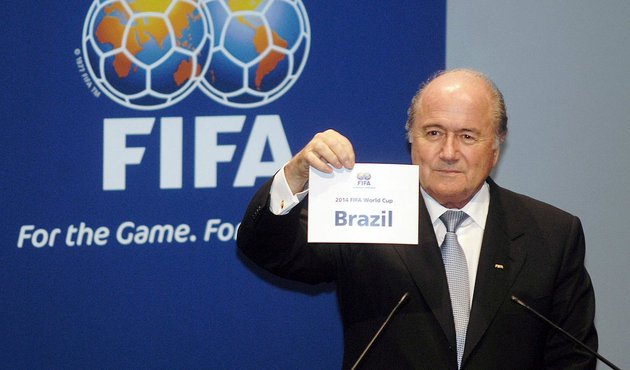

The headlines generated by the US investigation into FIFA reveal allegations of serious corruption at football’s governing body

Beneath the headlines, details are emerging of the crucial role banks played by processing the related payments.

This has two elements:

- Key mechanism for bribe payments. It would have been almost impossible for the alleged bribery involving FIFA officials to have occurred without access to the financial system. Indeed, the U.S. Department of Justice has claimed that the accused relied on the use of “trusted intermediaries, bankers, financial advisors and currency dealers, to make and facilitate the making of illicit payments.”[i]

- Did banks fail to do key checks? In almost every country, anti-money laundering laws require banks to do a range of checks on their customers, to detect whether the money they handle might be the proceeds of crime, or intended for terrorist groups. At the very least, the allegations involving FIFA officials raise serious questions about whether the banks named in the indictment carried out the checks they are supposed to, and if so, whether they were adequate.[ii] At least three banks, HSBC, Standard Chartered and Barclays have already announced internal probes into the payments.[iii]

The wider corruption scandal involving banks

The involvement of the financial system in the FIFA bribery allegations is symptomatic of a much bigger problem and a largely hidden truth.

Banks play an integral role in enabling large scale theft from state budgets, by providing a place for unscrupulous government officials to hide their ill-gotten gains, with devastating human rights implications.

In the words of a Nigerian anti-corruption investigator: “If you know there’s no landing space to land your plane, you don’t take off in the first place. It’s the same with money: if there is nowhere to land it once you’ve stolen it, you can’t steal it."[iv]

Key statistics:

- A World Bank study looking at a sample of 200 cases of large scale corruption found that governments were at least $56.4bn poorer as a result.[v]

- According to research commissioned by the Nigerian government, the country and its citizens have missed out on at least $35 billion over 10 years due to corruption in the oil industry.[vi] This represents more than one year of government spending. Just one tenth ($3.5 billion) could have been used to give a basic eduction to the 5.5 million girls in Nigeria who are currently missing one.[vii]

- UN Office on Drugs and Crime (UNODC) estimates that the amount of money laundered globally each year is between $800 billion – $2 trillion (2-5% of global GDP).[viii]

- In 2011 the UK banking regulator (the Financial Services Authority) found that 75% banks were not doing enough to prevent money laundering.[ix] In 2014, it’s replacement (the Financial Conduct Authority) found “significant and widespread weaknesses in most banks’ anti-money laundering systems and controls.”[x]

The cost of corruption

Corruption is not a victimless crime. It is major problem with a devastating human cost.

Just as FIFA money going missing starves critical grassroots programmes of funding, theft of state funds traps millions more in poverty in developing countries.

When officials steal from their country’s coffers, they decimate funds that should be spent on hospitals, schools and other basic services.

Rich countries are affected too. Corruption thwarts competition and innovation, and adds to the cost of doing business around the world, undermining the global economy.

A report by the B Team, a group of international CEOs and business leaders including Richard Branson and Mo Ibrahim, states: “Corruption is bad for business, adding up to 10% to the cost of doing business globally, and is equivalent to a 20% tax on foreign businesses. It undermines competition and financial stability, and undercuts investments in human capital and sustainable development."[xi]

Corruption also leads to failed states and breeds terrorism, threatening the national security of all countries.

Banks have a history of breaking the rules

While many banks do a good job at upholding anti-money rules, a large number do not.

This failure spans a spectrum, from lacking the required systems to spot suspect funds, to turning a blind eye when risky funds are identified, to knowingly handling ill-gotten gains.

The result is that many banks leave the door wide open for money launderers.

This raises two main questions: why are many banks repeatedly breaking the law and/or regulatory standards, and what can be done to change this?

Skewed incentives lie at the root of the problem. Under the current system, banks can make significant profit even if they handle tainted funds.

There are several reasons for this: on a global basis the rules are rarely enforced; where penalties are handed out, they usually do not go far enough; and, senior executives who have oversight of breaches rarely face financial or reputational consequences themselves.

It can even make sense for banks to break the rules under the present system.

The solutions

We need to change this balance of incentives, so that banks have much more to lose than they have to gain from handling suspect funds.

By far the single most effective solution would be to hold senior bankers personally responsible when their banks break the rules.

Until the people who run banks start to lose bonuses, face personal fines and suspension, or in the most extreme cases go to jail, they will not take the rules seriously.

Recent policy developments give cause for cautious optimism. This year the UK’s Financial Conduct Authority will finalise the details of the Senior Managers Regime, a new measure to require banks to name a senior banker as responsible for each key risk the bank faces.

Under current proposals this will include giving a senior manager the personal responsibility for ensuring that the bank complies with anti-money laundering rules.

It is vital that the final policy ensures this is allocated to someone who reports to the board of a bank.[xii]

The EU has passed an updated Anti-Money Laundering Directive which should also give senior executives overall responsibility for the issue, and it is vital each member state implements this in an effective way.[xiii]

However, as U.S. laws stand, officials have claimed it is extremely difficult for them to establish legal liability for executives, [xiv]

Summary of key recommendations:

Governments and Regulators should:

- Start holding senior bankers personally responsible when banks violate anti-money laundering regulations.

- Remove legal impediments preventing authorities from holding senior executives personally liable for banks’ wrongdoing.

- Adopt a much stronger, and smarter, approach to enforcing existing anti-money laundering rules.

- Establish adequate anti-money laundering regulations governing banks and others in countries where these regulations currently do not exist.

- Remove obstacles for banks (such as difficulties in identifying the real, ultimate owners of companies which they hold accounts for).

Banks should:

- Appoint someone from either the board, or senior management team, to have the overall responsibility for anti-money laundering regulations, as part of a broader culture change.

- Significantly enhance the scrutiny of accounts held by people with access to government budgets, and who pose a high risk of money laundering.

- Work closely with each other, governments and a range of actors to solve key problems.

Further information

- For a comprehensive look at this issue, with a range of case studies and examples of banks facilitating corruption and other serious crimes, and a full set of policy recommendations, see the new Global Witness report Banks and Dirty Money

Table 1: Banks named in the U.S. court indictment [xv]

Banks have been listed in the US indictment for a number of reasons.

Sometimes banks are listed for having processed alleged bribes, or for being used to spend the proceeds of the bribery; and some of the banks were simply correspondent banks – i.e. one stage in a chain of payments, and so would have limited access to information on the underlying nature of the transaction.

At other times the bank is listed for being used as part of the suspected wire fraud conspiracy, which can include the bank being used to pay contracts which resulted from a bribe, but which may have seemed legitimate (e.g. the rights to broadcast football tournaments).

As outlined above, none of the banks have been accused of any wrongdoing so far.

Bank |

Location of bank |

Paragraph mentioned in Indictment |

|---|---|---|

Banco de Credito Centroamerica |

Managua, Nicaragua |

302 |

Banco do Brasil |

New York, U.S. |

125 |

Banco do Brasil |

Asuncion, Paraguay |

125 |

Banco Itau |

New York, U.S. |

163 |

Banco Itau |

Brazil |

206 |

Banco Itau |

Miami, U.S. |

206, 302 |

Banco Lafise |

Costa Rica |

293 |

Bank Hapoalim |

Zurich, Switzerland |

250-2, 258 |

Bank Julius Baer & Co |

Zurich, Switzerland |

250 |

Bank of America |

New York |

192, 196, 251, 284 |

BankInter |

Madrid, Spain |

206, 302 |

Barclays |

Cayman Islands |

138 |

Barclays |

New York, U.S. |

138 |

Capital Bank |

Panama |

237, 328 |

Citi Private Bank |

New York, U.S. |

46 |

Citibank |

Miami, U.S. |

179-182, 221, 231, 237, 250, 284, 293, 302, 328, |

Delta National Bank & Trust Co |

Miami, U.S. |

46, 163, 229-230 |

Doha Bank |

Qatar |

221 |

Espirito Santa Bank |

Miami, U.S. |

251 |

Fidelity Bank |

Cayman Islands |

229-231, 315 |

First Citizens Bank |

Trinidad and Tobago |

138 , 179-182 , 194 |

FirstCaribbean International Bank |

Bahamas |

198 |

HSBC |

New York, U.S. |

229-231, 315 |

HSBC |

Hong Kong |

229-231, 315 |

HSBC |

London, UK |

163 |

Intercommercial Bank |

Trinidad and Tobago |

221 |

Itau Unibanco |

New York, U.S. |

163 |

JP Morgan Chase |

New York, U.S. |

163, 237, 250, 302 |

JP Morgan Chase |

Miami, U.S. |

258 |

Republic Bank |

Trinidad and Tobago |

192-193, 196-198, 213, 284 |

Standard Chartered |

New York, U.S. |

229-231, 315 |

UBS |

Unclear |

251 |

Wachovia |

Unclear |

179-182 |

Wells Fargo |

New York, U.S |

237, 293 |

i See the Department of Justice indictment, p29 http://www.justice.gov/opa/file/450211/download The U.S. authorities have listed over 20 banks which processed payments relating to the scandal (see table 1 below).

ii For an example of transactions which might raise questions, see the BBC investigation looking at how alleged payments were laundered by then FIFA Vice President Jack Warner http://www.bbc.co.uk/news/world-latin-america-33039014 At least three banks, HSBC, Standard Chartered and Barclays have already announced internal probes into the payments.

iii See the Daily Telegraph report http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/11641624/Banks-probe-Fifa-payments-amid-corruption-allegations.html

iv For a comprehensive look at this issue, with a range of case studies and examples of banks facilitating corruption and other serious crimes, and a full set of policy recommendations, see the new Global Witness reportBanks and Dirty Money www.globalwitness.org/reports/banks-and-dirty-money

v See the World Bank report “Puppet Masters” 2011, Appendix B, p117, http://star.worldbank.org/star/sites/star/files/puppetmastersv1.pdf

vi See the Guardian “Nigeria: how to lose $35bn” November, 2013 http://www.theguardian.com/world/2012/nov/13/nigeria-oil-corruption-ridabu

vii This is based on the UNESCO figures which estimate that five years of schooling, the agreed level for a basic education, costs approximately $125 per pupil per year. See the UNESCO: http://unesdoc.unesco.org/images/0018/001885/188561e.pdf For the figure of 5.5 million girls missing an education see the Nigerian Voice article about a UNESCO report in 2013 http://www.thenigerianvoice.com/news/126463/1/nigeria-accounts-for-55m-out-of-school-girls-says-.html

viii See the UNODC website http://www.unodc.org/unodc/en/money-laundering/globalization.html accessed May 2015

ix See the 2011 FSA report “Banks Management of High Money-Laundering Risk Situations”, Executive Summary http://www.fsa.gov.uk/pubs/other/aml_final_report.pdf

x See the FCA’s press release for its report “How small banks manage money laundering and sanctions risk” November 2014 http://www.fca.org.uk/news/fca-finds-small-firms-need-to-manage-financial-crime-risks-more-effectively

[xi] See the B-team report “Ending Anonymous Companies”, Executive Summary p3 http://issuu.com/the-bteam/docs/bteam_business_case_report_final.we?e=15214291/11025500 The B Team is a global initiative that brings together international CEOs and business leaders to "make business work better.” www.Bteam.org

xii See the Financial Conduct Authority’s latest document on the proposed Senior Manager’s Regime: http://www.fca.org.uk/your-fca/documents/consultation-papers/cp15-09

xiii See the EU Council statement 12 January 2015, p67,point 3a http://bit.ly/1F88VGU

xiv For example see the quotes from former Assistant Attorney General Nathan Hochman about the acquittal on aiding tax evasion charges of a senior executive at the Swiss Bank UBS, in this Bloomberg article http://www.bloomberg.com/news/articles/2014-11-03/ex-ubs-executive-weil-acquitted-of-u-s-tax-conspiracywhich is something that lawmakers should look to address.

xv For the full indictment see http://www.justice.gov/opa/file/450211/download