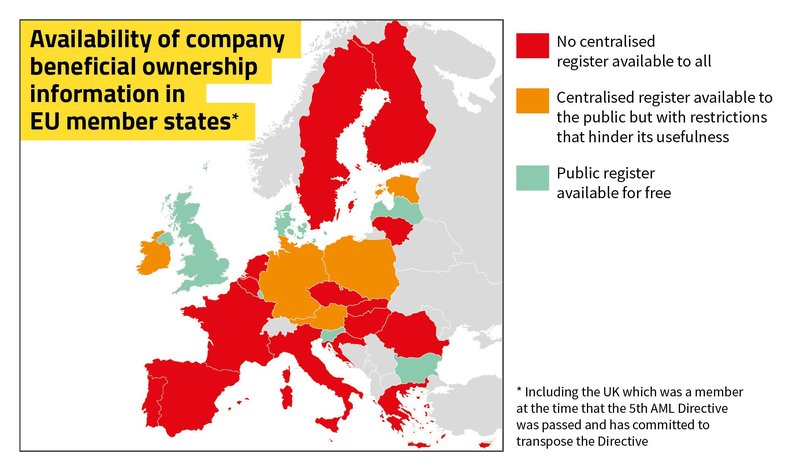

EU Member States were given more than two years to implement beneficial ownership registers, but progress has been at best patchy with only five having fully and properly done so

The EU’s 5th Anti-Money Laundering (AML) Directive requires all Member States to set up a centralised register of the ultimate, or so-called "beneficial", owners of companies and make this information available to the public.

Countries were given more than two years to implement these changes, meaning that the registers should have been up and running by 10 January 2020. Global Witness has found progress has been at best patchy with only five having fully and properly done so.

The 5th update to the AML Directive came as a result of the Panama Papers leak in 2016, which led to the resignations of political leaders and the demise of the law firm and corporate services provider at the heart of the story – Mossack Fonseca.

Just three months after the Panama Papers revelations, the European Commission presented plans to amend the 4th AML Directive.

As a result of this, all Member States agreed that greater scrutiny by investigative journalists and civil society organisations will help to prevent the abuse of anonymous companies by the criminal and the corrupt.

We at Global Witness have been campaigning for beneficial ownership information to be made public for more than 10 years.

Anonymously-owned companies are one of the key tools used by money launderers and tax evaders to hide their ill-gotten gains and taxable assets from law enforcement and tax inspectors – and public registers are a way of making this more difficult.

We wrote to all EU Member States and analysed publicly available information to find out how well countries are doing in setting up these public registers.

We found that:

- 17 of 27 Member States (63%) do not yet have a centralised register of the beneficial owners of companies which is available to the public. This category includes some countries which do not yet have a register of beneficial owners which is accessible to members of the public with a legitimate interest, which was required to have been implemented by the 4th AML Directive by June 2017; some countries that expect to implement a fully public register soon; and some countries that claim to have a public register but whose registration requirements make it available only to citizens or residents of a few European countries which in our opinion does not constitute public access.

- 5 of 27 Member States (18.5%) have a centralised register of the beneficial owners of companies which is available to the public but with significant restrictions that hinder its usefulness in combatting money laundering. These restrictions include setting up a paywall or only being able to search using a company’s tax identification number.

- 5 of 27 Member States (18.5%) have implemented a public register which is free to access. The UK is also in this category.

We congratulate Bulgaria, Denmark, Latvia, Luxembourg and Slovenia for having set up free public registers of the beneficial owners of companies, and have given them a green grading in our analysis.

This top category includes three countries which have been hit by recent money laundering or tax evasion scandals.

Denmark’s biggest bank, Danske Bank, was involved in one of the world’s largest money laundering scandals. Latvia has been linked to the "Troika Laundromat" exposed by the Organised Crime and Corruption Reporting Project via the use of nominee directors, and one of its banks was shut down by the US for links to money laundering and North Korea’s nuclear weapons programme.

Luxembourg was at the centre of a 2014 leak of information published by the International Consortium of Investigative Journalists about its tax rulings.

It would seem that scandals and public pressure have played a useful role in pushing countries to become more transparent more quickly.

We encountered a number of problems with registers that countries have set up:

- Limiting access to the register. Four countries – Belgium, Croatia, Portugal and Sweden – require people to register by using an electronic identification system that would appear to be available only to citizens and residents of a few European countries. Greece is expected to do the same. This does not constitute the ‘public’ access that is required by the 5th AML Directive and we have therefore graded these countries as red.

- Tipping off beneficial owners. At least one country – Greece – state that the beneficial owners of companies will be informed if someone has searched for them (apart from if the search was carried out by public authorities). This is highly problematic as any money launderer, tax evader or terrorist financier will be tipped off that they are being investigated, enabling them to re-incorporate the company elsewhere or otherwise attempt to cover their tracks. Indeed, the global anti-money laundering standards are so concerned about the potential for tipping off that they forbid financial institutions from informing customers if they suspect them of money laundering and have informed authorities about this.

- Making it hard to search for companies. Two countries – Poland and Portugal – require users to know the tax identification number of a company in order to be able to search for its beneficial owners. While it seems that this information can be found online for most companies, the beneficial ownership register does not tell users where to go to find it out and it took us some time to find. We cannot think of any reason why such an obstacle should be placed in the way of users and have therefore graded countries with these types of obstacle as amber.

- Setting up paywalls. Seven countries – Austria, Belgium, Estonia, Finland, Germany, Ireland, and Sweden – require users to pay in order to access beneficial ownership information. Two additional countries (Greece and Italy) suggest that they will impose fees once the register is set up. Malta imposes fees, but makes the beneficial owners’ information accessible only to people who agree to use the information for the purpose of carrying out customer due diligence (e.g. banks and lawyers). The fees range from €1 per company (Estonia) to €7 per company (Finland) and include, in the case of Sweden, a one-off payment of €41 or, in the case of Greece, a payment to be made of €20 for every 10 searches carried out (rather than for information obtained).

It is possible that there are more countries that intend to set up paywalls as we do not know the intentions of some countries that have not yet set up their register.

The 5th AMLD Directive allows for countries to charge people for access to beneficial ownership information as long as the charge does not exceed the administrative costs of making the information available (which, in the case of some of the larger fees, we wonder whether this could be true).

We have graded any country that has a paywall in place as amber because meaningful anti-corruption investigations often require access to multiple documents, quickly turning a small fee into a high paywall, constituting a significant barrier to use for investigative journalists and civil society groups, particularly given that it is essential for investigators from the Global South to find out who owns European companies.

There are 17 countries which do not appear to have a beneficial ownership register that is open to all members of the public.

This includes six countries (Czechia, Finland, France, Portugal, Romania and Spain) which have a register but only make it available to people that can demonstrate legitimate interest or purpose of use, four countries (Belgium, Croatia, Portugal and Sweden) that make the register available only to citizens or residents of a few European countries, and eight countries (Cyprus, Greece, Hungary, Italy, Lithuania, Malta, Netherlands and Slovakia) which either do not appear to have any beneficial ownership register as yet or have one, but not one that is available to members of the public with a legitimate interest.

All of these countries have been graded red, but they encompass a wide range of situations.

For example, France has passed legislation that will set up a public register that is free to use and that is expected to be up and running soon, whereas in Malta it is only possible to access beneficial ownership information for the purpose of carrying out customer due diligence, making the register not compliant with the 4th AML Directive (which requires access to anyone with a legitimate interest), let alone the 5th AML Directive.

We have written extensively in the past on why beneficial ownership registers should be public; why it’s important that they are set up using open data standards and formats; what the key elements of a public register ought to be; and what lessons can be learned from existing registers, such as the one set up by the United Kingdom.

With this particular piece, our analysis just looks at who beneficial ownership information on companies is available to.

We have not looked at how well Member States have done in implementing the registers of the beneficial owners of trusts that the 5th AML Directive requires to be made available to anyone with a legitimate interest.

Neither have we looked at the quality of the company data – the percentage of companies that have reported who their beneficial owners are, nor whether there is any system in place to verify the self-reported data.

Our previous analysis of UK beneficial ownership data which identified important data quality and verification gaps as well as suspicious entries was only possible because of the register’s availability as open data. For this reason, we strongly recommend that Member States set up open data registers.

We call on the European Commission to get tough with the Member States that have failed to properly implement the 5th AML Directive.

The rest of the world is watching what happens in the EU in order to inform their approach to beneficial ownership transparency.

If we want to see an end to the global money laundering scandals in which vast sums are stolen, often from some of the poorest people in the world, company ownership must be brought out of the shadows.

Annex: Availability of company beneficial ownership information in EU member states

Download Resource