, when a group of NGOs and hundreds of Cambodian farming families quietly achieved what had once been considered unimaginable.

They reached an agreement with Australia’s second largest bank, ANZ. The bank handed land-grab victims the gross profits it made from a loan to a sugar company, Phnom Penh Sugar.

The NGOs argued the $40 million loan should never have passed the bank’s due diligence checks.

The sugar company was accused of perpetrating forced evictions, military-backed land seizures, destruction of crops and property, arbitrary arrests and widespread use of child labour.

The decision was a result of a complaint first filed in 2014 under the Organisation for Economic Co-Operation and Development’s (OECD) Guidelines for Multinational Enterprises.

It came after six years of concerted campaigning.

The OECD has since issued guidance on the steps that financial institutions should take to do due diligence on environmental and social risks, making future similar cases likely.

ANZ said it “acknowledges its due diligence on the project funded by its loan was inadequate and recognizes the hardships faced by the affected communities.”

It noted that it is not legally liable for the adverse impacts arising from the land use concession and sugarcane project.

In a similar vein, campaign groups filed a case against Dutch bank ING in 2019 through an OECD complaint mechanism.

They argued that by providing successive corporate loans to businesses involved in environmental and human rights abuses, the bank was not only directly linked to harms but actively contributing to them, triggering an obligation to provide redress and remedy to affected communities.

An ongoing case focuses on ING’s successive financing of companies including Noble Group, which was accused of forest destruction.

While the OECD complaints mechanism is non-judicial, complaints can help shape the discussion around future legal frameworks.

The bank stated at the time of the complaint: “At ING, we aim to use our leverage by engaging with our clients to improve their businesses.

"... In total we finance less than 10 clients that earn 10% or more from palm-oil-plantation-related activities.

"More than 85% of those clients currently have a ‘No Deforestation, No Peat, No Exploitations’ policy in place.”

Holding corporates to account

Another test case for financial sector accountability is being brought in Dutch courts by the Civic Council of Popular and Indigenous Organizations of Honduras (COPINH) against FMO, the Dutch Development bank.

The case seeks to hold the bank accountable for having financed Agua Zarca, a hydroelectric project in Western Honduras on the Gualcarque river, considered sacred to Indigenous Lenca people.

The dam’s builder, the Honduran firm Desarrollos Energeticos SA (Desa) was accused of appropriating land despite strong Lenca opposition and in violation of their right to self-determination.

FMO exited the investment in July 2017 after police arrested a Desa employee the previous year in connection to the murder of environmental defender Berta Cáceres.

One of the firm’s former top executives was found guilty in July 2021 of collaborating on the murder of Cáceres, who had long spoken out against the dam.

The bank said that at the time of the loan it expected the dam project to have a positive impact on the standard of living in Honduras.

After suspending the loan, it commissioned an independent investigation into its actions.

As of July 2020, it was consulting stakeholders on whether to invest in fragile states in future.

The Chinese government has already committed to exploring how lenders could be made liable for environmental harm.

An official policy paper issued in 2016 said the government would study how other countries’ legal systems set requirements on lenders’ environmental liability to clarify China’s own legal position.

Legal action is being taken against the financiers of a pig farm accused of introducing raw sewage into the Han River.

The Chinese NGO Fujian Green Home Environment Friendly Center (known as Fujian Lv Jia Yuan) filed a claim for 38 million yuan (£4.2 million) in damages in 2018 against two Chinese banks and to the pig farm to which they loaned money.

The NGO’s case, which argues the banks are liable for the environmental harm caused, is understood to be ongoing.

Other Chinese banks have received administrative fines for financing companies that failed domestic environmental standards.

New legal horizons

Since 2017, France’s Duty of Vigilance law has required businesses, including banks, to identify, mitigate and prevent human rights abuses and environmental harms.

It is understood the law has yet to be used in a bank-related compensation case, but test cases are expected in coming years.

Meanwhile, the Financial Action Task Force, an inter-governmental money laundering and terrorist financing watchdog, has recommended that environmental crime provisions be added to existing legislation tackling white collar crime around the world.

The EU and UK are currently developing legislation to require companies to undertake due diligence on deforestation risk in their supply chains, with pressure from parliamentarians to extend similar requirements to financial institutions.

As pressure builds for more extensive and accessible laws and frameworks, the number of test cases around financial responsibility for environmental harms will continue to rise.

Rainforest covers most of the Brazilian state of Acre, but these areas are increasingly being destroyed by fires used to clear land for cattle ranching and soy farming. Lalo de Almeida / Panos / Global Witness

Rabobank: "Growing a better world together"

| Deforestation-linked agribusinesses invested in (/20) | 8 |

| Value of deals | $3.63 billion |

| Estimated proceeds (adjusted) | $76.2 million |

| Most lucrative relationship | Sinar Mas Group |

Estimated deforestation-adjusted proceeds from deals with selected agribusinesses 2016-2020. Data source: Profundo/Global Witness

Coöperatieve Rabobank UA, (Rabobank), emerged from Dutch farmers’ credit cooperatives in the Netherlands in the 19th century.

Today the Netherlands’ second largest bank, it retains a major focus on the food and agricultural sector, with the self-declared mission of “growing a better world together.”

While Rabobank is keen to promote an image of sustainability, Global Witness analysis of its financial transactions since 2016 suggests that the bank could have earned $76.2 million from deals with clients with proven links to deforestation.

As with previous calculations, this figure has been adjusted to reflect the proportion of clients’ business directly involving production or trade of deforestation-linked commodities such as palm oil.

One particularly profitable relationship Rabobank has is with a sprawling network of companies controlled by Anthoni Salim, Indonesia’s fourth richest man, with a net worth of almost $6 billion.

Salim reportedly owns a 45% stake in Hong Kong-listed company First Pacific and acts as its chairman, as well as being CEO of its subsidiary IndoFood, which controls over 300,000 hectares of Indonesian palm oil plantations.

Salim Group: “Child labour and abuses”

The Salim group of companies is notorious for rainforest destruction. Greenpeace accused the group of clearing over 7,000 hectares between 27 April 2015 and 2 March 2018 in just two of its oil palm plantations in Kalimantan, including protected peatland.

The Salim empire is also reported to be expanding its reach into one of the world’s new deforestation frontiers – the Indonesian-controlled provinces of Papua and West Papua – through alleged ties to companies actively engaged in razing the rainforest.

Two of the firm’s Indonesian subsidiaries were accused in 2016 of using child labour and of other labour abuses, in a complaint filed by NGOs at the Roundtable on Sustainable Palm Oil (RSPO), the industry’s flagship certification scheme.

Indofood subsequently withdrew from the RSPO and its subsidiaries’ memberships were terminated.

Global Witness approached Salim Group companies for comment on these allegations but did not receive a response.

Despite a plethora of troubling reports about the Salim group dating back several years, Rabobank only cut ties with Indofood as a client in 2019, after the firm’s RSPO exit.

The bank could nevertheless have made $8.8 million in income from its loans to the Salim business empire according to our analysis, deals struck while the Salim group was destroying swathes of Indonesian rainforest.

This figure is adjusted to reflect the proportion of the Salim group’s operations that are directly linked to palm oil and other forest-risk commodities.

Forest clearance on an oil palm concession in Indonesia, 2018. Ulet Ifansasti / Greenpeace

Sinar Mas: 30-year history of destruction

Between 2016 and 2020 Rabobank also repeatedly financed the Sinar Mas group, owner of the infamous Asia Pulp and Paper (APP), a company that WWF has described as having “a history of almost 30 years of deforestation, destruction of wildlife habitat, peat drainage and conflicts with local communities.”

In 2018, the FSC took the unusual step of halting its association with APP. This followed reports of its relationship with companies accused of destroying Indonesian rainforest and contributing to disastrous peatland fires in order to feed the paper giant with wood supplies.

APP told Global Witness that it is in discussion with FSC with a view to ending its disassociation, and that “APP has committed to a sustainability roadmap since 2013 and [has] been implementing it for the past 8 years.”

Sinar Mas is also a major player in the palm oil sector through the company Golden Agri Resources (GAR), which Sinar Mas describes as “our agribusiness and food pillar.”

Sinar Mas was heavily criticised in the 2000s for illegal land clearing and the destruction of High Conservation Value forest, prompting Nestlé to drop the company as a supplier.

GAR has since made some moves to clean up its image, including introducing a "no deforestation" policy in 2011.

But controversy has continued to dog the group’s palm oil operations.

A 2019 investigation by Rainforest Action Network reported that GAR bought palm oil from two mills that sourced from a Sumatran plantation inside the Rawa Singkil Wildlife Reserve.

This is a high-priority conservation area and critical wildlife habitat dubbed the “orangutan capital of the world.”

In 2018, Greenpeace reported that GAR was buying from 10 different groups responsible for deforestation.

A spokesperson for GAR told Global Witness that although it “share[s] the same history and values with the Sinar Mas brand,” it is managed independently from Sinar Mas.

They said that GAR has a no deforestation policy and that its goal was “a fully traceable palm oil supply chain,” adding that “at end of 2020, [GAR had] achieved 90% traceability to the plantations.”

Sinar Mas did not respond to a request for comment.

Religious sites bulldozed

A palm oil venture into the West African state of Liberia has also led to a slew of social and environmental allegations being levelled at GAR.

It was the principal investor in Golden Veroleum Liberia (GVL), which reportedly cleared over 15,000 hectares of forest – including chimpanzee habitats – and has been embroiled in numerous land disputes.

In 2016, Global Witness documented that GVL bulldozed religious sites sacred to the Blogbo people in Sinoe County.

GVL was censured by the RSPO in 2018 for failing to obtain the free, prior and informed consent of local communities, and in 2021 an independent HCSA panel upheld a complaint against the company for clearing high value forest and failing to respect community land rights.

GVL told Global Witness that “the allegations on religious sites reported by some members of the Blogbo community has been refuted in writing by other members of the community,” adding that the grievance was being addressed by a remediation process that has reported to the RSPO.

GVL palm oil plantation, Liberia. The expansion of agribusiness plantations, backed by international banks, has taken a heavy toll on forests. Global Witness

All told, this amounts to a lamentable catalogue of abuses linked to the Sinar Mas group. Yet Global Witness analysis of financial data indicates that Rabobank has provided $376 million in loans and credit facilities to subsidiaries of the Sinar Mas group since 2016.

Rabobank could have earned as much as $43.8 million in deforestation-adjusted earnings from these deals.

When contacted by Global Witness, Rabobank said it was “not willing to finance deforestation or land grabs” and had put policies in place to this end.

The bank added that it favours “an engagement approach towards those companies which are our current clients in order to effectively address any [environmental or social] concerns,” although it has exited some relationships when progress was not satisfactory.

A spokesperson for the bank underlined that, while it had a relationship with the Sinar Mas group, Rabobank did not directly finance its paper and pulp subsidiaries nor GVL, the Liberian palm oil project with which the group has been linked.

Deutsche Bank: "The risks of inaction are substantial"

| Deforestation-linked agribusinesses invested in (/20) | 19 |

| Value of deals | $4.50 billion |

| Estimated proceeds (adjusted) | $14.1 million |

| Most lucrative relationship | Cargill |

Estimated deforestation-adjusted proceeds from deals with selected agribusinesses 2016-2020. Data source: Profundo/Global Witness

Deutsche Bank boasts that its employees have planted 300,000 trees across dozens of hectares of land during extensive volunteering hours over the past decade.

On its website and social media, smiling teams of employees plant silver firs, red oaks and sweet chestnuts in a German forest and lower fruit-bearing seedlings into the ground in Maharashtra, India.

Yet Germany’s largest lender has made an estimated $14.1 million in deforestation-adjusted income over the past five years as a result of providing $4.5 billion of financial backing to some of the world’s worst deforesters.

World’s oldest wooded savanna

Two of its most lucrative relationships are with Cargill and SLC Agricola, agribusinesses linked to the destruction of the Brazilian Cerrado, which is described by the conservation organization WWF as the world’s oldest wooded savannah and one of its most biodiverse.

Known as the “upside down forest’’, it stores an estimated 118 tons of carbon per acre, according to the UN, mostly in soil and roots systems deep underground.

More than 730,000 hectares were cleared in 2020, driven primarily by cattle rearing, soy production and land speculation. This equates to wiping out an area larger than Brunei every year.

More than a third of Deutsche Bank’s financing of the 20 deforesters in Global Witness’ analysis went to Cargill.

Last year alone, Cargill may have bought from farming groups on whose land 19,000 hectares of deforestation was found, according to Chain Reaction Research (CRR).

CRR used information from a Brazilian governmental soy subsidy program to identify buying relationships with producers.

Cargill told Global Witness that it “does not and will not supply soy from farmers who clear land illegally or in protected areas.”

The bank made an estimated deforestation-adjusted income of $4.51 million from providing $1.54 billion of financial backing to Cargill, mainly in the form of revolving credit facilities.

SLC Agricola: Repeatedly fined

Deutsche Bank also had an estimated $6.83 million worth of shares in Brazilian soy producer SLC Agricola, which netted an estimated $1.75 million in deforestation-adjusted dividends.

Chain Reaction Research has shown that SLC Agricola cleared more than 30,000 hectares of forest in the Brazilian Cerrado between 2011 and 2017, an area the size of the Maldives.

It cleared a further 1,355 hectares in the same region between March and May 2019.

SLC Agricola said it complies with environmental law and that its activities are monitored by appropriate bodies.

It said: “The opening [clearing] of areas by SLC Agricola has always been done legally, respecting all regulations and with the appropriate licences, and aim to guarantee the production of food, specifically soy and corn, to support the Company’s mission to feed the world in a sustainable and responsible way.”

SLC Agricola has been fined repeatedly since 2007 by the Brazilian federal environment agency Ibama for offences ranging from planting soy in embargoed areas to damaging native forest without prior approval from the relevant authority, Global Witness revealed in 2020.

A company document from December 2020 shows SLC Agricola was planning for the possibility of having to pay at least six outstanding environmental fines totalling R$4.08 million (£565,000).

The company described the likelihood of having to pay the fines as “probable” in the case of one fine worth approximately R$330,000 and “reasonably possible” in the case of the five other fines.

Human rights abuses and land-grabbing

Deutsche Bank also had a strong financial relationship with major Brazilian meat trader JBS Group.

JBS bought cattle from at least 327 ranches in which deforestation occurred between 2017 and 2019 in the Brazilian Amazon rainforest state of Para, sometimes in breach of legal obligations, Global Witness revealed last year.

JBS told Global Witness that in each case it adhered strictly to a cattle supplier monitoring protocol and to its agreement with Brazil’s Federal Prosecution Office.

Further to this, JBS bought cattle from Rafael Saldanha, a rancher accused of human rights abuses, murder and land-grabbing by Brazilian prosecutors, our report showed.

Recent investigations by Global Witness have found that JBS continued to purchase from the same rancher in 2020 and in early 2021, contrary to its voluntary commitments.[2]

JBS said the land-grabbing allegations were thrown out by a court in 2021, and emphasised its purchases from the rancher were compliant with its legal no-deforestation commitments with federal prosecutors.

It did not respond on whether the purchases were compliant with its voluntary commitments, which have higher standards.

Its statement read: “As our detailed technical analysis shows, proper application and consideration of the Federal Prosecution Office Supplier Monitoring Protocol criteria and agreed methodology shows 100% JBS compliance with its terms in the cases outlined.

"We wish to reiterate that the implementation of sustainability policies in complex production chains like that of cattle in Brazil is a huge challenge that can only be overcome, once and for all, through the joint effort and commitment of all stakeholders.”

In 2020 alone, the bank made an estimated $1.55 million in interest and dividends on JBS bonds and shares, once adjusted for the proportion of JBS’ business dedicated to beef.

This is despite Global Witness’ revelation in our 2019 report Money to Burn that Deutsche Bank was among financiers which had provided tens of billions of dollars between 2013 to 2019 to companies destroying the largest rainforest areas in the world.

Cattle in the Brazilian Amazon state of Pará. The expansion of cattle ranching has been a major driver of deforestation. Greenpeace

IOI Group: “Serious environmental destruction”

Deutsche Bank has also benefitted from problematic investments in Southeast Asian palm oil developments.

The bank has made an estimated $505,000 in deforestation-adjusted interest and dividends from bonds and shares in the Malaysian IOI Group over the past five years.

IOI was heavily criticised by Greenpeace in 2016 for buying palm oil from suppliers “linked to serious environmental destruction and human rights abuses.”

IOI told Global Witness this characterisation was an overstatement, as the companies highlighted by Greenpeace were either IOI’s indirect suppliers or, in one case, did not supply IOI from Indonesia, which Greenpeace’s deforestation allegations focused on.

IOI has reduced the deforestation risk within its supply chain since 2016 by improving its due diligence tools as well as the traceability of its palm oil suppliers, it said.

It also said that Deutsche Bank was not one of IOI’s principal financiers.

IOI reportedly owned nearly a third of palm oil producer Bumitama during the period between 2014 and 2018 when Greenpeace alleged that 2,300 hectares of deforestation was carried out in areas to which Bumitama was connected.

Bumitama has previously said any past land clearing that did not adhere to RSPO standards would be compensated under the RSPO’s remediation procedures.

It did not respond to a request for comment from Global Witness.

Falling short

Deutsche Bank’s investment division is seen as critical to the recent turn-around in fortunes of this German household name.

Unusually, until May 2021, its chief executive Christian Sewing was also head of its investment banking arm.

The bank achieved its highest quarterly profit since 2014 in the first three months of 2021 primarily thanks to lucrative deals struck by this investment arm.

In previous years, Deutsche Bank had been loss-making, after a series of fines including a £163 million penalty imposed in 2017 by Britain’s Financial Conduct Authority over money-laundering concerns.

The bank’s renewed strategic focus on investments makes it even more urgent that it clean up its deforestation investment policy.

Deutsche Bank declined to comment on this report when contacted by Global Witness.

It has signed the United Nations’ Principles for Responsible Banking, which commits banks to the Paris Climate Agreement Goals, and has also said it will not finance the destruction of primary forest, High Conservation Value or peatlands, illegal logging, and uncontrolled or illegal use of fire where there is clear and known evidence of any of these harms taking place.

But it stops short of prohibiting the financing of all deforestation, and implies some forest loss would be acceptable if offset through tree-planting.

Its own ESG research recently warned that environmental damage cannot be reversed, that “burned rainforest cannot grow back easily” and that “the risks of inaction are substantial.”

The bank’s environmental team has also acknowledged that a rise in temperature above pre-industrial levels by 3°C would lead to the possible collapse of the Amazon rainforest and the extinction of up to half of the species on earth.

The deals outlined above make a mockery of these fine words. The investment bank’s success story masks gaping holes in its approach to forest preservation. And for all its talk of sustainability, the bank has continued to invest in some of the world’s worst deforesters.

| Deforestation-linked agribusinesses invested in (/20) | 18 |

| Value of deals | $9.38 billion |

| Estimated proceeds (adjusted) | $56.9 million |

| Most lucrative relationship | Itochu |

Estimated deforestation-adjusted proceeds from deals with selected agribusinesses 2016-2020. Data source: Profundo/Global Witness

The US’s largest bank put on a digital event about sustainable investing called “The Amazon rainforest and you” earlier this year.

JPMorgan, an investment bank with around $3 trillion under management, arranged for activist filmmaker Celine Cousteau to speak at the talk.

Her documentary about threatened Indigenous people in the Brazilian rainforest’s Javari valley launched on streaming service Amazon Prime around this time.

Clients who tuned in to the JPMorgan talk heard how soy, palm oil and beef are among the commodities that have accelerated rainforest destruction.

The talk emphasised the need to protect rainforests, echoing Paris Climate Agreement values, which include conservation and enhancement of forests, and which JPMorgan has promised to align its investments with.

But actions speak louder than words.

Global Witness analysis now suggests JPMorgan may have made as much as $56.9 million in deforestation-adjusted earnings from deals worth $9.38 billion with firms that have fuelled rainforest destruction.

This would make it the biggest deforestation financier in the US, EU, UK and China.

JPMorgan is estimated to have received more than a tenth of the $538 million proceeds attributable to US banks and investors.

This regional income figure is based on estimated earnings from providing finance to deforesters, adjusted to account for the proportion of the agribusiness focused on a forest-risk commodity.

An estimated $15.6 million of JPMorgan’s income came from financing palm oil, beef and soy flows linked to Cargill, whose harmful operations – including its ties to deforestation in the Brazilian rainforest and Cerrado woodlands – are examined above.

Global Witness contacted JPMorgan for a response on its alleged deforestation links, but the bank declined to comment.

Genting Group: Gambling with our future

Another lucrative income stream for JPMorgan is the palm oil sector, our analysis suggests. The bank is the largest funder of Genting Group, a casino operator which also trades in Malaysian and Indonesian palm oil.

Genting was thrust into the spotlight in 2015 when the Norwegian Pension Fund, the world’s largest sovereign wealth fund, dropped it from its portfolio because of what it judged the risk of “severe environmental damage” posed by the company’s operations.

It made this decision because it found Genting had cleared close to 40,000 hectares of forest in Indonesian Borneo between 2008 and 2012, according to the chief advisor to its ethics council, Hilde Jervan.

Genting said its Indonesian oil palm plantations were developed on abandoned timber logging concessions that were not classified as forests under Indonesian law.

It added that this helps “land rehabilitation” and the local economy.

Between March 2015 and June 2018, plantation company Permata Sawit Mandiri (PSM) cut down 500 hectares of rainforest inhabited by orangutans in West Kalimantan, Indonesia, according to a Greenpeace investigation.

Genting was a majority owner of this company until September 2017, when it reportedly sold it off.

Genting told Global Witness it did not carry out any forest clearance or palm oil development on this land and it had decided to dispose of PSM as its land was deemed unsuitable for palm oil development.

There was also deforestation at a plantation owned by Genting subsidiary Citra Sawit Cemerlang plantation in 2019, according to a report by Mighty Earth.

Genting said it had investigated this allegation and found that all land development was “in line with the HCV and HCS [High Carbon Stock] assessments and did not contribute to deforestation.”

As well as being linked with deforestation, JPMorgan Chase has come under fire for investing in fossil fuels. Here, climate activists are seen protesting at the bank’s New York headquarters in April 2021. Erik McGregor / Lightrocket via Getty

Tearing up graveyards

Indigenous Peoples’ groups have filed complaint after complaint about the impact Genting’s farming has had on them.

A shocking claim came from the Sungai and Dusun people of Tongod, a forested part of Sabah in Malaysia. The Genting subsidiary and plantation operator Tanjung Bahagia Sdn Bhd bulldozed graveyards in their villages, the communities wrote to the RSPO.

The plantation continued to expand on their land in violation of their customary rights until 2011, according to the Sungai and Dusun people. The plantation limited their access to hunting, fishing, farmland and forest products, with long term impact on the communities.

Genting said it strongly disagreed with all these allegations.

The RSPO closed the case without ruling for or against it after it said the Tongod people’s challenge against Genting in the Malaysian courts was successful in March 2016.

The communities had been protesting the use of the land since 1997.

Genting said that at the time of its purchase of Tongod Land in 2001 the state government had already issued a private title for the land and taken into account any prior customary rights claims.

It said the court case was related to events which took place before Genting acquired the land.

A different Genting subsidiary destroyed an Indonesian community’s farm and its rattan plantation, according to their complaint filed to the RSPO in October 2018.

The PT Kapuas Maju Jaya plantation failed to compensate members of the Kelompok Tani Penghijauan Tingang Menteng group in exchange for operating on 150 hectares of the community’s land in Central Kalimantan, Indonesian Borneo, the complaint alleged.

An RSPO document suggests the case was closed after the community’s representative passed away during a state-led mediation process with Genting.

Genting told Global Witness it had compensated the community and the case was closed after the RSPO’s Complaints Panel concluded Genting had fulfilled its legal obligations.

A company spokesperson added: “GENP [Genting Plantations Berhad] ... continues to protect the indigenous groups by adopting the Free, Prior and Informed Consent approach. We respect the legal and customary rights of locals, indigenous and tribal peoples.”

Lucrative relationship

Despite all this, JPMorgan provided $688 million of financing to Genting between 2016 and 2020, which – based on the estimated portion of the business involved in forest-risk commodities – netted the bank an estimated $866,000 in revenues.

JPMorgan continued to hold bonds and shares in Genting as of June 2021 despite a string of complaints which basic due diligence would have highlighted.

Following a campaign by activist investor Green Century Capital Management, JPMorgan said in April it was preparing to require palm oil clients to have no-deforestation policies.

It told Global Witness the updated policy would be effective by the time of this report’s publication.

While Genting has a no-deforestation policy, this does not appear to have protected the Indigenous groups who lived in forest it has built plantations on.

Itochu: Tainted supply chain

JPMorgan is also the largest financer of the major Japanese wholesale food company and palm oil trader Itochu.

JPM made deals worth $2.41 billion with Itochu, according to Profundo, netting an estimated $15.8 million in proceeds relative to the portion of Itochu’s business dedicated to forest-risk commodities.

Japan’s growing biomass power production industry has made the country a significant importer of Indonesian palm oil, according to a Chain Reaction Research report from April 2021, and Itochu is at the forefront of this boom.

Between June and November 2020, Itochu was one of the main Japanese importers of palm kernel shells for power generation, primarily used as cheap fuel for biomass power plants.

Last year 4,538 hectares of forest were cleared by 40 mills in Itochu’s palm oil supply chain, according to the Chain Reaction Research report.

Itochu told Global Witness it did not purchase from all the deforestation-linked mills cited in the report, although it acknowledged trading with some of the mills identified.

It said it had temporarily suspended business with some of these mills and had resumed trade only after the suppliers had taken “corrective measures” such as halting forest clearance and replanting damaged forest.

Aerial images of cattle fields in São Félix do Xingu, Pará State, Brazil, 2019. Fábio Nascimento / Greenpeace

Brookfield Asset Management: Implicated in deforestation

Finally, JPMorgan is one of the top financial backers of Brookfield Asset Management, making deals worth an estimated $845 million with the Canadian asset manager over the past five years.

Brookfield claims its clean energy investments are helping to accelerate the transition to a low-carbon economy.

However, a Brazilian farm connected to one of its subsidiaries, Brookfield Agriculture Group, was accused by the NGO Mighty Earth of clearing 954 hectares of wooded savanna in 2019.

Brookfield was also responsible for an estimated 13,746 hectares of deforestation between 2000 and 2017, according to Chain Reaction Research analysis of satellite data showing tree loss within its farm boundaries.

Both allegations centre on Brazil’s Cerrado region.

Brookfield did not provide Global Witness with a comment.

Celine Cousteau gave some words of advice to those attending JPMorgan’s talk.

“It’s beautiful to have words of intention but it’s necessary to have action that follows,” she said. “So my suggestion would be, again, look at what matters to you and then take action."

Bank of China: "Lucid waters and lush mountains"

| Deforestation-linked agribusinesses invested in (/20) | 14 |

| Value of deals | $4.67 billion |

| Estimated proceeds (adjusted) | $111 million |

| Most lucrative relationship | Sinar Mas Group |

Estimated deforestation-adjusted proceeds from deals with selected agribusinesses 2016-2020. Data source: Profundo/Global Witness

With over $3 billion in assets, Bank of China is Asia’s fourth largest bank and the oldest bank in China, founded in 1912.

The state-owned bank reported to its shareholders last year that it had “vigorously backed environmental protection activities and practiced with actions the vision that lucid waters and lush mountains are invaluable assets.”

But a closer look at its balance sheet suggests that in the last five years it may have profited handsomely from deals with some of the world’s worst rainforest destroyers.

Royal Golden Eagle: Sky-high deforestation rates

The bank has been a key financier of the Indonesian conglomerate Royal Golden Eagle (RGE). One member of the RGE group – the company April International – is one of the world's largest producers of pulp and paper and has a long track record of controversies linked to deforestation.

In 2013, the company was disassociated from the FSC following a complaint by Greenpeace, WWF and other NGOs about large-scale deforestation and human rights violations.

The complaint was prompted by reports that April suppliers had cleared a whopping 140,000 hectares of forest, including elephants and tiger habitats in Sumatra in the space of just four years.

When contacted for comment by Global Witness, RGE said: “APRIL has had a no-deforestation commitment in its Sustainable Forest Management Policy since 2015 … APRIL has reaffirmed its commitment to fully engage and cooperate with FSC … in a constructive and robust process of ending APRIL’s disassociation [from the FSC].”

More recent reports, including one published in 2020 by the Indonesian NGO Jikalahari, have alleged that April’s subsidiary Riau Andalan Pulp and Paper (RAPP) continues to drain carbon-rich Sumatran peat forest.

The draining of peatland, often for the conversion of swamp forest into plantations, has played a key role in the disastrous forest fires and haze that have plagued Indonesia over the past decade.

RGE told Global Witness that RAPP’s operations were “government-approved” and involved “prior consultations with communities … and protection of conservation areas,” adding that the operations aimed to “improve water management and reduce fire risk.”

Endangered rhinos

In 2020, RGE was accused by the NGO Aidenvironment of having ownership and supply chain links with three Indonesian pulp and paper firms responsible for widespread deforestation.

RGE has strongly denied these allegations, saying: “We reiterate our categorical rejection of any links with these companies and any claim that deforestation has occurred in our supplier network.”[3]

RGE also manages a company called Apical, which describes itself as one of Indonesia’s largest palm oil exporters.

In 2020, Apical was accused by the NGO Rainforest Action Network of sourcing palm oil from a mill supplied by PT Tualang, an Indonesian company destroying forest in the Leuser ecosystem, a critical habitat for rhinos, tigers and orangutans on the island of Sumatra.

In response to these allegations, the company told Global Witness that it had not sourced directly from PT Tualang but via a mill owned by a third party, and that the case had been dealt with via Apical’s grievance mechanism.

Police officers try to extinguish a forest fire at Rumbai Pesisir village in Riau, Sumatra. Afrianto Silalahi / NurPhoto via Getty Images

Despite these scandals, Bank of China has made deals worth an estimated $298 million with the RGE group since 2016. This includes helping to arrange a syndicated loan with a total value of $1 billion for April International in 2020.

Global Witness analysis shows that Bank of China could have made millions from its relationship with RGE between 2016 and 2020, despite the harms described above.

The bank’s proceeds in proportion to RGE’s operations in forest-risk sectors would amount to $33.5 million.

COFCO: Trading giant

Bank of China is also a major financier of COFCO, China's largest food and agriculture company, which has been linked with deforestation risks through its soy supply chain.

These parts of COFCO’s business could have generated an estimated $20.4 million in forest-risk adjusted income for the bank since 2016, based on Profundo’s analysis of publicly available data about COFCO’s commodities empire.