Washington, D.C.: The US Securities and Exchange Commission (SEC) voted yesterday to release a proposal for an oil and mining payment transparency rule which falls far below the global standard, and must be strengthened in its final form to effectively deter corruption.

Section 1504 of the 2010 Dodd-Frank Act requires extractive companies to disclose payments made to the US and foreign governments. Also known as the Cardin-Lugar provision, it was once a beacon of US leadership in the global fight against oil and mining corruption. The SEC’s new draft implementation rule, however, would utterly fail to safeguard against corruption in the extractives sector and appears instead to be a massive handout to the oil and gas industry.

“We agree with SEC Chair Jay Clayton that the US should be proud of its decades-long leading role in the global fight against corruption. That is why we are deeply disappointed that this leadership is set back by today's rule that falls far below the global transparency standard. It must be improved,” says Zorka Milin, Senior Policy Advisor at Global Witness.

“Our grade for this proposed SEC rule: 'F'. Big Oil interests including the American Petroleum Institute have applied intense pressure to allow oil and gas companies to operate in opacity, and they’ve clearly made their mark. This proposal is riddled with loopholes, and eliminates meaningful reporting at the level of individual projects. In 25 years of investigating this sector, Global Witness has found time and again how transparency at the deal-making level is instrumental in deterring corrupt transactions.

“These types of payment disclosure laws are already implemented and enforced in over 30 countries. It was the 2010 Cardin-Lugar provision that inspired the EU, Canada and Norway to adopt matching laws. The SEC must strengthen its proposal to meet the global standard that the United States itself set,” says Milin.

The SEC’s previous attempt to implement the Cardin-Lugar provision was overturned by Congress and President Trump in 2017. But Congress did not repeal the underlying statute that still requires SEC implementation, and Congressional disapproval of the previous rule does not justify such a complete gutting of the law, which is not defensible as a legal matter because it fails to meet the anti-corruption intent of the original law.

As a co-founder of the PublishWhat You Pay (PWYP) coalition, Global Witness has led the global fight to make oil and mining companies publish their payments to governments, with measures to do so adopted in the UK and EU.

“We second SEC Commissioner Allison Lee’s critiques of this draft rule. It undercuts a long history of US leadership on corruption, including the global oil transparency regime that the US law at issue here catalyzed. There is no legal reason for the SEC to give in to Big Oil pressure,” says Milin./ ENDS

Contacts

-

Julie Anne Miranda-Brobeck

Head of US Communications and Global Partnerships

You might also like

-

Briefing Revenue disclosure laws – Cardin-Lugar and the global transparency standard

Global movement to end the corruption that blights resource-rich countries is gathering pace.

-

Press release U.S. Congress votes for corruption by overturning historic transparency law in gift to big oil

Today’s decision by the Republican-led U.S. Senate to overturn a rule designed to stop oil companies striking corrupt deals with foreign governments is a grave threat to U.S. national security and an astonishing gift to big oil.

-

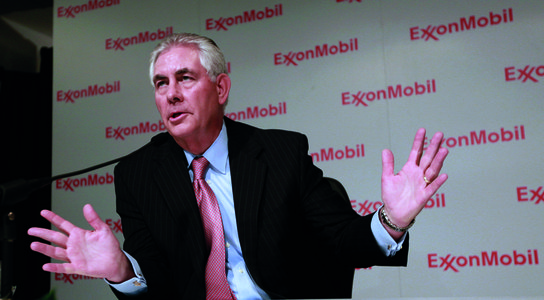

Press release US authorities must investigate Exxon for its purchase of a corruption-tainted oil block in Liberia

Global Witness calls on the US Department of Justice (DOJ) and the US Securities and Exchange Commission (SEC) to investigate US oil giant Exxon for its 2013 business deal in the West African country of Liberia, where the company spent $120 million on an oil block it knew was tainted by corruption.