The second part of our investigation into the Indonesian coal industry focuses on serious questions about a former business deal of Luhut Pandjaitan, one of the most powerful Indonesian officials in recent years.

Read our briefing in full: Indonesia’s Shifting Coal Money: Part 2 (pdf, 1850KB)

A former general, diplomat and businessman who has been a senior government advisor and a minister, Pandjaitan is a close ally of President Joko Widodo, and is currently the Co-ordinating Minister for Maritime Affairs.

Up until November 2016, Pandjaitan held a controlling stake in coal company Toba Bara Sejahtra, which he sold for an undisclosed amount.

We look at

another important unknown in this sale: how the identity of those who bought

this controlling stake are hidden behind an offshore trust company in

Singapore.

Key findings of our investigation

Who bought

the company and how much did they pay?

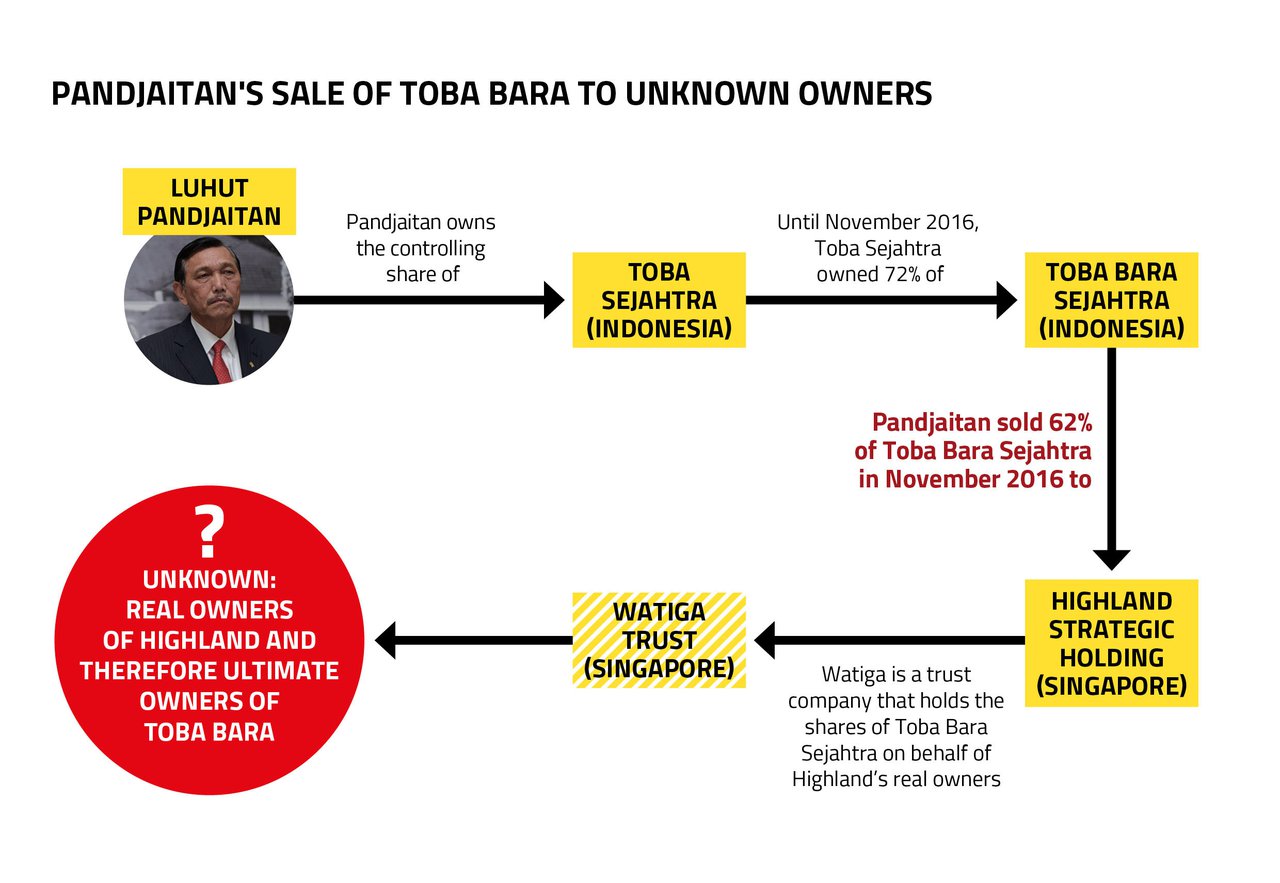

Back in 2016, Pandjaitan was the controlling shareholder of a private Indonesian company called Toba Sejahtra.

This, in turn, owned 72% of an Indonesian coal mining company called Toba Bara Sejahtra (known simply as Toba Bara), a company which has coal mines on the island of Kalimantan, and is constructing two coal-fired power plants on the neighbouring island of Sulawesi.

On 9 November 2016, Toba Sejahtra agreed to sell nearly 62% of Toba Bara’s shares to a Singapore company called Highland Strategic Holdings. Another Singapore company, Watiga Trust, holds those shares on behalf of Highland.

It is reasonable to ask who ultimately owns Highland Strategic Holdings which bought the controlling interest in the company from Pandjatan, and how much it paid.

But when we wrote to Pandjaitan, Toba Bara Sejahtra and the offshore trust company to ask them these questions, they all declined to answer.

Why these

questions matter

We don’t know how much Pandjaitan sold his company for – though we can assume it was a hefty amount worth tens of millions of dollars. And we also don’t know who he sold it to.

These two facts alone leave unanswered questions, which are particularly important issues at a time when he is a senior member of the government seeking re-election in 2019.

The facts also

highlights why this might create risks for investors.

Risks for investors?

This story, like others in our series on Indonesian coal companies, features an offshore company at the heart of a transaction worth millions of dollars. In this case its opaque ownership leaves unanswered questions about a former business deal involving an influential figure in Indonesia's upcoming election.

The briefing also highlights how in order to make sound and responsible investment decisions, investors need to know who are the ultimate owners of a company they are dealing with and what their track record is.

This is important so that investors can manage all types of risks, including both financial risks and non-financial ones, such as legal and reputational risks. It also highlights how the majority of the profits from an Indonesian coal company are now destined to flow offshore.

You might also like

-

Briefing Indonesia's shifting coal money 1: Sandiaga Uno and the offshore dealings of Berau Coal

One of Indonesia’s best-known politicians may have benefited from payments to an obscure offshore firm by one of the country’s largest coal companies.

-

Press release Vice-Presidential candidate Sandiaga Uno linked to payments of millions of dollars shifted out of Indonesian company into an obscure offshore firm

New report links Sandiaga Uno to payments of at least US$43million from a major Indonesian coal company, Berau Coal, into an obscure offshore firm in the Seychelles.

-

Campaign Hub Indonesia's Shifting Coal Money

We already know coal is terrible for the environment, but our investigations into the Indonesian coal industry highlight a host of other risks