On 23 February, Oleg Tinkov posted a family portrait on his Instagram page. The picture showed the Russian businessman, his wife and his three children in the cabin of what appeared to be a private jet, festooned with plastic bunting to celebrate his son Roman’s 17th birthday.

The Tinkov family in the cabin of what appears to be a private jet

The jet – a Dassault Falcon 8X which retails for $58 million and carries the registration mark M-TINK – had shuttled between Farnborough, Berlin and Antwerp over the course of the day, before returning to the German capital, where the family celebrated at a high-end restaurant in the city centre. The next morning it flew back to the UK, landing in Oxford, where Roman goes to school – one of at least eight trips to the city by jets with the registration mark M-TINK since 2016.

Within the week, Tinkov was under arrest in London, charged in the United States with tax fraud over hiding hundreds of millions of dollars in assets from the government. In early March, as shares in Tinkov’s company nosedived, the Instagram post – along with another recent picture showing the jet – was quietly deleted.

Tinkov was released on bail shortly afterwards. As he fights extradition to the US, hacked bank records and correspondence published online by a group called Distributed Denial of Secrets – combined with original research by Global Witness – provide a window into the opaque corporate structures used by Tinkov, raising new questions about his tax arrangements and his aircraft. They also point the finger at the Isle of Man, a tax haven on Britain’s doorstep which continues to shelter assets for the billionaire class.

Tinkov was under arrest in London, charged in the United States with tax fraud over hiding hundreds of millions of dollars in assets from the government

Citizen Tinkov

According to Tinkov’s autobiography, I’m Just Like Anyone Else, he was born in Siberia in 1967, the son of a coal miner and a seamstress. After a string of entrepreneurial ventures in the 1990s and early 2000s in the retail, food and drink sectors, he founded Tinkoff Bank, an online bank which now has more than seven million current account customers. In its latest ranking of billionaires, Forbes listed Tinkov as one of the richest businessmen in Russia, and he is best known as the sponsor of the now-defunct Tinkoff professional cycling team, which counted star cyclist Peter Sagan among its racers.

Peter Sagan riding for the Tinkoff team. Photo credit: Ronan Caroff via Flickr

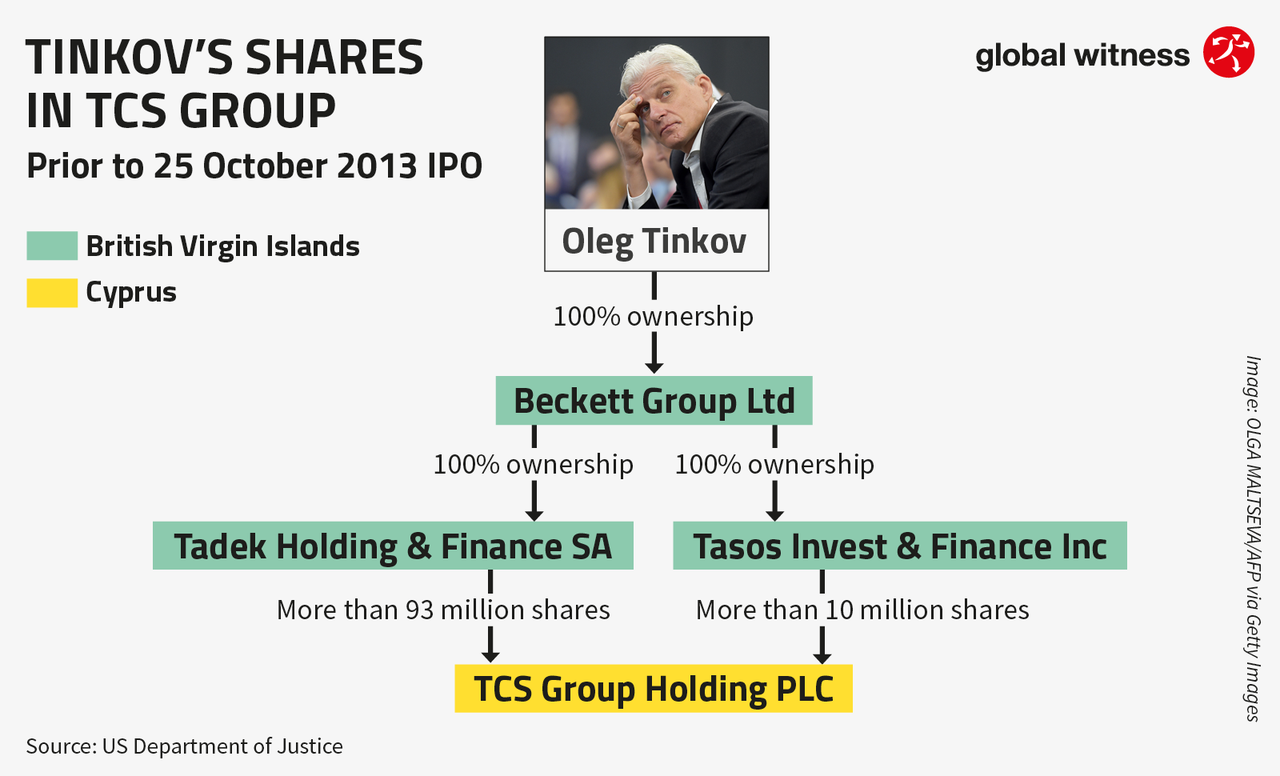

In October 2013, Tinkoff Bank’s holding company, Tinkoff Credit Systems (TCS), floated on the London Stock Exchange. According to an indictment for tax fraud filed by US prosecutors in September 2019 and made available to the public following Tinkov’s arrest in February, the bank’s founder owned more than 100 million shares in TCS by the time of its initial public offering. When 11 million of these shares were sold as part of the deal, Tinkov’s companies generated almost $200 million in gross proceeds.

A few days after the IPO, Tinkov – a naturalised US citizen since 1996 – renounced his citizenship. Under US law, any citizen with a net worth of at least $2 million must calculate the value of their assets at the time of their ‘expatriation’, reporting any gain made on those assets to the taxman. According to the indictment, Tinkov reported a 2013 income of less than $206,000 and a net worth of just $300,000. By contrast, the US indictment puts Tinkov’s wealth in October 2013 – including his shares in TCS – at more than $1 billion.

The Manx connection

Tinkov owned his shares in TCS through a byzantine corporate structure. According to the US indictment, the businessman became sole shareholder of a British Virgin Islands (BVI) company called Beckett Group Ltd. in April 2013. Beckett Group, in turn, was given 100% ownership of two other BVI companies the following month, and these companies owned TCS shares on Tinkov’s behalf.

Tinkov’s links to two of the companies – Tadek Holding & Finance S.A. and Tasos Invest & Finance Inc. – were fully disclosed in TCS’s prospectus at the time of the IPO. Details of the structure also appear in UK regulatory filings and beneficial ownership documents filed with the Russian Central Bank.

While the US indictment focusses on the British Virgin Islands, a separate trail of data leads back to another offshore jurisdiction with close links to the UK: the Isle of Man. Tinkov appeared in the Paradise Papers leak in 2017 as a client of corporate services provider Appleby. Le Monde reported at the time that the businessman had used a company registered in the Isle of Man to buy a series of jets worth tens of millions of dollars from the French manufacturer Dassault, while seemingly avoiding paying a penny of VAT – allegations to which he apparently made no response.

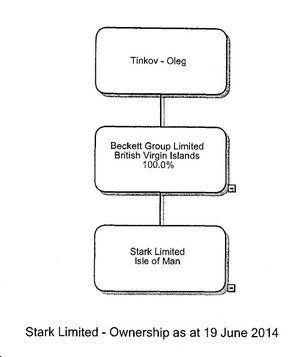

The structure used by Tinkov is legal, and has some similarities to the widely-reported arrangement used by Formula One driver Lewis Hamilton. His Isle of Man company, Stark Limited, bought the plane with a loan from a separate BVI company called Moonfield Trading Inc., also owned by Tinkov according to Le Monde. Like the companies holding his shares in TCS, Stark was itself wholly owned by Beckett Group. Rather than using the plane directly, Stark leased it to Moonfield. By operating as a leasing company, Stark could claim to offset the VAT that would otherwise be due on the purchase of the jet when it entered the Isle of Man. Unlike other jurisdictions, where VAT must be paid and then claimed back at a later date, the Isle of Man effectively allows importers not to pay any tax in the first place. There is no evidence to suggest that in setting up and using these structures an illegal act was committed.

A diagram showing the ownership structure of Stark Limited

Presented by Global Witness with information on one of Tinkov’s accounts and the company structures, tax barrister Jolyon Maugham QC said that on the basis of the information he was shown “it is reasonable to conclude that the offset procedure was used. A number of features of the arrangements – for example, the use of the IOM as a place of importation; the circular payments comprising a loan from Moonfield to Stark, lease payments from Moonfield to Stark, and the return of the sums of those lease payments by loan repayments from Stark to Moonfield; and indeed the leasing arrangements themselves – are difficult otherwise to rationalise.” He concluded that it is “reasonable to say that there has been tax avoidance.” Tinkov did not respond when Global Witness wrote to him via a spokesperson to ask for his comments.

Tinkov is just one of hundreds of wealthy individuals who have flocked to the Isle of Man since the launch of the island’s private aircraft register in 2007. As a Crown Dependency, the Isle of Man is treated as part of the UK for VAT purposes, and therefore as part of the European Union VAT area. While Brexit may throw this arrangement into disarray, for the time being aircraft registered for VAT on the Isle of Man can travel freely throughout the EU. In 2018, the European Commission called on the UK to clamp down on what it described as “abusive VAT practices in the Isle of Man”, and a promised investigation into the situation remains ongoing. Meanwhile, an October 2019 review by the UK Treasury did not recommend significant changes, calling only for more stringent checks to ensure that planes’ VAT status continued to be appropriate after registration.

[It is] reasonable to say that there has been tax avoidance - Jolyon Maugham QC

Responding to questions posed by Global Witness, a spokesperson for the Isle of Man government declined to comment specifically on Tinkov, but said that the island’s VAT law mirrors law in the rest of the EU and that the government “meet[s] all of our international obligations in preventing tax evasion and will not tolerate anyone that seeks to avoid paying tax.” They also said that the government had implemented a new training programme for customs staff to ensure that post-registration assurance on aircraft VAT registrations is carried out effectively.

Tinkov's son, Roman, cuts a ribbon on a plane's staircase

Uncle Sam takes note

Tinkov’s first jet – a $28 million Falcon 2000, according to Le Monde – was purchased in 2013. A post on his Instagram page shows his son, Roman – then 10 years old – cutting a red ribbon on a plane’s staircase, with the caption “Roma bought a toy.” The same year, according to the American indictment, Tinkov declared a net worth of less than half a million dollars. Documents seen by Global Witness suggest that this potential discrepancy may have caught the attention of US investigators.

Stark Limited, Tinkov’s jet leasing company, maintained a bank account with the Isle of Man branch of Cayman National, a bank based in the Cayman Islands. When the branch’s servers were hacked late last year, internal data – including emails, documents and transaction information – was made public. Amongst the millions of files is a cache of evidence prepared for an appearance by a member of Cayman National staff at the Isle of Man Courts of Justice in June 2018. While an official summons included in the folder refers to “a criminal investigation that is being carried on in Ireland”, an accompanying email describes the information as “evidence sought by the US Department of Justice”, referring specifically to the Falcon 2000, as well as two other jets.

The Cayman National files also give an insight into the workings of Tinkov’s leasing structure. Internal emails show how members of Cayman National’s compliance department became increasingly concerned about the Stark account following the Paradise Papers revelations. Staff worried that Estera, the successor to Appleby’s fiduciary services arm, appeared to be “skirting around” concerns about Tinkov. In one email, a member of Cayman National staff points out the circularity of the structure directly: “the funds coming into Stark Limited’s account are from Moonfield Trading Inc’s account at Tinkoff Bank in Russia … The funds received are being paid out within a matter of days to an another [sic] account in the name of Moonfield Trading Inc at ABLV Bank in Latvia.”

This seemed to be a straightforward leasing structure, with the attendant tax advantages. In fact, it appears that substantially the same money moved backwards and forwards. Analysis of transaction data shows that Stark received €7.97 million in “advanced rental payments” from Moonfield between July 2014 and January 2018, of which €7.9 million was sent straight back to the BVI company as loan repayments, with the remainder spent on fees. The average gap between Stark receiving a payment and sending back the balance was just a week – in one case, the money stayed in Stark’s account for less than 24 hours – and in almost every case the payment reference for both transactions named Moonfield as the sender or recipient.

As Cayman National’s banking director put it in an internal email, the structure was “effectively a ‘pass through’ account”. The bank became so concerned that it filed a disclosure with the Isle of Man’s Financial Intelligence Unit, warning among other things that Moonfield’s accounts were outside Estera’s control and that Cayman National didn’t feel it had “full knowledge of the underlying source of the funds being received into Stark Limited’s account from the Russian ‘Moonfield’ account or what is happening with the funds once they reach the Latvian ‘Moonfield’ account.”

As Cayman National’s banking director put it in an internal email, the structure was “effectively a ‘pass through’ account”

Tinkov did not respond to a request for comment from Global Witness put to him via his spokesperson. A spokesperson for Cayman National declined to comment on Tinkov’s account, and went on to say that the bank no longer accepts Russian clients.

In quarantine

After posting £20 million in bail in February, Tinkov was released. According to a court report in the Daily Express, his bail conditions confine him to a flat near Holland Park in west London – 15 minutes’ walk from the Russian embassy – between the hours of 7 p.m. and 7 a.m., and he must stay within the M25 ring-road at all times. If extradited and convicted on both charges in the US, he faces up to six years in prison.

Tinkov attends the St Petersburg International Economic Forum in 2019. Photo credit: Olga Maltseva/AFP via Getty Images

TCS’s share price plummeted from a high of more than $26 on 11 February to less than $11 at the end of March, outstripping a general collapse in the market driven by coronavirus. In public statements, the company has sought to distance itself from its controversial founder, who stepped down from the Tinkoff Bank board in early April. “I don’t know anything about Oleg’s tax affairs”, Tinkoff Bank CEO Oliver Hughes told Russian business daily Vedomosti. “I’m just not in the loop.”

The PR operation may have extended to social media, too: among Tinkov’s recently deleted Instagram posts is a 6 February selfie which seems to show Tinkoff Bank executives Alexander Emeshev and Artem Yamanov. Hughes and Tinkoff Bank did not respond to a request for comment on the picture or on the charges filed against Tinkov. There is no suggestion that they had any knowledge of Tinkov’s tax affairs prior to the publication of the US indictment.

Ultimately, Tinkov has more serious problems. In early March, his spokesperson released a statement revealing that he was suffering from acute leukaemia and had undergone several rounds of chemotherapy. On 19 March, the businessman transferred his shares in TCS to a family trust, and according to quotes reported by the TASS news service he has put the US case to one side: “With respect to the US issues relating to my taxes from the past, I have hired lawyers to work on this issue, leaving me to focus on my main battle. This is undoubtedly the hardest period of my life, but I am counting on God, my body, my friends and your support.”

Tinkov’s next legal hearing – a case management conference at Westminster Magistrates’ Court – was set for 27 April, but was rescheduled to 13 July, 31 July and then to 25 September, with TASS reporting that the last postponement was because Tinkov was in hospital. When it will actually go ahead is not yet clear.

Header photo credit: Olga Maltseva/AFP via Getty Images.

Find out more

You might also like

-

Press release Isle of Man tax regime allows super-rich to avoid up to £1 billion in VAT on private jets

The global super-rich have avoided paying up to £1 billion in VAT on the purchase of private jets by using advantages including financial secrecy in the Isle of Man

-

Article The Tax Haven Next Door

New Global Witness research and data from Cayman National Bank’s Isle of Man branch — hacked and posted online — reveal a group of super-wealthy characters whose use of the island’s financial services sector and “pro-business” regime might have saved them millions of pounds in VAT on private jets.

-

Briefing Getting the UK's house in order

Failure to check key information and enforce rules on the UK company register enables criminals and the corrupt to use UK companies to store cash