This week’s explosive new leak of secret corporate documents from the offshore legal giant Appleby – the so-called ‘Paradise Papers’ – will have caused sleepless nights for the world’s rich and powerful, as jealously-guarded details of their financial arrangements are made public.

Among those in the spotlight, one corporate behemoth stands out: Glencore. Perhaps not a household name, but a FTSE 100 company and the world’s biggest commodities trader, Glencore went public in 2011 in what is still the biggest ever Initial Public Offering in the London Stock Exchange’s history. While most of the individuals and companies named in the Paradise Papers have been embarrassed by one story, Glencore has featured in no fewer than four major exposés.

In the last five days, the Paradise Papers have raised concerns that Glencore may have: artificially reduced its tax bill in Burkina Faso; covered up its ownership of a large stake in a controversial shipping company; and avoided tax in Australia via a scheme of convoluted currency swaps.

Perhaps the most damaging revelations concern Glencore’s partnership with a notorious middleman in Democratic Republic of Congo. Over the last five years Global Witness has investigated Glencore for its suspect mining deals in Congo. The Paradise Papers add further weight to our call for Glencore to face an investigation for bribery and corruption, particularly over its Congo deals.

Since 2012 we’ve exposed Glencore’s transactions in Congo with Dan Gertler, a billionaire mining magnate and a close friend of Congolese President Joseph Kabila. Over the course of a ten-year partnership, Glencore pumped cash, loans and shares worth over half a billion dollars into offshore companies owned by Gertler, which allowed him to make at least $67 million in risk-free profit. Several of these transactions didn’t make much obvious commercial sense for Glencore – unless they were intended as a means for ‘rewarding’ Gertler, the president’s friend.

Kofi Annan’s Africa Progress Panel showed in 2013 that just five suspicious mining deals involving Gertler – a couple of which involved Glencore as well – saw Congo lose out on $1.4bn: that was twice the country’s annual spending on health and education combined. There is hardly a country on earth that needs those funds more urgently than Congo, where 80 percent of the population survives on less than two dollars a day and many families can only afford to feed their children every other day.

Glencore should have seen Gertler as a bribery risk from the very start. He’s been close to President Kabila for two decades, and has been implicated in dodgy mining deals in Congo for almost as much time. There has always been a clear and obvious risk that money funnelled to Gertler could be used in turn to buy influence with Congo’s president and other key officials.

Last year US authorities fined the New York hedge fund Och-Ziff over $400m for its part in a bribery conspiracy in Congo and four other countries in Africa. Och-Ziff’s partner in Congo is widely acknowledged to have been Gertler, and the US evidence shows that this partner paid out over $100m in bribes to top Congo officials for access to mining licences. Och-Ziff’s own compliance staff had raised red flags about the partnership, which went ignored.

Glencore has defended its worldwide operations and denied any wrongdoing. Gertler has denied allegations of bribery, while Glencore has said that its business deals with Gertler are above board and at arm’s length. But the Paradise Papers appear to show that isn’t the full truth.

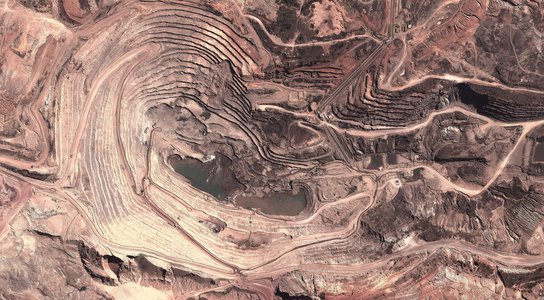

In 2014 Global Witness revealed that Glencore had made a secret $45m loan to one of Gertler’s British Virgin Islands companies in 2009, as they planned to take over Katanga Mining Limited which owned a huge copper mine in Congo. The loan allowed Gertler to cling onto a significant shareholding of Katanga Mining as other investor’s shareholdings were wiped out.

This loan was secret, until exposed by Global Witness in 2014. On top of that, we now know via the Paradise Papers that it was tantamount to an ‘incentivisation’ package from Glencore to Gertler. Leaked board minutes and the loan contract show that this $45m loan – Gertler’s route to holding onto a good percentage of Katanga Mining – was contingent on him resolving licensing and royalty disputes between Katanga Mining and the Congolese government. These negotiations had proved problematic up to this point, but were settled within weeks of Gertler being mandated.

The statement of facts from the US case against Och-Ziff, agreed by Och-Ziff itself, shows that in the months leading up to the mutually beneficial Glencore-Gertler loan arrangement, its Congo partner – widely recognised as Gertler – had been paying bribes of millions of dollars to the key decision-makers in Congo’s mining sector.

A partnership with Gertler has proved devastatingly risky for two companies so far: Och-Ziff, and the Kazakh miner ENRC, which remains under investigation by the UK’s Serious Fraud Office (SFO) for bribery and corruption in its deals with Gertler in Congo. Glencore, via Katanga Mining, is reportedly under investigation now in Canada for certain payments to yet another offshore company owned by Gertler.

It is past time for Glencore to face an investigation into its deals with Gertler. It may have bought him out of their joint-ventures in a February deal worth almost a billion dollars, but the company and its executives must be held accountable for financing Gertler over a decade of partnership and helping to set him up as the kingpin of Congo’s mining sector.

Appleby states it has thoroughly and vigorously investigated the Paradise Papers allegations and is satisfied that there is no evidence of any wrongdoing by themselves or their clients.